Alys Tomlinson/Getty Images

- Money in Excel is a financial planning tool that can help you track how much money you spend every month.

- You can download the Money in Excel template from Microsoft's website, and use it with Microsoft 365.

- To use Money in Excel, you need to let Excel connect to your financial services using a secure connection.

- Visit Insider's Tech Reference library for more stories.

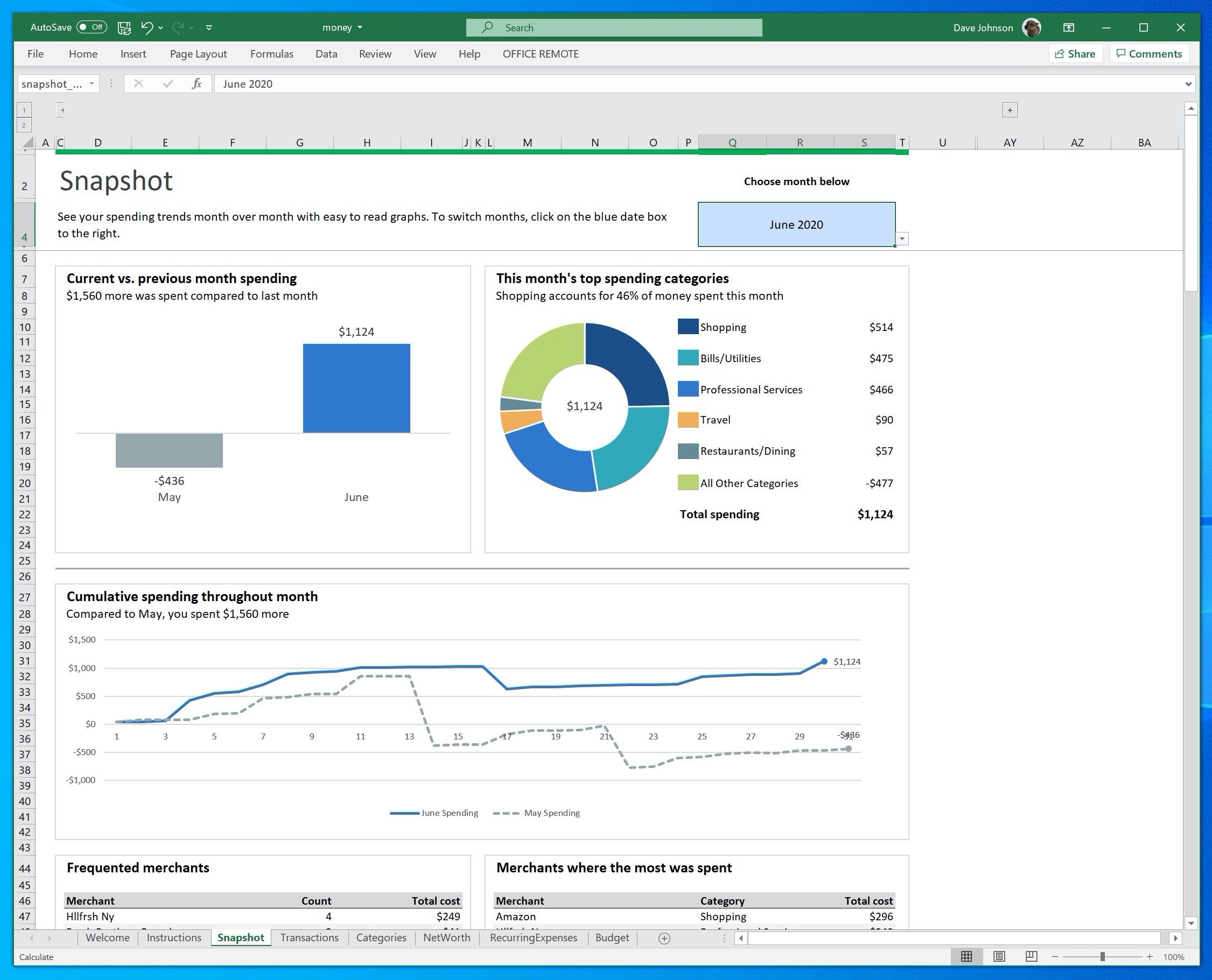

Microsoft includes a few unexpected (and relatively unadvertised) features in its Microsoft 365 subscription. One of the most useful is Money in Excel, a workbook for Microsoft Excel that gives you a dashboard to review all your personal finances.

You can use Money in Excel to securely connect all your financial accounts – savings, investments, loans, credit cards, and so on. From there, the workbook can analyze your data and generate reports. These can include monthly snapshots of your budget, your overall net worth, recurring expenses, and more.

How to use Money in Excel

Money in Excel is an easy-to-use template that gives you multiple views of your finances. The hardest part is setting it up for the first time, and that's mainly because you'll have to go through the time-consuming process of syncing each of your financial accounts one at a time.

Here's how to get started with the Money in Excel template.

Why you should consider using Money in Excel

Unless you already use financial software, you probably don't have access to a program that can present simplified views of your entire financial picture like this. If you already have a Microsoft 365 subscription, Money for Excel is an essentially free way to do that.

Money in Excel has considerable advantages. It's highly secure, for example, since Microsoft doesn't have direct access to your login credentials; that's managed by Plaid, a secure solution used by all major financial institutions.

It also delivers a wealth of information that's hard to get any other way. Consider, for example, the Recurring Expenses template. This gives you "hidden" insight into recurring charges on your various credit cards all on one page. One or more of your credit card companies might offer a feature similar to this, but you probably don't have access to a single view that includes all your credit and debit cards.

Likewise, Money for Excel can synthesize all your accounts to show you your net worth, create a monthly budget, and see how much money you spend by category - like dining out - regardless of which combination of accounts you use to spend that money.

Dave Johnson/Insider