- Gold investments plunged 60% in the first half of 2021, data from the World Gold Council showed.

- Jewellery demand fared much better, but hasn't yet recovered its pre-pandemic levels.

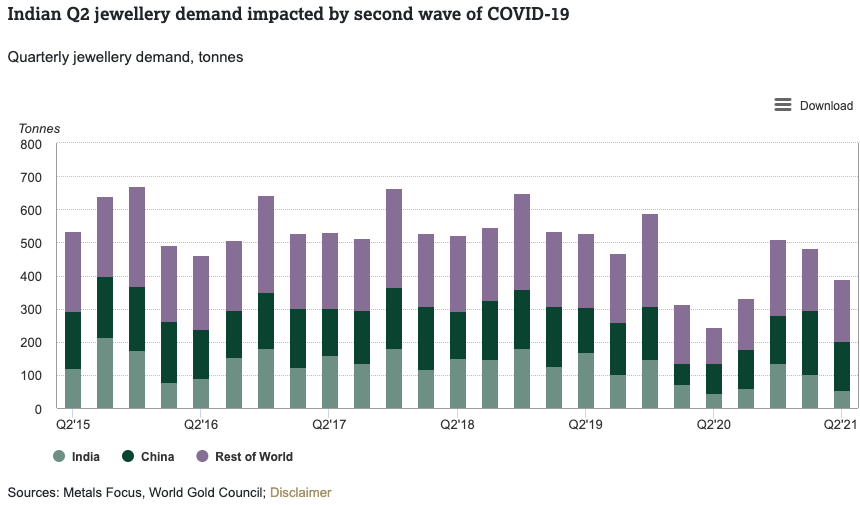

- Demand from India, a key market for gold, was significantly hurt by the impact of COVID-19.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Investor appetite for piling into gold through commodity funds seems to have dwindled in 2021 compared to last year, but retail shopping remains hot.

Demand for gold as an investment fell to 455.9 tons in the first half of the year, down 60% compared with a year ago, when exchange-traded funds logged record inflows, figures released Thursday by the World Gold Council showed. Investment demand for gold covers ETFs as well as coins and bars.

Overall, global demand for the precious metal stood at 1,833.1 tons in the first six months of 2021, down 10% year-on-year. That slide came as gold futures fell 3% in the first half to stand at about $1,775 per ounce as of June 30.

In the second quarter, global demand for gold gained momentum to reach about 955 tons, roughly the same level as the same period last year, according to the report.

"It has recovered noticeably as compared with the previous two weak quarters," said Daniel Briesemann, precious and industrial metals analyst at Commerzbank.

The WGC report highlighted a divergence in appetite for gold between institutional investors buying bars and coins, and consumers purchasing physical gold and personal ornaments.

After dropping to its lowest annual level on record in 2020, jewellery demand soared 60% to about 390 tons in the second quarter. But it still hasn't recovered to pre-pandemic levels, as first-half demand came in at 873 tons, considerably lower than for the period in years before the outbreak of COVID-19, the council said.

For the entire year, jewellery demand is expected to total between 1,600 to 1,800 tons, which would be above 2020 levels but well below pre-pandemic levels. The WGC report cited continued disruption in some markets, such as India, as a hindrance to recovery.

Buyers in China and the US contributed the most to jewellery demand in the first half. In the second quarter, India's market was significantly affected by the impact of the coronavirus outbreak, with demand plunging 46%.

The WGC had previously estimated new COVID-19 variants could limit the uptake in jewellery demand in key markets.

Central banks worldwide maintained their gold buying, increasing reserves by about 200 tons in the second quarter. Net purchases in the first half were 333.2 tons, 39% higher than the five-year average.

Gold prices have remained steady in recent weeks, around the $1,800 level, but rose to just shy of $1,820 on Thursday after Federal Reserve officials signaled the US economy is getting closer to the point where huge monetary stimulus can be reduced.