- Republican are getting closer to passing their massive tax reform plan.

- They recently changed the top individual tax bracket to 37%, down from the current 39.6%, and lower than the 38.5% proposed by the Senate.

- This small change will give a huge boost to ultra-wealthy Americans.

Republican leaders reached an agreement on their final tax bill on Wednesday, making it more likely that federal taxes will be overhauled by Christmas.

The bill, called the Tax Cuts and Jobs Act, is currently in a conference committee to reconcile discrepancies between the House and Senate versions that those chambers passed. The official text of the compromise bill is not expected to be released until Friday – and then it will still need to be evaluated by congressional scorekeepers like the Joint Committee on Taxation.

But there have already been reports about some of the changes in the agreement, including to the top individual tax bracket – which would drop to 37% from the current 39.6%, instead of the 38.5% proposed in the Senate version of the tax bill.

Business Insider analyzed last week how the proposed changes to the tax brackets and itemized deductions might affect the amount of taxes owed by high-earning Americans in 2018. We ran the numbers comparing what the current system looks like, and how the Senate's tax plan and the House's tax plan might change things up.

Since it's now being reported that the top individual tax bracket would drop to 37%, we updated our analysis to compare the differences among the current system, the House's plan, the Senate's version, and the conference committee's version.

We noticed one interesting thing in our new analysis: dropping that bracket by just 1.5 percentage point might give the ultra-wealthy a huge boost.

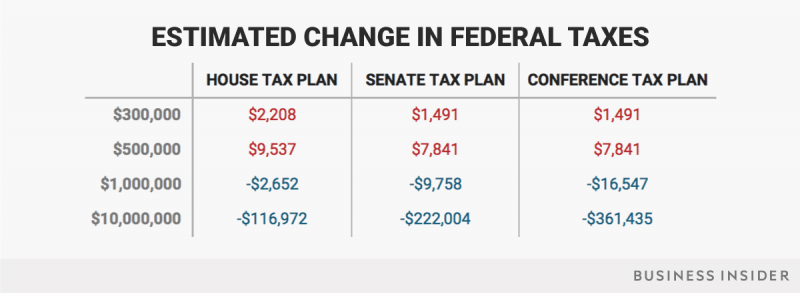

The chart shows our estimated changes in federal taxes for a single, childless taxpayer earning $300,000, $500,000, $1 million, and $10 million a year. The columns are for the House's plan, the Senate's plan, and the conference committee's plan, which uses the new 37% bracket.

Just dropping the top individual tax bracket to 37% from the 38.5% originally proposed by the Senate can lead to huge savings for ultra-wealthy Americans. It's most useful to compare the conference tax version to the Senate's version because their brackets are identical aside from the top tax bracket.

Those earning $10 million a year would save an estimated $361,435 compared to the current tax system. That translates to nearly $140,000 more in savings under the conference committee's version compared to the Senate's version.

Those earning $1 million would also save more under the conference committee's version. Those earning $300,000 to $500,000 would not see a change between the Senate and conference committee's plans since their incomes do not hit the top bracket.

How changing the top income tax bracket could affect a wealthy, single, childless taxpayer compared to the Senate's tax plan

- $300,000 household income: estimated annual tax increase of $1,491 - unchanged

- $500,000 household income: estimated annual tax increase of $7,841 - unchanged

- $1 million household income: estimated annual tax savings of $16,547 - more savings

- $10 million household income: estimated annual tax savings of $361,435 - more savings

Most Americans will see a slight increase in their take-home pay under the current proposals. But all of that may change as many provisions are set to expire. Some analysts have said that nearly half of Americans would see a tax increase if that happens.

Exactly how much taxpayers will save if Republicans succeed in overhauling the US tax code will depend on many factors. And as it stands now, a final bill has still not been revealed.

But it's noteworthy that even just from a slight change to the top tax bracket, very wealthy households, including President Donald Trump, stand to benefit handsomely from the plan.

For our calculations, we assumed each theoretical taxpayer would itemize deductions and not be subject to the Alternative Minimum Tax. If you're curious, you can read about how we did everything in the original post.