This story was delivered to BI Intelligence Apps and Platforms Briefing subscribers. To learn more and subscribe, please click here.

Mobile app marketers are expected to lose more than $100 million in 2016 as a result of app install and engagement fraud, according to a new AppsFlyer report. This includes misattribution due to fraudulent click data, paid installs from fraudulent devices, simulated in-app events, and the impact fraudulent behaviors have on lookalike targeting and retargeting. The report suggests that $250 million will be lost without being verified as fraud, bringing total potential revenue loss to $350 million.

To attract users, mobile marketers are increasing their ad spend and putting more effort into app-install and engagement campaigns. In an AdColony survey of the top 100 grossing mobile app developers, more than 80% of respondents said they intend to increase their spend on app-install ads in 2016.

In line with the increasing ad spend, mobile app install and engagement fraud is rising. There are three trends highlighted in the AppsFlyer report worth noting:

- Developed markets are targeted more than emerging markets. Countries that drive greater cost per install rates – including Germany, the US, the UK, and Australia – are a bigger target for potential fraud. However, countries that exercise stricter controls over inventory, such as Japan, have been able to mitigate the share of fraudulent devices on the market. Android is roughly 50% more fraudulent than iOS. Google’s heavily fragmented smartphone OS provides an appealing target for potential fraud. This is because software updates require original equipment manufacturers and carriers to roll out the new OS to end users, which can take months. Apple’s higher CPI and CPA payouts make it very attractive to fraudsters. Apple’s ability to generate higher revenue from its apps than Google Play is giving fraudulent actors a greater incentive to attack the platform.

Lastly, the report indicates that fraudulent players are becoming more sophisticated, optimizing methods aimed at duping advertisers into paying for false installs and in-app engagement. This is concerning given how important app install revenue is for the app market. In the US, we estimate app install ads accounted for 25% of total mobile ad revenue in 2015.

Will McKitterick, senior research analyst for BI Intelligence, Business Insider's premium research service, has compiled a detailed report on mobile app-install ads that looks at the revenues from app-install ads and how they're expected to grow over the next five years. It also looks at the performance of app-install ads and how these metrics are expected to change over time.

Furthermore, the report examines the top app-install ad products and pricing models offered by the leading advertising platforms, including Facebook, Twitter, Yahoo, and Google, as well as newer app-install formats from Instagram and Snapchat. Looking to the future, the report examines how companies are shifting their app-install ad spend to new formats, as well as the new tools they're using to improve optimization and ad effectiveness.

Here are some key takeaways from the report:

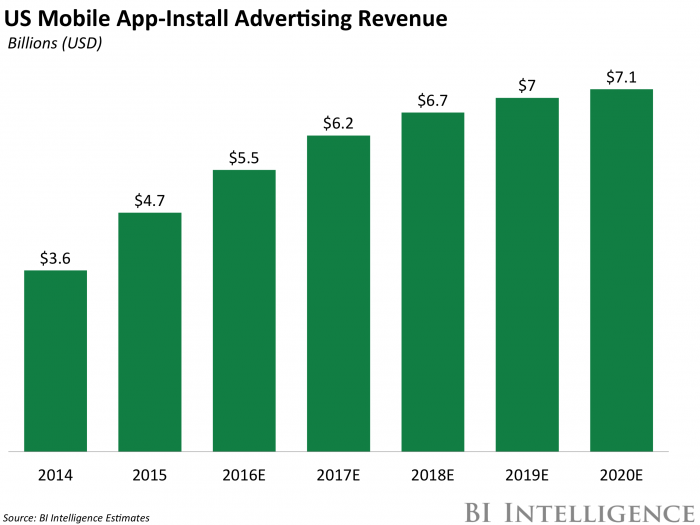

- Mobile app-install ads - ad units that direct users to download a mobile app - are an essential tool for developers, and they account for a major share of mobile ad spend. We estimate 25% of total US mobile ad revenue was generated by app-install ads in 2015. A combination of new developers entering the space and rising ad budgets will drive increased spending in years to come. US app-install ad revenue will grow to over $7 billion by year-end 2020, according to BI Intelligence estimates. Mobile app install advertisers have traditionally invested heavily in display and interstitial ads, but are moving to mobile video and native install formats. 86% of developers currently use in-feed video app-install ads, and video ads are seen as the most effective app-install format. As formats like video rise in popularity, older formats are losing their appeal for install campaigns. Static nonnative ads are widely used but are not seen as effective. Free app networks and offer walls have also fallen out of favor. Ad platforms are now developing innovative new install formats to earn even more revenue from these lucrative ad units. New approaches, including deep linking and app streaming, are more contextualized and interactive than older ad formats.

In full, the report:

- Forecasts app-install ad spending in the US through 2020. Explores which app-install ad formats developers believe are most effective. Discusses what the most popular platforms and ad networks are doing to attract ad spending. Investigates new tools for marketing apps, including deep linking and app streaming.

To get your copy of this invaluable guide, choose one of these options:

Subscribe to an ALL-ACCESS Membership with BI Intelligence and gain immediate access to this report AND over 100 other expertly researched deep-dive reports, subscriptions to all of our daily newsletters, and much more. >> START A MEMBERSHIPPurchase the report and download it immediately from our research store. >> BUY THE REPORT

The choice is yours. But however you decide to acquire this report, you've given yourself a powerful advantage in your understanding of the fast-moving world of mobile app-install ads.