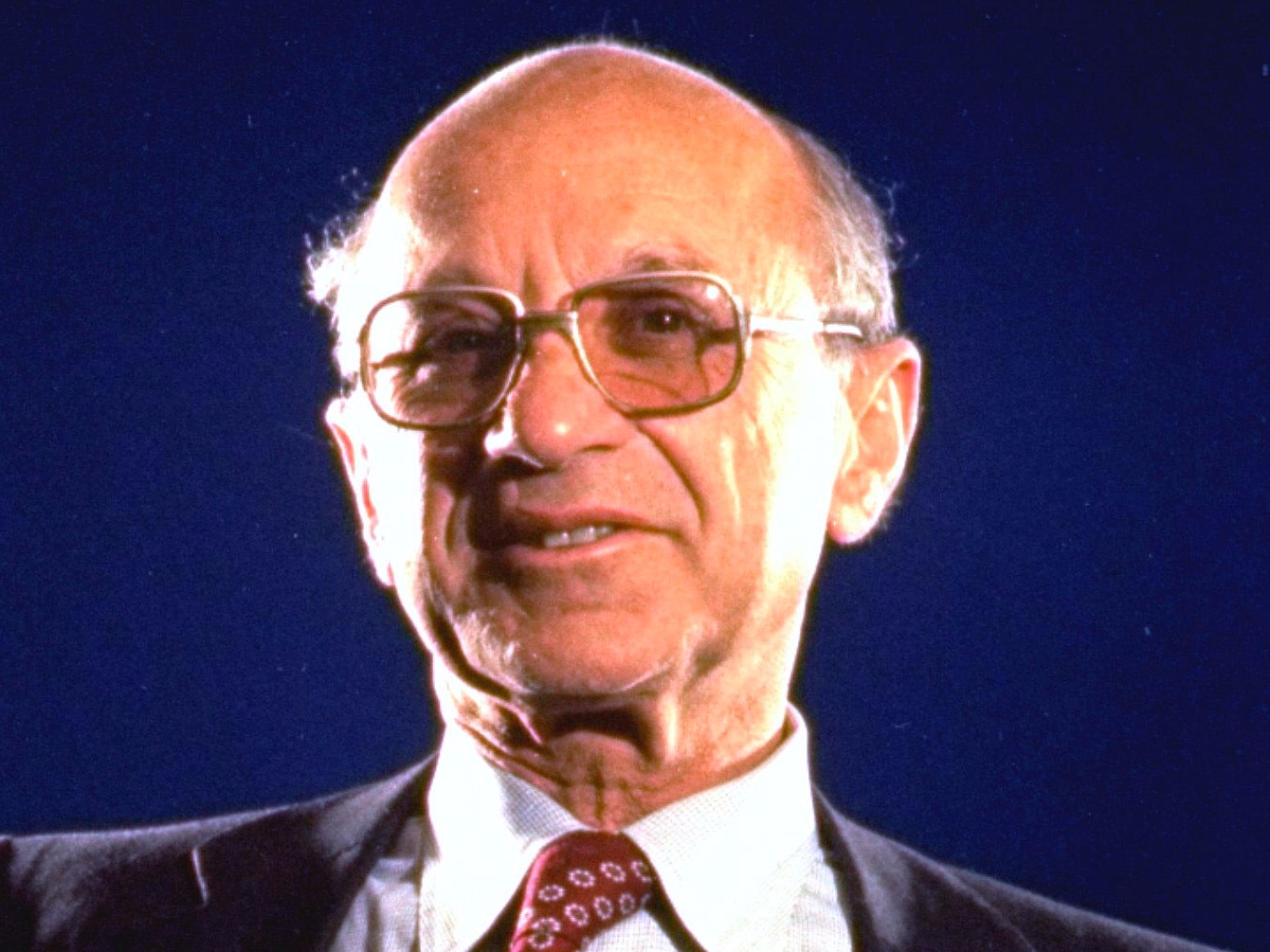

- In 1967, Milton Friedman argued that low unemployment spurred wage rises, wages rises in turn spurred inflation, and inflation then spurred further wage rises. The inflation/wages trade-off typically took between two and five years, Friedman said. But that explanation fails to explain current conditions: low inflation, low unemployment, and nonexistent wage increases. The difference between then and now is that “gig economy” companies like Uber and Deliveroo can turn their demand for workers on and off in seconds, not years. That has produced the opposite of what Friedman predicted.

