- This post is part of Business Insider’s ongoing series on Better Capitalism.

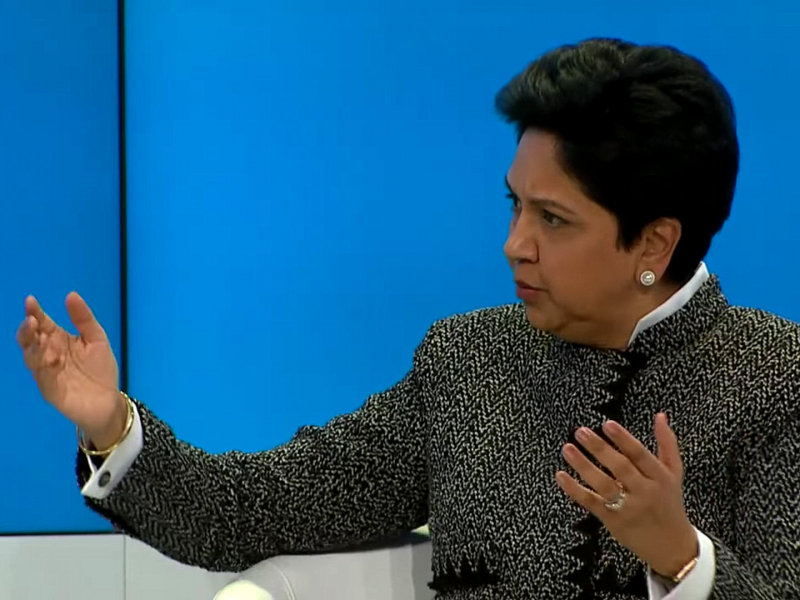

- At our Davos panel in January, PepsiCo CEO Indra Nooyi explained how her long-term strategy for the company eventually paid off, but almost lost her the job.

- She said that CEOs and shareholders need to have better dialogue around future value creation, as opposed to solely chasing quarterly results.

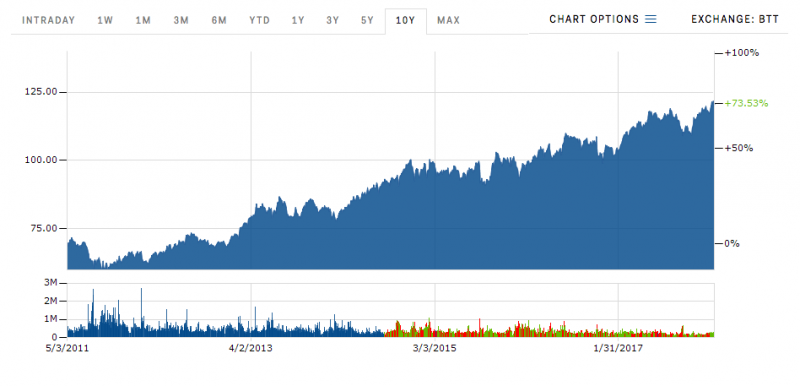

Six years ago, analysts would regularly trash PepsiCo CEO Indra Nooyi in public, and the board had to consider if it needed to replace her. As the Wall Street Journal reported at the time, “soda sales have been sluggish, profits have missed targets and the stock is down 1% over Mrs. Nooyi’s five-year tenure.”

Critics blamed Nooyi’s “Profits with Purpose” movement toward healthier products, which they characterized as feel-good nonsense that would tank the company while Coca-Cola grew stronger.

Now, PepsiCo has beat quarterly expectations since 2016, and analysts are impressed.

As Nooyi said at Business Insider's panel "Towards Better Capitalism" at the World Economic Forum's annual meeting in Davos, "I have the results to show for long term management and the scars to show for short term management."

Nooyi, Business Insider's CEO Henry Blodget, and the rest of the panel discussed ways we could achieve "better capitalism" by recognizing that investments in future impact, community, employees, and customers result in sustainable, impressive growth that trumps the often fleeting or unstable results that come with solely chasing short-term performance.

Nooyi explained that she thinks her 12-year tenure as CEO is a good case study for the idea. She told the panel that while analysts scoffed at her Profits with Purpose initiative, they were ignoring her real motivation.

"They kept telling me, 'Why are you Mother Teresa? Why are you trying to change your portfolio to healthier products?' Because that's where the market was going. That's where we needed to go," she said.

Nooyi said that both CEOs of public corporations and their shareholders need to have better dialogues around strategy. And that's not to say that keeping an eye on quarterly results is bad, she noted, but it becomes toxic to the company's future value when it's the only thing that matters.

She said that, "if you're doing something truly strategic and transformative, it always evokes criticism."

While the takeaway of the panel was that more executives and investors are seeing the light of investing in future value, Nooyi said that the process still requires plenty of patience and determination.

"Will your competitors challenge you at every point in time? In my industry they do. Where I said lower the sugar levels, go to a different product portfolio, they doubled down on sugar drinks. So what do you do? You lose share, you give up some share. That's OK. Because we played a different portfolio game. But educating the investor world is difficult. It requires enormous courage, conviction, consistency," she said. It's "painful. Very painful."

You can watch the full panel discussion below: