- Stocks tanked after the Federal Reserve raised interest rates, even though the move was telegraphed.

- Johan Grahn of Allianz Investment Management shared why a soft landing for the economy won’t happen.

- Here’s how investors can manage risk and limit volatility as odds of a recession rise.

The Federal Reserve’s decision to raise interest rates by 75 basis points in September to stop high inflation came as no surprise. Or, in the words of Johan Grahn, the head of ETF strategy at $19.5 billion Allianz Investment Management, it was “not necessarily earth-shattering.”

But the move may end up shattering an already-fragile economy.

“There’s no doubt that they will have to strangle the economy,” Grahn said of the US central bank in an interview with Insider on Wednesday afternoon. “And I think that’s clear to most.”

Investors appear to agree with Grahn’s bearish sentiment. The S&P 500 went into free fall right after the Fed’s announcement on Wednesday but then shot up by 2%, only to give up those gains and finish the day down 1.7%. Heavy selling continued on Thursday.

Any hopes that inflation will fall on its own without the Fed taking drastic actions have vanished.

"They've kind of reset the bar for expectations," Grahn said. "So if there was ever anyone thinking that, 'Well, maybe there is a pivot coming down the pike here,' they effectively eliminated that type of speculation for at least the next 12 months."

Fed chair Jerome Powell, who in the past has done everything in his power to be optimistic, has acknowledged that bringing down inflation will be painful. Consequences of higher rates include lower corporate earnings and stock valuations, slower growth, and a higher unemployment rate.

"They're trying to calm things down and, frankly, put a lid on the economy and the economic growth," Grahn said. "And then with that, you should not be expecting equity markets to go up. And so when they do, it's counterintuitive to what the Fed is trying to do."

Sacrificing economic growth — even to the point of causing a recession — is better than letting inflation run wild for years, Grahn said. That aligns with the "short-term pain for long-term gain" philosophy that Neil Azous, the founder and CIO of Rareview Capital, described to Insider.

What's unclear is exactly how much pain the Federal Reserve can tolerate. Harley Bassman, a managing partner at Simplify, recently told Insider that a slight rise in unemployment is better than inflation continuing to hurt tens of millions of Americans.

But hoping for higher unemployment at the expense of lower inflation could easily backfire, Grahn warned, just like the US central bank's plan to get higher inflation while bringing down unemployment did. In fact, Grahn said it's more likely that the US unemployment rate jumps from 3.5% to between 5% and 8%, rather than only rising to 4%.

In the end, the Fed's hyper-aggressive approach to beating inflation for good can only end in one way, in Grahn's view: a recession.

"I don't think there is a soft landing opportunity," Grahn said. "The record will show it. But aside from that, I think if you apply the logic of what the Fed is doing right now when they're using the kind of language that they use, 'at all costs,' 'single-focus mandate to bring down inflation,' — which is obviously the same thing as saying 'sinking the economy' — 'looking to work until the job is done.' Those are the words that they used."

Grahn added: "The question is if the crash landing is going to happen sooner or later."

How to invest as recession risk rises

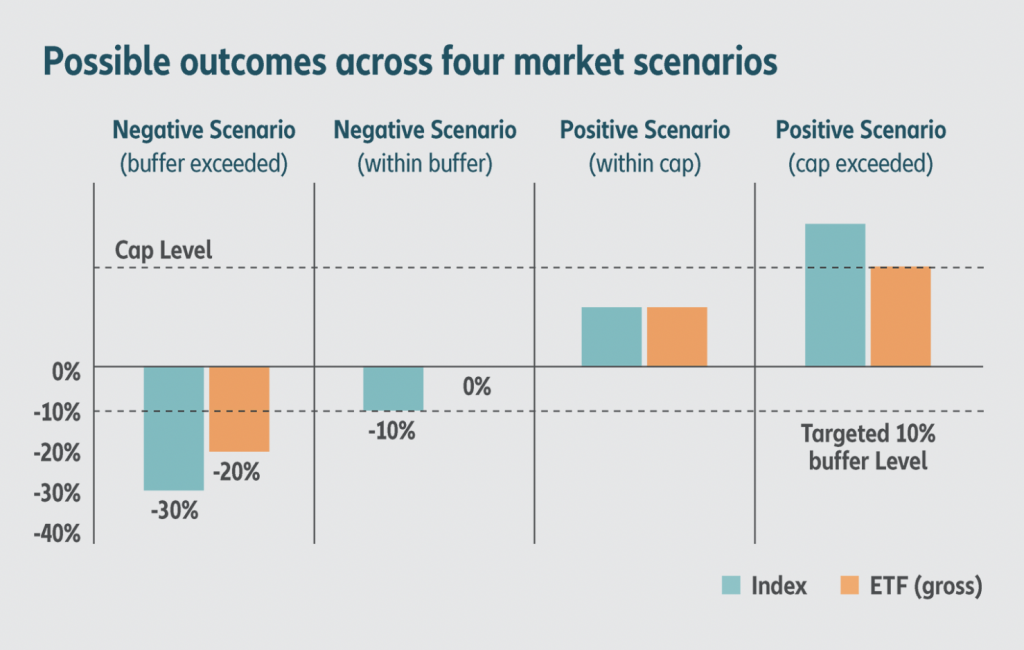

Investors can manage risk in their portfolios as inflation stays hot and the economy weakens by using a buffer strategy, Grahn said. This approach insulates investors from losses of up to 10%, which means a 20% decline would be a hit of just 10%. The catch is that the upside is also capped, meaning that investors would forfeit any gains over 10%.

Foto: Allianz Investment Management

While this strategy may not be for everyone, it can be an effective way to minimize volatility and downside risk if one is willing to give up the ability to maximize upside.

"It's the idea of realizing what you're willing to sacrifice," Grahn said.

One way to employ this strategy is to buy exchange-traded funds (ETFs) from firms like Allianz or Cboe Vest. But sophisticated investors can take a do-it-yourself approach, Grahn said.

By buying bearish put options and selling bullish call options in what's called a collar, traders can get some limited upside while reducing their exposure to downside risk.

Investors tend to overestimate their ability to handle volatility, Grahn said, adding that making decisions ahead of time is wiser than making a panicked move during big market swings. Before using this strategy or any other, the strategist said that investors must first define their risk.

"If you're willing to sacrifice the potential — if your view is that equity markets are going to be sluggish at the best over the 'X' number of years — you either have to just buckle down and say, 'I'm OK with that, and I will adjust the rest of my life accordingly," Grahn said. "But if you say, 'Oof, it felt bad six months ago, it felt worse three months ago, now it feels really painful — I can't take it anymore,' now you're going to make a mistake. Now you're too late."