- Bank of America released its latest Global Fund Manager survey on Tuesday.

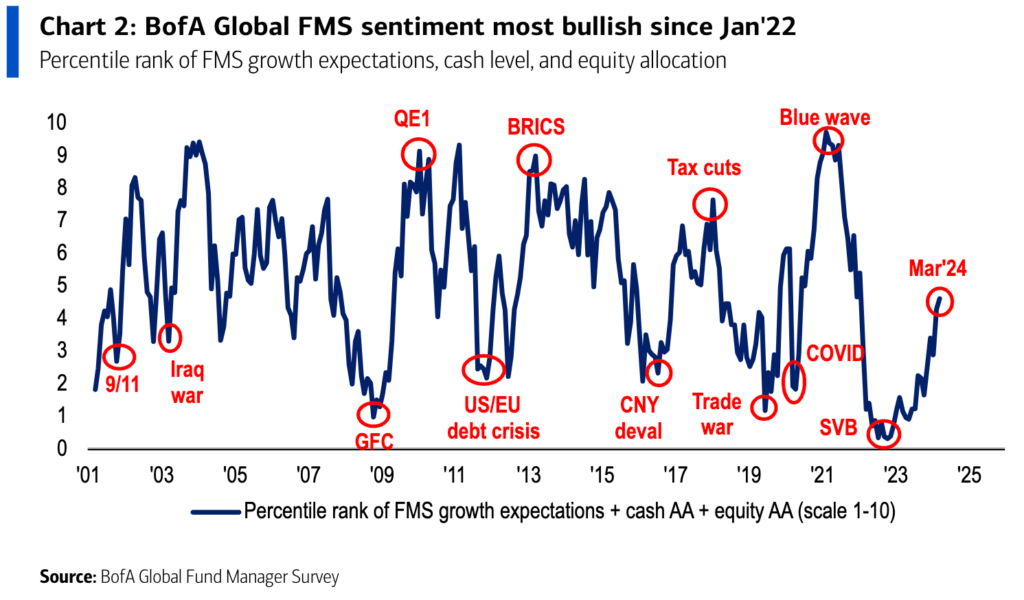

- Growth expectations and allocations to stocks are at two-year highs.

- 40% of respondents said AI stocks are in a bubble.

Investors are optimistic about the stock market, though some are growing wary about a potential bubble, according to Bank of America's global fund manager survey released Tuesday.

The most popular trade reported among investors was "long Magnificent Seven," Bank of America said. That's as 40% of respondents said AI stocks are indeed in a bubble.

The next most crowded trades included short Chinese stocks, long Japan stocks, long bitcoin, long cash, and long IG corporate bonds, the survey showed.

Respondents also reported "risk appetite" at the highest level since November 2021, and are showing the highest allocations to stocks in two years.

"Macro bullishness drove investors' equity allocation to net 28% overnight (the highest since Feb'22) while allocation to cash fell slightly to net 5% overweight (down from 6% overweight)," BofA strategists wrote. "On a relative basis, investors are the most overweight equities vs cash since Nov'21."

The survey, which polled 226 panelists with $572 billion in assets under management from March 8-14, also found that recession fears have been surpassed by the highest growth expectations in two years.

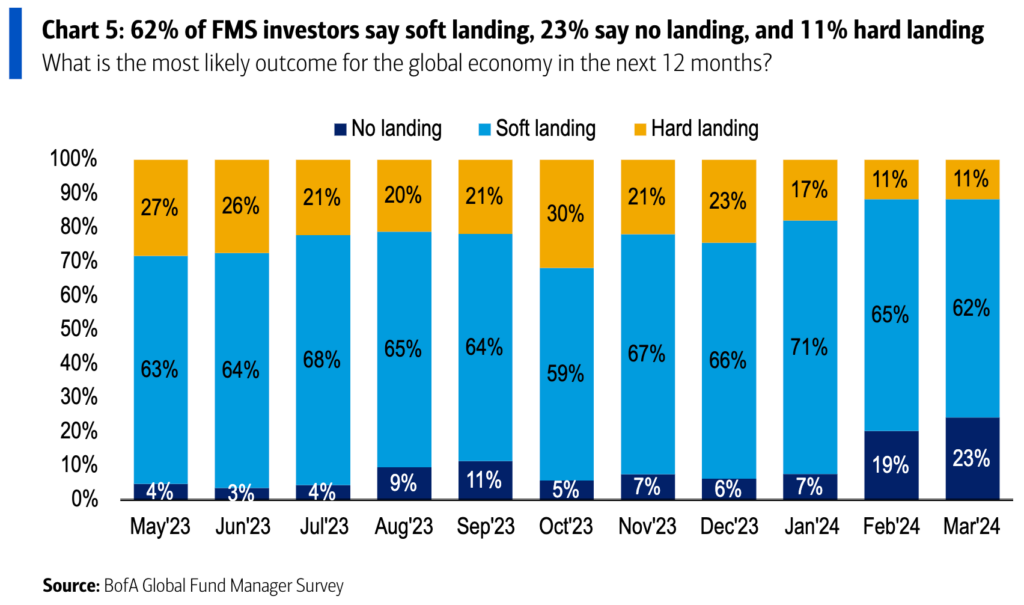

Two-thirds of participants said a downturn looks unlikely, and they see the odds of a soft landing at 62%, as the chart below illustrates.

In March, investors also reported a sharp month-over-month rotation into emerging markets, with the largest jump since June 20202. The combined allocations to the eurozone and emerging markets, Bank of America said, reached the highest level since May 2023.

"This growing bullishness on international equities highlights FMS investors' improving sentiment on global growth expectations," strategists said.

The optimism in the survey comes ahead of the Federal Reserve's Wednesday meeting, in which markets expect policymakers to hold interest rates steady. In January, forecasts for aggressive rate cuts helped the stock market crush record after record.

Yet even as traders tempered their predictions, stocks have not lost momentum.

Markets expect the first cut in June, and the hotter-than-expected February CPI report last week did little to change the outlook.

"If the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year," Jerome Powell said in March 6 remarks.