thianchai sitthikongsak/Getty Images

- Communications stocks represent companies in a sector that includes the phone, internet, and media industries.

- Communications stocks belong to both stable dividend-paying firms and volatile up-and-comers.

- Investors can minimize risk by buying communications-focused ETFs and index funds.

- Visit Business Insider’s Investing Reference library for more stories.

In 2020, communications became more important than ever. Entering an era of remote work and play, people turned to communications technology of all kinds. Internet and cell phone service, video conferencing, video games, and streaming services were the lifeline that allowed us to muddle through – even thrive – in a challenging year.

But even before the coronavirus, communications was a key area to invest in, populated by some of the biggest names in the corporate world, and dealing with services used by millions every day.

The communication services sector represents about 10% of the S&P 500. It’s so important for keeping everyday life running that the U.S. government classifies it as “critical infrastructure.”

Here’s what you should know about how to invest in communications stocks, what the risks are, and what rewards you might anticipate.

What is the communications sector?

Communications stocks are shares of companies that facilitate interaction in some way. These companies might operate land-based or cellular phone lines, broadband internet, wireless internet, and satellite communications.

Companies in the media, entertainment, interactive gaming, information creation, and information distribution businesses also belong to the communications sector.

If this sounds like a highly diverse group - well, it is. And it only recently became so.

It happened due to the widely used Global Industry Classification Standard (GICS). The GICS, jointly created by Standard & Poor's Dow Jones and Morgan Stanley Capital International, provides a way for investors to categorize and analyze stocks.

In September 2018, GICS changed its index methodology and reorganized the communications sector.

Basically, it expanded the existing telecommunications sector to become a broader communications services sector. Stalwart telephone and traditional media stocks were suddenly in the same category as upstart, growth-oriented internet and info-tech companies.

Still, a common thread among these companies is their reliance on subscription fees and advertising revenue.

Why invest in communications stocks?

It's difficult to characterize communications stocks. Since the category change, the sector has become one that offers something for every investor.

Overall, communications is now better described as a growth sector - one likely to offer greater potential for appreciation than the market overall.

It's also now more cyclical, or dependent on economic trends - likely to function better in boom times and during bull markets.

Still, depending on which specific stock you're talking about, your reason for investing in a communications company might have more to do with earning a reliable dividend than attempting to capitalize on trendy growth. Many of the individual telecom blue-chip companies might well retain their defensive-stock nature - their ability to perform well in both prosperous and recessionary times.

Types of communications stocks

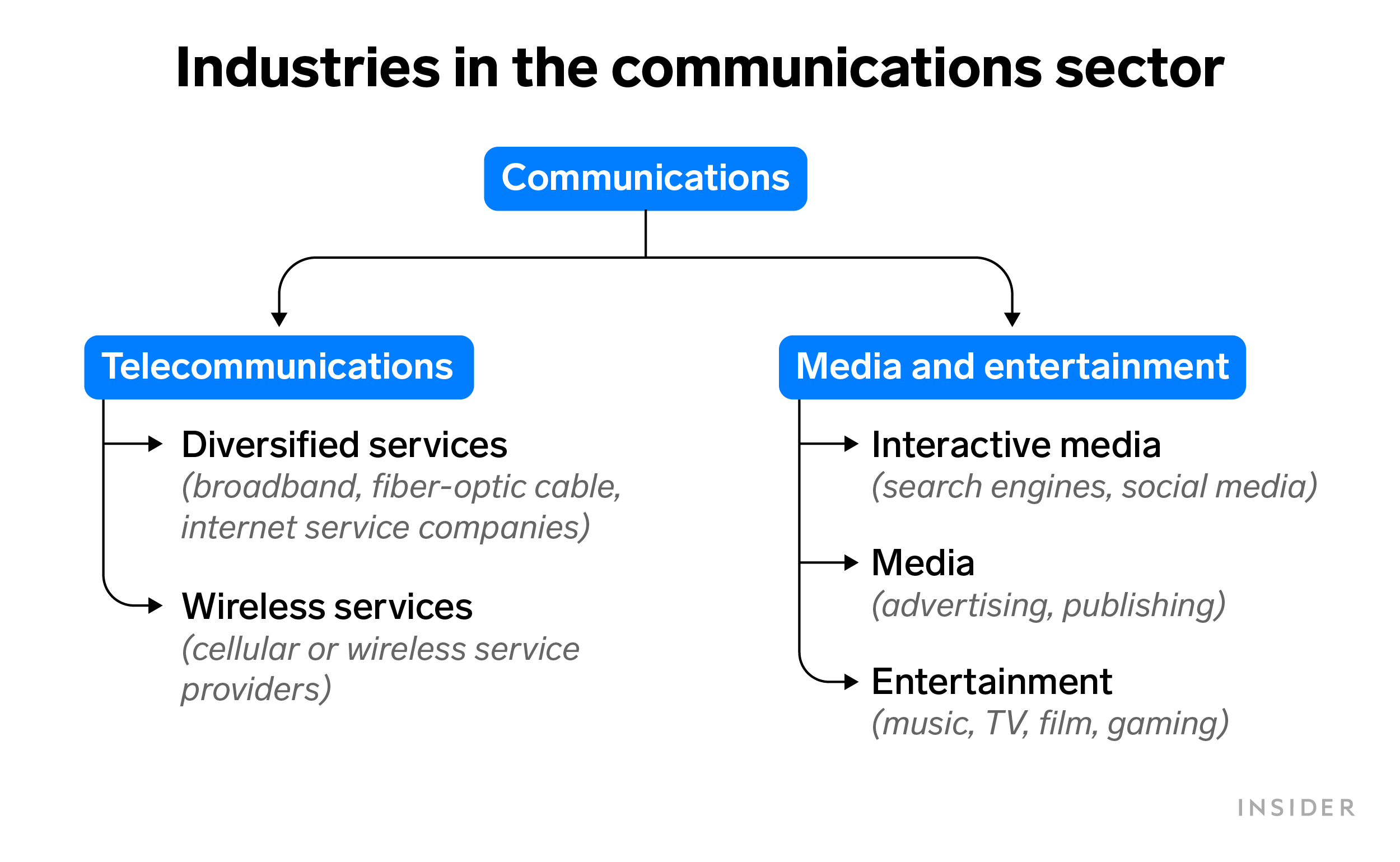

To help make sense of the broad new communication services sector, let's break it down into subsectors. We've highlighted some key players in each, though many could be categorized under more than one sub sector because of their diversified suite of services.

Shayanne Gal/Insider

Diversified telecommunication services

This category consists of broadband, fiber-optic cable, and internet service providers.

Key players: Lumen Technologies (LUMN), AT&T (T), Verizon Communications (VZ), Globalstar (GSAT), Bandwidth (BAND), Consolidated Communications Holdings (CNSL), Anterix (ANTX)

Wireless telecommunication services

This category is made up of cellular or wireless communications service providers.

Key players: T-Mobile U.S. (TMUS), Telephone and Data Systems (TDS), Boingo Wireless (WIFI), Gogo (GOGO)

Media

Media companies earn revenue from advertising, broadcasting, cable & satellite service, and print or electronic publishing.

Key players: Charter Communications (CHTR), Comcast (CMCSA), Dish Network (DISH), Fox (FOX), Nexstar Media Group (NXST), ViacomCBS (VIAC), Discovery Communications (DISCA), Fluent (FLNT)

Entertainment

Companies in this sector work on movie and television production, distribution, and screening; music production and distribution; entertainment theaters; sports; streaming entertainment content; mobile gaming applications; and at-home educational software.

Key players: World Wrestling Entertainment (WWE), Live Nation Entertainment (LYV), Electronic Arts (EA), Activision Blizzard (ATVI), AMC Entertainment Holdings (AMC),Netflix (NFLX), Walt Disney Company (DIS)

Interactive media & services

These companies profit from pay-per-click advertising, search engines, social media, social networking platforms, online reviews, and online classifieds.

