At the end of 1899, both Queen Victoria and Czar Nicholas II still sat on their respective thrones, William McKinley was the 25th American President, and Germany had not even been unified for 30 years.

Notably, all these countries had some of the world’s largest stock markets at the time.

Credit Suisse recently shared with clients a summary of their “Yearbook” report, which looks at the past 117 years of investment history for 23 countries, including the United States, Canada, ten eurozone nations (Austria, Belgium, Finland, France, Germany, Ireland, Italy, the Netherlands, Portugal, and Spain), six non-eurozone European nations (the United Kingdom, Denmark, Norway, Russia, Sweden, and Switzerland), four Asia Pacific markets (Australia, China, Japan, and New Zealand), and South Africa.

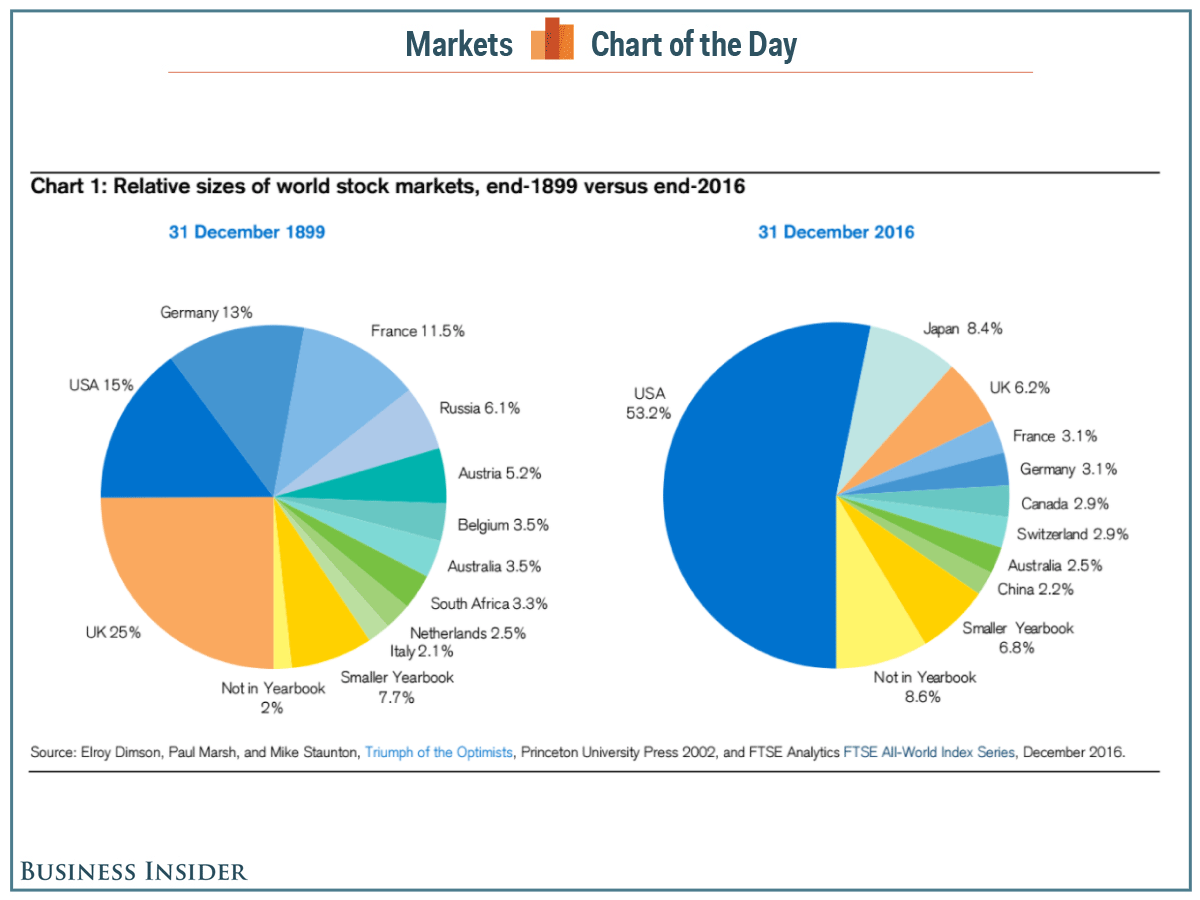

Within the report, the team included two charts comparing the relative sizes of global stock markets at the end of 1899 to those at the end of 2016.

At the end of 1899, the UK equity market was the largest in the world by market capitalization, with a full 25% of the global total, followed by the US at 15% and then Germany with 13%. The US market overtook the UK during the 20th century, and has since ballooned into the world’s dominant stock market, representing 53.2% of global capitalization at the end of 2016. But, Japan had the world’s largest market for a hot second: At the start of 1990, it made up almost 45% of the world index, above the United States’ 30%, according to Credit Suisse’s data.

"Our 23 countries accounted for 98% of world equity market capitalization at the start of 1900, and today they still represent some 91% of the investable universe," the team wrote.

As an interesting aside that Credit Suisse did not go into, the relative size of stock marketssomewhat (but not entirely) mirrors the relative geopolitical positions of countries on the global stage.

For example, the UK's stock market was the largest at the end of 1899 near the end of Queen Victoria's reign and the "Britain's imperial century." But its relative size shrank after the two World Wars and during the Pax Americana.

In any case, check out the two charts (Note: "Smaller Yearbook" includes countries from among those listed above who had small enough markets to be grouped together, while "not in Yearbook" represents mostly emerging market countries for which the team did not have data going back to 1900.)