Roaring Kitty

- Keith Gill boasted $40 million of GameStop shares, call options, and cash on Wednesday.

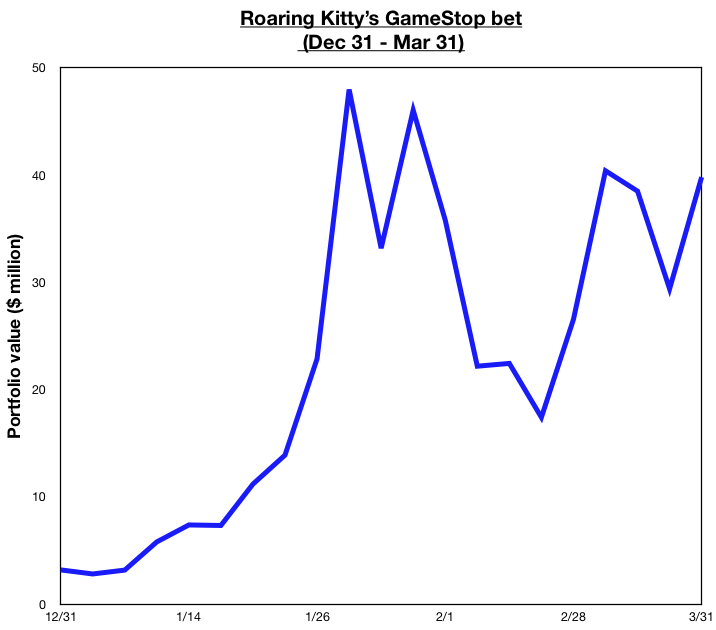

- The retail investor's portfolio surged 1,100% in value last quarter.

- Gill, who goes by Roaring Kitty, doubled down on GameStop in February.

- See more stories on Insider's business page.

The amateur investor who helped inspire the GameStop short squeeze ended the first quarter with $40 million in his portfolio – a 1,100% gain in three months.

Keith Gill, who goes by u/DeepFuckingValue on Reddit and the name Roaring Kitty on YouTube, posted a screenshot of his portfolio on the Wall Street Bets subreddit on Wednesday. It showed a total of $39.8 million in assets, comprising $19 million in GameStop shares, $8.9 million in bullish call options on the stock, and $11.9 million in cash.

Gill, who initially invested $50,000 in GameStop back in June 2019, uploaded a screenshot at the end of last year showing his portfolio was worth $3.2 million at the time. It skyrocketed in value during the buying frenzy, reaching $48 million on January 27. However, it tumbled to about $17 million on February 19 after the video-game retailer's stock deflated.

Many investors would have been tempted to cash out their profits, but Gill doubled his direct holding to 100,000 shares in mid-February. GameStop's stock price rallied from around $40 on February 19 to $190 on March 31, resulting in a strong rebound for his portfolio.

Insider was unable to verify Gill's screenshots, but the Wall Street Journal viewed his trading account in January and confirmed it held over $30 million in assets at the time.

Gill's massive windfall isn't just the product of a social-media mob targeting a heavily shorted stock in an attempt to get rich quick and stick it to Wall Street. It also reflects an early endorsement from "The Big Short" investor Michael Burry, who bought a stake in GameStop in 2019 and wrote several letters to the retailer's board calling for changes.

More significantly, Chewy cofounder Ryan Cohen invested in GameStop last year, secured a board seat in January, and has helped the company make a flurry of hires that signal it's focusing more on e-commerce.

Here's a chart showing how Gill's GameStop bet performed last quarter: