Welcome to Insider Finance. If this was forwarded to you, sign up here. Plus, download Insider's app for news on the go – click here for iOS and here for Android.

On the agenda today:

- Meet the 12 people powering the next big CLO boom.

- Square's $29 billion Afterpay deal poses a new threat to PayPal.

- Point72 just poached a star credit trader from JPMorgan.

Let's get started.

This year's M&A frenzy isn't ending anytime soon, experts say

The co-heads of Goldman Sachs' powerhouse M&A business said the huge surge in dealmaking isn't going to slow down in the near future. They gave us four big factors that will keep the dealmaking party going.

Square is on a collision course with PayPal

Square's $29 billion bid for Afterpay poses a new threat to PayPal, which launched its own buy now, pay later offering less than a year ago. Now, the two payment giants are duking it out for both merchants and consumers. More on the fight to be the go-to finance super app.

Melvin Capital gained ground in July, but is still in a big hole

Thanks to Reddit traders' January short squeeze, Gabe Plotkin's $11 billion fund is still down 43.2% for the year. Here's what you need to know.

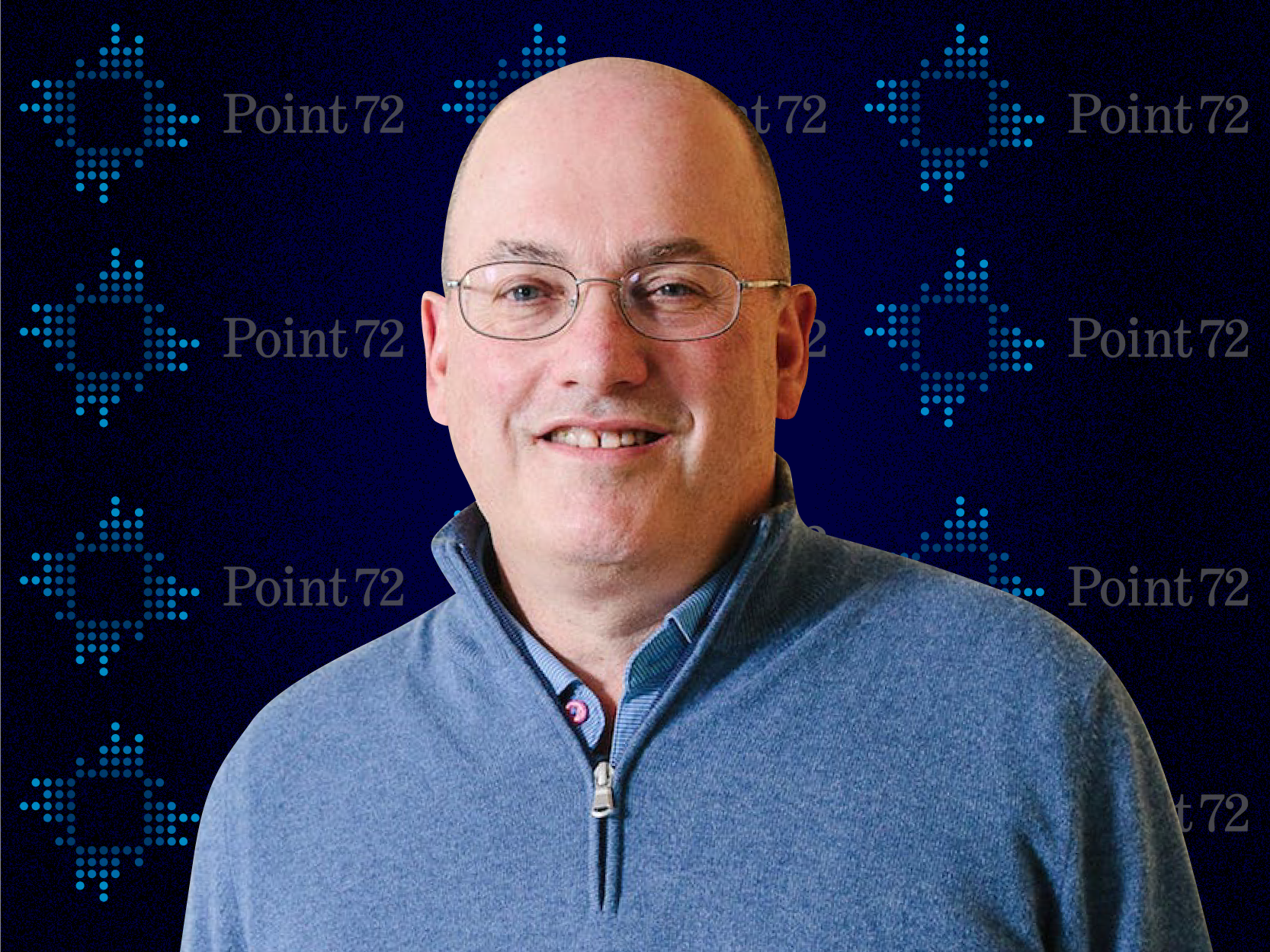

Point72 has poached a star credit trader from JPMorgan

Leon Hagouel is joining the hedge fund after 15 years at JPMorgan, where he specialized in trading credit-default swaps, junk bonds, and distressed debt. Hagouel is set to start at Point72 in October as a macro portfolio manager. Here's what we know about the hire.

Inside a $360 billion second act for one of Wall Street's most controversial investments

Critics have bemoaned collateralized loan obligations, or CLOs, as absorbing too much risky corporate debt. But the asset class defied skeptics, surviving the pandemic and soaring to record levels in 2021. We spoke with a dozen experts throughout the asset class, who gave us an inside look at what's next.

Speaking of CLOs … meet the people engineering the asset class's next big boom

Dealmakers, traders, and investors told us how they made a career in CLOs, explaining how they win investors over to a space with a fair share of critics. Meet them here.

A wealth-tech startup just hired two new execs from Betterment and JP Morgan.

In preparation to go head-to-head with custodians like Schwab and Fidelity, Altruist just hired a new CFO and head of investing. Here's what we know about the new hires.

