- There is now conclusive proof that Europe is in the midst of an economic slump.

- Data released on Monday showed that industrial production throughout the whole of the eurozone dropped sharply, pointing to only a glacial pace of growth in the continent at the end of 2018.

- Two of the continent’s four biggest economies, representing a total GDP of more than $5.5 trillion, are on the brink of recession.

The global economy is fraught with problems at the start of 2019. President Donald Trump’s trade war with China rumbles on; the US government shutdown is now the longest in history and is dragging on the country’s economy; and in China, economic data points to a continuing slowdown for the world’s second largest economy.

As economists, investors, and policymakers focus intently on what’s going on in the US and China, there’s another major economic crisis brewing.

This time, it’s in Europe, where growth has slowed practically to a standstill, and two of the continent’s four biggest economies, representing a total GDP of more than $5.5 trillion, are on the brink of, or already in, recession.

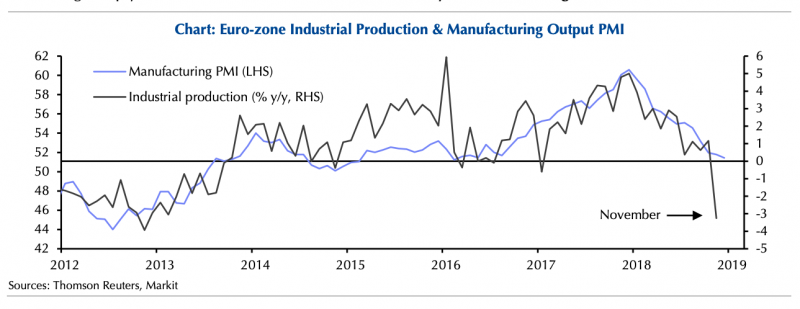

Data released on Monday showed that industrial production throughout the whole of the eurozone slumped into the end of 2018, signalling that the single currency area’s economy is still growing, but doing so at a glacial pace.

Eurostat, the EU's statistical authority said on Monday that industrial production fell by 1.7% between October and November last year.

"The numbers bode ill for GDP in Q4," Andrew Kenningham, the chief Europe economist at Capital Economics, said in a note to clients.

"While the eurozone may have eked out a small increase in GDP in Q4, it has clearly shifted down a gear. And there is little reason to expect a sharp rebound in 2019."

The chart below shows the sharp contraction in industry, the traditional driver of many major European economies:

Away from the broad progress of the whole eurozone, things are even more dire. Both Germany, Europe's largest economy (GDP: $3.7 trillion), and Italy, Europe's 4th largest, and the eurozone's 3rd largest (GDP: $1.9 trillion) saw their economies slump into the end of 2018, while France is also in the doldrums.

When official data about growth is released in March, both Germany and Italy will almost certainly have fallen into technical recessions, defined as two consecutive quarters of negative growth.

Germany's economic powerhouse struggles

Data last week showed that Germany, Europe's economic powerhouse and by far its largest economy, has likely fallen into a recession after the country's manufacturing sector reported a truly shocking end to 2018.

In the month of November industrial production fell by 1.9%, while the year-on-year data showed a 4.6% drop, the worst annual performance since the financial crisis.

Read more: Germany, the 4th-largest economy, probably just went into an unexpected recession

"Germany likely was in recession in H2 2018 ... Yesterday's manufacturing data in Germany provided alarming evidence of a much more severe slowdown in the second half of last year than economists had initially expected," Claus Vistesen, the chief eurozone economist at research house Pantheon Macroeconomics said.

Manufacturing is the big driver of the German economy, so when it falters, so too does Germany as a whole.

The economy already shrank 0.1% in the third quarter of last year, and the data points to a second quarter of negative growth in 2018's final three months.

Much of that slump is down to what's happening in the automotive industry, long the jewel in German manufacturing's crown. Greater competition in global markets, as well as newly introduced European Union greenhouse-gas emissions targets for automakers - the EU seeks to reduce emissions by 30% - have helped to trample on the auto sector in the country. BMW, for instance, saw third-quarter operating profits plunge 27%.

A third recession in a decade?

As Germany struggles, so too does Italy look to be on the cusp of a fresh recession, a third in just over a decade, as the systematic weaknesses in the country's economy continues unabated.

While the budget crisis that gripped the country in the second half of 2018 seems to finally have a solution, the country's government is volatile and highly euroskeptic, and it is not impossible that it will go back on promises made to the EU during negotiations.

Not only that, but the fundamentals of the Italian economy continue to struggle. Like Germany, Italy's manufacturing sector has bombed out in recent months, with both survey and official data showing a continued contraction in the sector at the end of 2018.

Read more: Italy finally squeezed a budget through parliament, averting a head-on collision with the EU

Andrew Harker, an associate director at IHS Markit, which compiles PMI, said last week that it was a "worrying end to the year for Italian manufacturers, with firms continuing to struggle to secure new business."

"This is in marked contrast to the start of 2018, when the sector was experiencing strong growth. Moreover, with business confidence at a six-year low, there appears little sense of optimism that the current soft patch will come to an end in the near future," he added.

Italian GDP, like Germany, also contracted 0.1% in the third quarter of the year, and the weakening manufacturing sector points to another quarter of contraction, and a second nation in a technical recession.

Other nations are nearing recessions, but aren't there yet

As Italy and Germany look to enter recessions, the rest of Europe is also struggling. In France, the eurozone's third largest economy, growth has stopped in its tracks as the continued protests of the "Gilets Jaune" subdue activity.

The yellow vest protests are expected to halve the country's GDP growth by 0.2% from 0.4% in the fourth quarter, and retailers have lost more than €1 billion in revenues since the protests started in November.