Tesla is forcing insurance agencies to seriously consider how policies will change as cars become safer due to advances in self-driving technology.

The latest example is Farmers Insurance partnership with Tesloop, a small ride-sharing service that uses Tesla cars to transport customers between cities in Southern California.

Farmers wrote a new auto policy for Tesloop that slashes the service’s previous insurance costs by 25% by reducing its risk premium, Tesloop CEO Rahul Sonnad told Business Insider. Sonnan, however, declined to give exact figures and state Tesloop’s previous insurance provider.

The partnership gives Farmers a small test case to see what kind of insurance policies can be designed around autonomous technology, Mariel Devesa, Farmers’ head of production innovation, told Business Insider.

“For us it’s understanding what is new technology and then understanding what are the business models of these new products that are trying to disrupt the industry,” Devesa said.

Tesloop is still very limited in its scope - it only has a fleet of six cars - but its work with Farmers shows how insurance agencies realize industry disruption is inevitable with self-driving vehicles.

In fact, Tesla is already selling car insurance with its vehicles in Australia and Hong Kong as part of an overall vision to one day include insurance in the final price of all its cars.

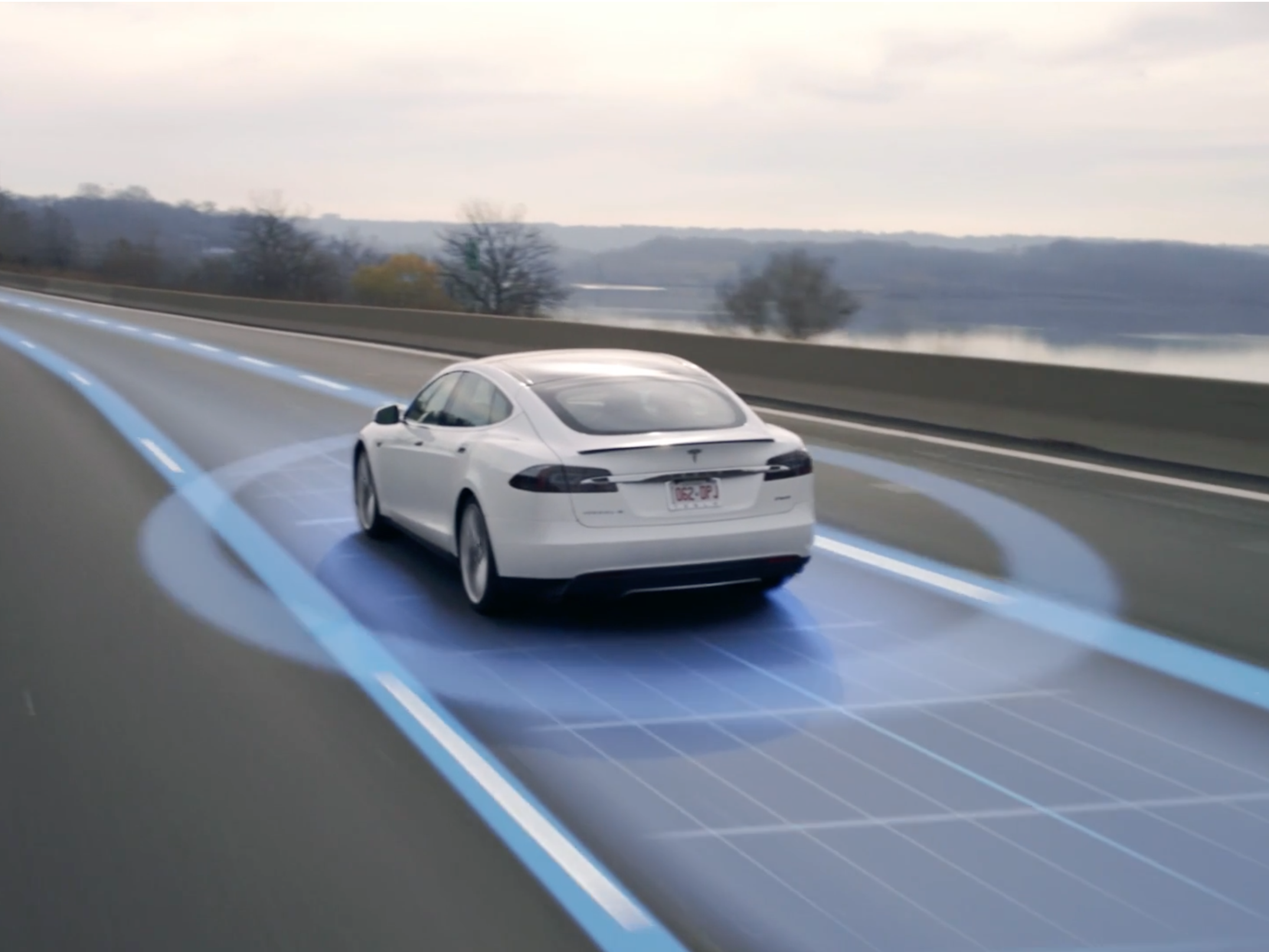

According to a report by the National Highway Traffic Administration (NHTSA), crash rates for Tesla vehicles have dropped 40% since Autopilot was first installed, and the cars are designed to get safer with Tesla's new Autopilot 2 technology. Tesla CEO Elon Musk said the company wants to ensure agencies are dropping costs proportionate to the reduced risk of driving a Tesla.

These kinds of price adjustments could hurt the industry. The personal auto insurance sector could shrink to 40% of its current size within 25 years as cars become safer with autonomous tech, according to a report by the global accounting firm KPMG.

"This is an example of what we're trying to do even though they're early stage," Devesa said about Tesloop. "How do we learn with them and grow with them?"

Devesa said there are still questions to flesh out when it comes to self-driving cars and liability.

For fully autonomous cars, coverage will likely shift from personal to commercial as accidents are linked to technical failures. Some automakers, like Volvo, have already agreed to accept full liability for completely driverless cars.

"The most complicated is between the here and the there," Devesa said. "With partial autonomy, when the driver is still behind the wheel, whose liability is it?"

How much of a role the government will need to play in determining liability is still unclear.

Experts previously told Business Insider that it's unnecessary for NHTSA to set regulations determining liability, saying there will be an inevitable series of lawsuits that will set a precedent for later on down the road.

Although NHTSA has released guidelines dictating the use and testing of self-driving vehicles, it has yet to introduce uniform policies.

"There are still a lot of things that are going to need to be worked out from a regulatory perspective," Devesa said. "But I think that's what adds to the opportunity because we can define what that looks like."