Credit Suisse just hired a program trading sales exec known as "the Whopper"

Chris "Whopper" Johnson is joining from Wells Fargo, where he spent the past decade. He'll start as head of program trading sales, filling a void for Credit Suisse, which has seen an exodus in the Archegos aftermath. Everything we know so far (and why they call him "the Whopper").

Wells Fargo's new tech exec is overhauling the commercial bank's data strategy

Ruth Jacks is tasked with overhauling the way the bank interacts with data - from procurement to storage, security, and usage - for its large corporate clients. She gave us an idea of what she's targeting in her new role.

Ramp is the eighth crypto firm to win approval from the UK's financial regulator

The startup, essentially a PayPal for crypto, has secured rare regulatory approval from the UK's financial watchdog. Get the full rundown here.

How much do payment giants pay their tech talent?

We used our searchable salary database (check that out here) to see how much Amex, Mastercard, PayPal, Square, and Visa pay their technology employees. See what tech workers make at the country's leading payment companies.

On our radar:

- JPMorgan wants to hire Olympic-level athletes as bankers, Financial News reports. Here's why.

- Bloomberg reports that hedge fund Alphadyne lost $1.5 billion in a short squeeze in the global bond market - one of the biggest casualties.

- Businesses are loading up on credit, according to the WSJ. Spending could follow.

- KKR brought in a record fundraising haul as its PE portfolio surged. More on its $59 billion in new capital.

- From the New York Times: If you paid your debt to society, you should be allowed to work.

- Five warning signs you're in a toxic workplace, and what to do about it before it ruins your personal life.

- Employers are waging a war over work from home. WFH is winning.

- We got a private tour of the most expensive home for sale in America. See photos of the penthouse at 432 Park Ave.

- Your Whole Foods delivery order is getting about $10 more expensive if you live in one of these six cities.

- These nine people are shaking up the notoriously old-school legal industry, with everything from AI research to new pricing models. Meet them here.

Dit artikel is oorspronkelijk verschenen op z24.nl