Key Players: Interactive Corp (IAC), Alphabet (GOOG), Facebook (FB), Twitter (TWTR), Yelp (YELP), Pinterest (PINS), Yandex (YNDX), Angie's List (ANGI)

The advantages of communications stocks

There are a variety of reasons for investors consider communications companies.

- Performance. Over the last 12 months (Jan. 6, 2020, through Jan. 4, 2021), the S&P Communication Services Select Sector index, which includes all the stocks in the communications sector, returned 23.22%. By comparison, the S&P 500 index returned 14.4%.

The index only goes back to September 2018 due to the communications category shift, so it's harder to describe this sector's long-term performance. However, when S&P created its new index, it backtested it to December 21, 2007. It found that the sector returned 9.9% annualized over the next 10-ish years, through May 16, 2018. Over that same period, the S&P 500's annualized return was 7.25%.

- Income. The growth companies in this sector help drive its returns. But the value companies provide investors with investment income. Verizon and AT&T, for example, both pay rich dividends, and have a long history of doing so.

- Diversification. Many companies in this sector earn revenue from diversified services. Comcast is a great example; it makes money from broadcast television, cable television, broadband service, satellite service, movies, and theme parks.

The downsides of communications stocks

Of course, no type of stock is without drawbacks. Those that are characteristic of communications include:

- Regulatory risk. This industry is subject to government regulation, which can affect performance. For example, changing privacy laws poses a threat to communications companies that rely on using consumer data to tailor advertising and recommendations.

- Operational risk. While many communications stocks thrived during the pandemic, others took a beating - especially those in the entertainment, recreational, and travel field. Disney's theme parks, which account for about 30% of the company's revenue according to Morningstar, have been closed or operating at limited capacity since the first quarter of 2020. Live Nation Entertainment, parent of Ticketmaster, took a big hit as governments banned large gatherings, including concerts, festivals, and live sports.

- Lack of differentiation/competitiveness. Some communications companies struggle to stand out because their services strike their customers as commodities. Among streaming services, lack of customer loyalty and the ease of switching providers resulted in a 41% churn rate for 1Q 2020, according to consulting firm Deloitte. Vulnerability to technological change can also be an ongoing challenge.

How to invest in communications stocks

You can buy individual shares or fractional shares of communications stocks through the usual brokerage channels - either online or apps, such as E*TRADE, Robinhood, SoFi Invest - or the traditional full-service firms, like Charles Schwab, TD Ameritrade, Fidelity, and Vanguard.

Of course, investing in an individual communications stock is riskier than investing in a communications industry ETF (sector risk) or index fund.

These are some of the biggest. Some of them also offer exposure to other sectors, such as utilities or information technology. So be sure to read the fund breakdown and strategy, to make sure you're getting the pure play you want.

- Communications Select Sector SPDR ETF (XLC)

- Vanguard Communication Services ETF (VOX)

- Vanguard Communication Services Index Fund Admiral Shares (VTCAX)

- Fidelity MSCI Communication Services Index ETF (FCOM)

- Defiance 5G Next Gen Connectivity ETF (FIVG)

- First Trust NASDAQ Technology Dividend Index Fund (TDIV)

- Invesco S&P SmallCap Utilities & Communication Services ETF (PSCU)

The financial takeaway

Communications stocks are shares in companies in the communication services industry - a huge sector that includes phone, internet, satellite, media, entertainment companies.

They represent well-established, dividend-paying companies as well as more volatile up-and-comers.

Since communications stocks can belong to both defensive and growth-oriented companies, individual investors can get the most bang for their buck, and minimize risk overall‚ by investing through communications-focused ETFs and index funds.

The communications sector is an exciting place to be right now. The companies it includes provide the services that are fundamental to our everyday lives. And the COVID-19 lifestyle shifts might make us permanently more reliant on communications companies, even once the pandemic is behind us.