- Fabric Ventures and TokenData report: $5.6 billion raised through “initial coin offerings” in 2017.

- There were 435 successful projects, raising an average of $12.7 million.

- The 10 largest projects raised 25% of the money.

- “On average, tokens have returned 12.8x the initial investment in dollar terms,” but the majority of gains come from early projects and returns are trending downwards.

LONDON – Startups and projects raised $5.6 billion last year through so-called initial coin offerings (ICOs), according to a new report.

Venture capital fund Fabric Ventures and cryptocurrency data provider TokenData shared the figure in their “State of the Token Market” report, which was shared with Business Insider ahead of publication this week.

2017 saw a huge boom in companies raising money by issuing their own digital currencies, which are structured similarly to bitcoin, in return for funds to build their business. These “coins” can then be traded freely on online exchanges, offering greater liquidity to investors than traditional equity investment.

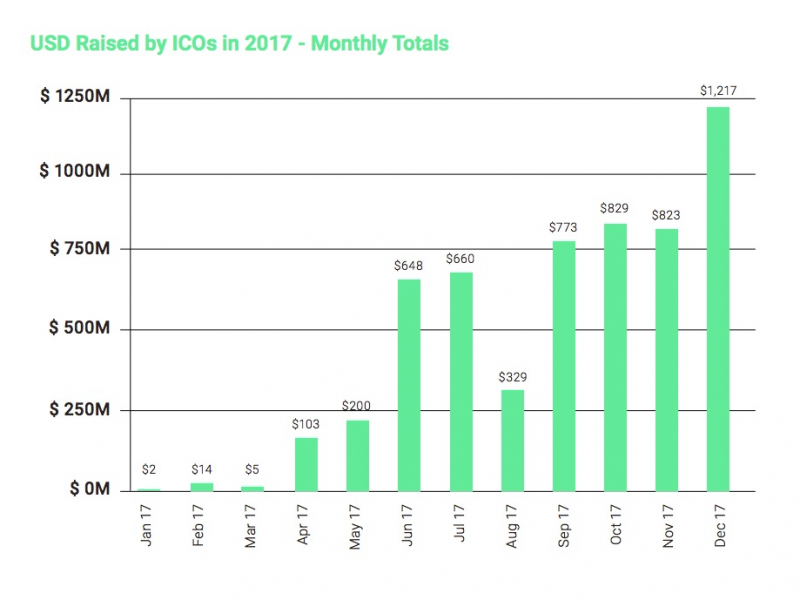

“More than $5.6 billion of capital was raised in 2017 according to the metrics used by the TokenData team,” the report says. “This compares to $1 billion of ’traditional’ venture investing in blockchain startups in the same time frame and a ‘mere’ $240 million raised by token sales in 2016.”

Fabric Ventures and TokenData found 435 successful ICOs out of an attempted 913 last year - meaning just 48% were successful.

The average amount raised was $12.7 million but the report notes: "Collectively, the 10 largest sales raised close to $1.4 billion and roughly 25% of the total capital raised in 2017."

Almost a third of funding went towards blockchain infrastructure projects. The biggest ICO of last year was Filecoin, a project to build a decentralized data storage solution based on the blockchain. The project raised $257 million in September.

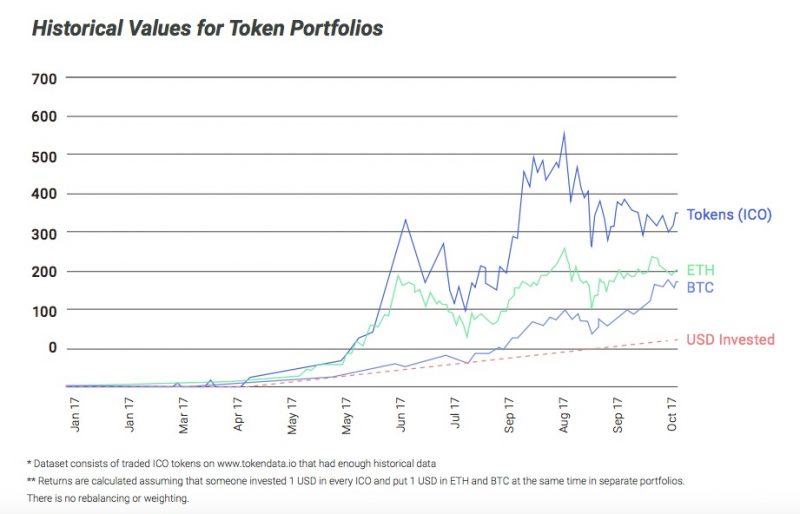

The majority of people investing in these ICO projects have been retail or small-time investors but institutions are increasingly looking at ICOs due to their eye-catching returns.

"On average, tokens have returned 12.8x the initial investment in dollar terms versus 7.7x for ETH and 4.9x for BTC during 2017," the report notes. That tallies with finding from Mangrove Capital Partners last year, which recorded returns of 1,320% up to October of last year.

But not all ICOs are equal. Fabric Ventures and TokenData note: "A closer look shows that returns are skewed towards a handful of tokens issued in the first quarter of 2017, when the ICO hype had not fully erupted, and that average token returns have been trending down since."

Fabric Ventures and TokenData voice some concern about the nature of the ICO market, which is attracting increasing regulatory attention due to the amounts of money pouring into the sector.

"The majority of investors are more interested in the speculative nature of cryptocurrencies than in the efficiency of open source development," the report notes. "A lot of these projects have raised massive amounts of money upfront before receiving any market validation, creating problems for long-term incentivisation of the team.

"We expect a Darwinistic process to kick-in, in which projects with better governance will raise funds more successfully and operate more efficiently."