- A study found houses in lower-income neighborhoods in the US are taxed more than those in rich ones.

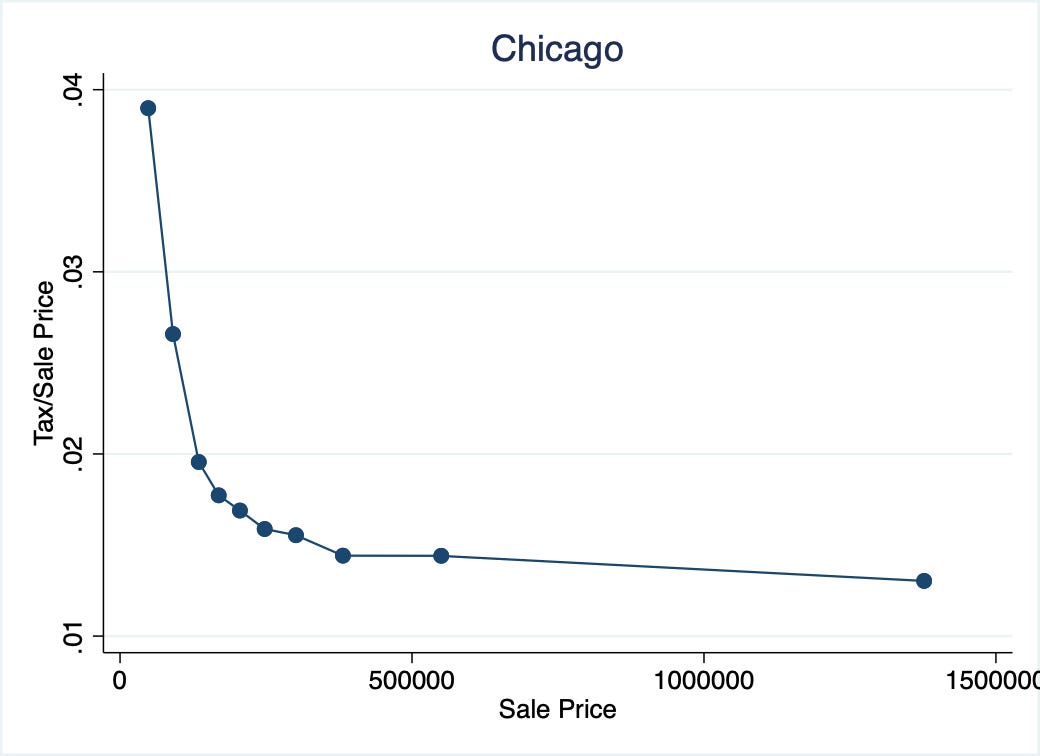

- In Chicago, more costly homes were effectively taxed at around 1.5% while cheaper homes were taxed at around 4%.

- In largely Black neighborhoods, homeowners are taxed around 50% more than in nearby neighborhoods.

- See more stories on Insider's business page.

A new study found that if you own a house in a lower-income neighborhood in the US, you're typically being effectively taxed around twice as much as a homeowner in a wealthier nearby neighborhood.

The study, conducted by researcher Christopher Berry and The University of Chicago Harris School of Public Policy and first reported by The Washington Post, analyzed a trove of data from the tax and deed database company Corelogic. Berry studied the records from "individual property sales, including addresses, sale prices, and assessed values" from 2006 through 2016. The data covered 2,600 counties that contain 99% of the US population, according to the study.

While the property tax rate you pay as a homeowner should be the same in principle as others in your county, regardless of the sale price of your home, the research concluded that in reality this is not the case.

In Chicago, for example, the study found that the most expensive homes in Chicago, those priced at more than $500,000, were taxed at an effective rate of around 1.5% or less, while those sold for less than $100,000 saw and effective tax rate of around 4%. Similar discrepancies were noted in cities including Detroit, New York, and New Orleans.

"This pattern jumps out from the data, so it didn't take me long to see once I had the data," Berry told Insider. "I think the issue is that not many people are looking at these data."

"Even experts on the property tax often overlook the issue of assessment quality," Berry added. "Meanwhile, assessors, who really should be looking at these issues, have developed a set of standards and practices that tend to sweep the problem under the rug."

So, how does a city go about setting the property tax anyway?

"The property tax is, in principle, an ad valorem tax, meaning a tax proportional to the property's value," Berry explained in his research. "Unlike a sales tax or a value-added tax, the property tax is not levied at the time of a transaction, but at regular intervals, usually annually."

"Because most properties sell infrequently, their value in any given tax cycle must be estimated, a job that falls to the office of the local assessor," Berry added. "The accuracy and fairness of the property tax depends fundamentally on the accuracy and fairness of the valuations estimated by assessors."

While homeowners can appeal the city's assessment of their house, the study notes that appeals are disproportionately pursued by those who own expensive property, which could contribute further to the problem.

"Since no way of measuring regressivity is perfect, they have essentially thrown up their hands and said, maybe it's just measurement error," Berry told Insider. "But the truth is that the magnitude of regressivity is much too big to be the result of measurement error."

Berry found that in predominantly Black neighborhoods, homeowners faced an effective property tax around 50% higher than homeowners in nearby neighborhoods located within the same county.

Accurate and fair tax assessments are vital to buyers who are trying to build wealth.

"This is an example of structural racism," Berry told The Washington Post. "African Americans and other minorities are more likely to own low-priced homes. This means that minorities are more likely to be overtaxed because they are more likely to own low-priced homes."

The national homeownership rate for Black families in the US is 44% while for white families it is 73.7%, Insider reported, which contributes to a gap in the accumulation of wealth from owning a home for Black families living in America.

A study published in October from the Massachusetts Institute of Technology found that Black Americans pay $390 more in property taxes annually than white Americans, on average. Factoring in higher mortgage-interest payments and insurance premiums, Black Americans on average pay $13,464 more than white Americans across the duration of their home loans, according to MIT.

According to Berry, giving taxpayers transparency is one way to see equal tax assessments for all homeowners.

There are three main opportunities to increase equity in assessments, according to Berry.

- Increased transparency: "Assessors should be more transparent about the quality of assessments and the existence of widespread regressivity," Berry said. "You can't fix a problem if you're not willing to acknowledge that it exists. This is basically where we are right now. Higher level governments, particularly state governments, could do more to force assessors to be transparent and accountable."

- Better data and better statistical models: "Better data could come from more efforts at keeping updated information about properties and better coordination between assessors are other offices that have relevant information, such as building permits," Berry said.

- Additional sources of relief for owners of low-priced properties: These are the people "most likely to be overassessed," Berry said. "For instance, exemptions could be more generous. In Detroit, owners who have income below the federal poverty rate are exempted from property taxes."

Even with these improvements Berry still believes that there will always be some amount of regressivity in assessments.

"The root, irresolvable problem is that there will always be features of properties that buyers and sellers can see but assessors can't. This will lead to regressivity for reasons explained in the paper. Even the best assessor isn't going to be able to fix these problems when important property features are not in the data."