Fifty years ago, Milton Friedman addressed the American Economic Association in Washington DC on the topic of monetary policy, inflation, and wage rises. He made a crucial claim, new at the time, which today is taken for granted: That low unemployment spurs wage rises, those wages rises in turn spur inflation, and that inflation then spurs further wage rises down the line, for as long as the rate of inflation continues to grow.

The upward movement of wages was good for workers in the short term, Friedman argued. As they won wage increases higher than the current rate of inflation they would, for a short time, gain real wage increases. Those gains would be wiped out as their wage gains spurred new inflation, of course. But they might hope to win again by negotiating even higher wages next time.

The tradeoff is always temporary, always adjusting, and central banks can’t create full employment by targeting a specific inflation rate, Friedman said. Once inflation kicks in, “wages must rise at that rate simply to keep real wages unchanged,” Friedman said.

Friedman thought that wages took between two and five years to reset.

The sweet spot for workers – when their wage demands went up faster than their inflationary effect – would last between two and five years, Friedman estimated:

"I can at most venture a personal judgment, based on some examination of the historical evidence, that the initial effects [on employment] of a higher and unanticipated rate of inflation last for something like two to five years; that this initial effect then begins to be reversed; and that a full adjustment to the new rate of inflation takes about as long for employment as for interest rates, say, a couple of decades."

As The Economist lamented this week, Friedman's explanation fails to explain current wage conditions: low inflation, low unemployment, and non-existent wage increases. Unemployment in both the UK and the US has been well below the "natural rate" of 6.5% that economists use as a rule of thumb since April 2014 - well over two years.

The mystery is, why has such low unemployment not spurred a burst of wage-growth inflation? According to Friedman, we should have seen huge pay gains for workers. Wage inflation ought to be raging.

Yet the UK flirted with deflation in 2015. Instead, of rising wages, we've got the lowest real wage growth rate in 40 years:

One obvious thing has changed between 1967 - when Friedman advanced his theory - and today: It no longer takes between two and five years to reset wage levels. Uber, eBay, Etsy, and Amazon all reset compensation levels - via supply and demand - in seconds. On top of that, UK companies rely on armies of "zero-hour" contract workers who get no guaranteed minimum hours at work. They're told on a daily basis when to show up, or not.

About half of all jobs created in the UK in recent years are "gig economy" jobs, according to Martin Beck, the lead UK economist at Oxford Economics.

"Taking the two years to the end of 2016, almost a third of the rise in the number of people in work reflected growth in self-employment (double the share of that category in total employment), with another fifth corresponding to more people in part-time work," he wrote in a recent note to clients.

Uber and Deliveroo turn their drivers on and off like a switch.

The effect of this, from employers' point of view, cannot be understated. In Friedman's time, taking on one new worker required a big financial commitment. This person needed to perform - and be paid for - 40 hours of productive work per week, regardless of the level of demand in the future.

It might take weeks or months for a company to decide it needed to commit to new hiring. And once those workers were hired an equally heavy inertia kept them hired: After all, who wants to go through another weeks long hiring process to find a replacement?

Today, Uber and Deliveroo turn their drivers on and off like a light switch. There is no incremental cost of taking on another worker because that worker will be dumped out of the system in minutes if there are no customers at any given moment. Similarly, zero-hours contracts allow managers to fire and rehire entire warehouses on a day-by-day basis.

The gig economy has thus broken a fundamental link in capitalism that was good for workers: There is no longer friction and inertia in hiring and unemployment, and employers can turn off their structural demand for new workers as soon as they see any sign of wages rising. That effect seems to have capped wage price inflation despite low unemployment - the opposite of what Friedman would have expected 40 years ago.