- Goldman Sachs’ equity strategy team has published its quarterly chart book detailing the final quarter of 2018, and what lies ahead for this year.

- Among its round-ups was a list of stocks trading at the highest premium to the firm’s price targets.

- Most of the names expected to fall the most can be found in two sectors: consumer staples and real estate.

Goldman Sachs’ equity strategy team just put together its quarterly chart book, detailing the brutal final quarter – and month – of 2018, and the firm’s outlook for this year.

The team, led by chief US equity strategist David Kostin, included a list of stocks with the most downside to the firm’s price targets.

In other words, the strategists compiled stocks trading at the highest premium to the firm’s price target, implying the stocks could fall sharply if the analysts are correct in their predictions.

Notably, of the 11 names Business Insider has listed below, most of the stocks are in the real estate or consumer staples sector. While the broader market posted a total return of -4% in 2018, real estate posted a total return of -2% in 2018, and consumer staples posted a total return of -8%.

Here's a breakdown of the stocks, in the order of largest implied drop to the smallest implied drop.

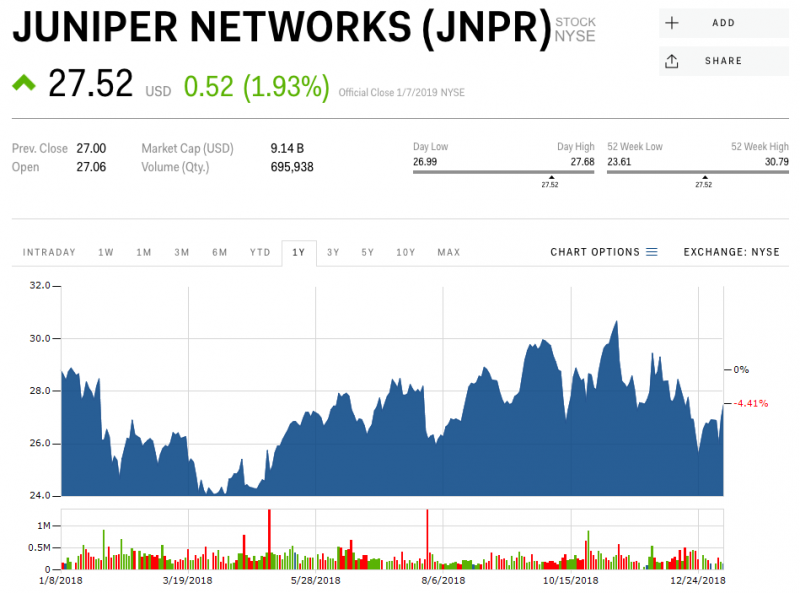

Juniper Networks

Ticker: JNPR

Sector: Technology

2018 performance: -6%

Current price: $27.52

Downside to target: -25.7%

Source: Goldman Sachs

Church & Dwight

Ticker: Church & Dwight

Sector: Consumer staples

2018 performance: +33%

Current price: $65.88

Downside to target: -25.5%

Source: Goldman Sachs

Clorox

Ticker: CLX

Sector: Consumer staples

2018 performance: +6%

Current price: $154.88

Downside to target: -25.4%

Source: Goldman Sachs

Realty Income

Ticker: O

Sector: Real estate

2018 performance: +11%

Current price: $62.60

Downside to target: -23.9%

Source: Goldman Sachs

Ventas

Ticker: VTR

Sector: Real estate

2018 performance: -2%

Current price: $57.92

Downside to target: -19.8%

Source: Goldman Sachs

Hershey

Ticker: HSY

Sector: Consumer staples

2018 performance: -4%

Current price: $105.41

Downside to target: -19.8%

Source: Goldman Sachs

SCANA

Ticker: SCG

Sector: Utilities

2018 performance: +23%

Current price: $47.80

Downside to target: -18.4%

Source: Goldman Sachs

Duke Energy

Ticker: DUK

Sector: Energy

2018 performance: 3.7%

Current price: $85.01

Downside to target: -15.4%

Source: Goldman Sachs

Equity Residential

Ticker: EQR

Sector: Real Estate

2018 performance: +3%

Current price: $65.10

Downside to target: -15.2%

Source: Goldman Sachs

McCormick & Co.

Ticker: MKC

Sector: Consumer staples

2018 performance: +36.5%

Current price: $137.84

Downside to target: -14.5%

Source: Goldman Sachs

HCP

Ticker: HCP

Sector: Real estate

2018 performance: 7.8%

Current price: $28.30

Downside to target: -14.1%

Source: Goldman Sachs

SEE ALSO: