Facebook reported another blowout quarter on Wednesday as the company’s advertising revenue and audience continued to expand well ahead of expectations.

But shares sunk more than 8% in after hours trading after the company cautioned that spending will grow in 2017 and said that the News Feed is nearly fully saturated with ads.

Here are the key numbers from Q3:

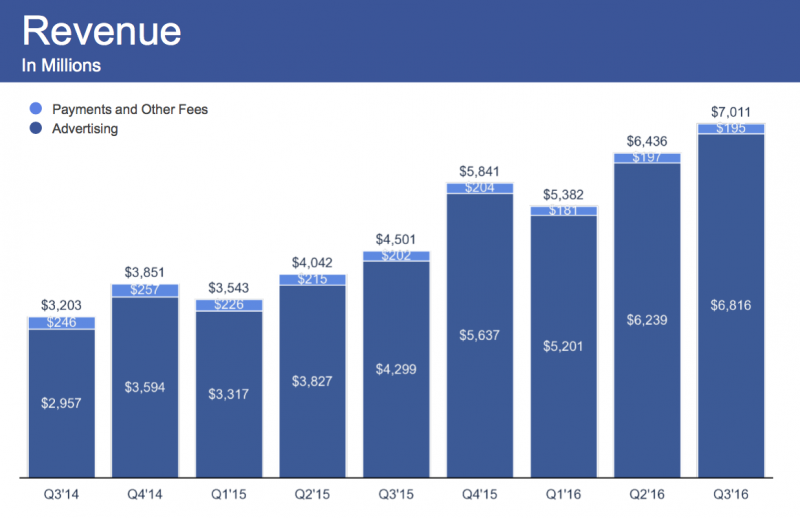

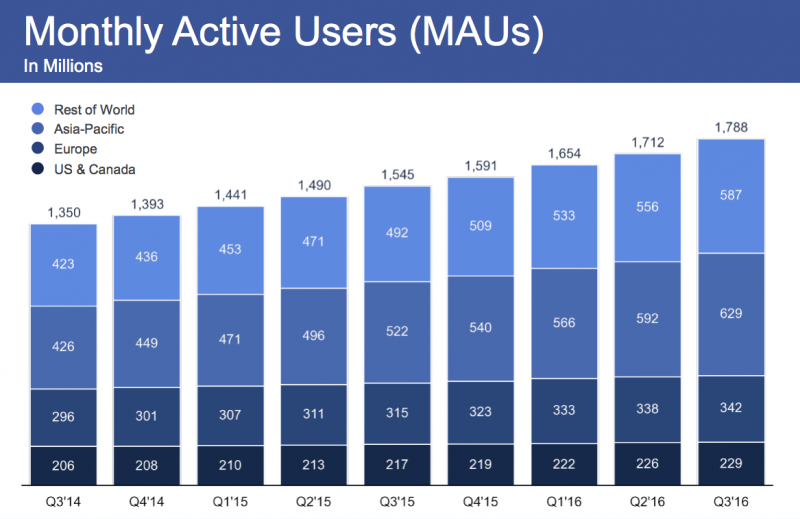

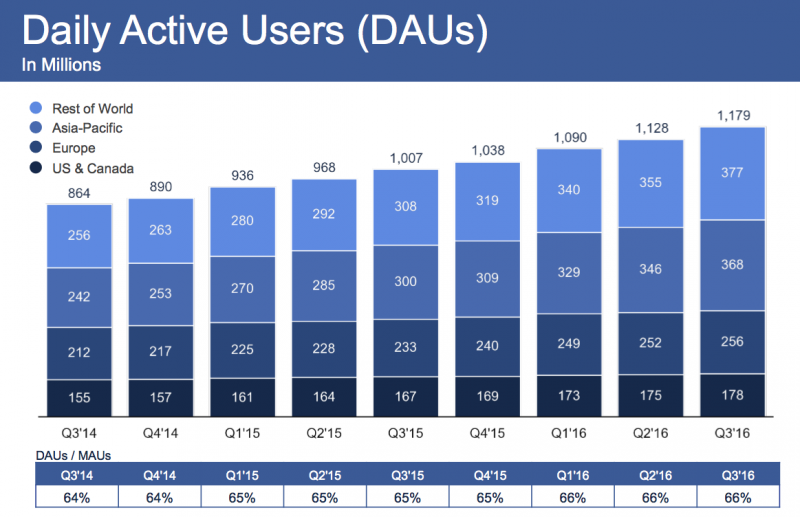

- Revenue: $7.01 billion vs. $6.92 billion expected, and up 56% from the year-ago period. EPS (adjusted): $1.09 vs. $0.92 expected. Monthly active users: 1.79 billion vs. 1.76 billion expected. Daily active users: 1.18 billion vs. 1.16 billion expected.

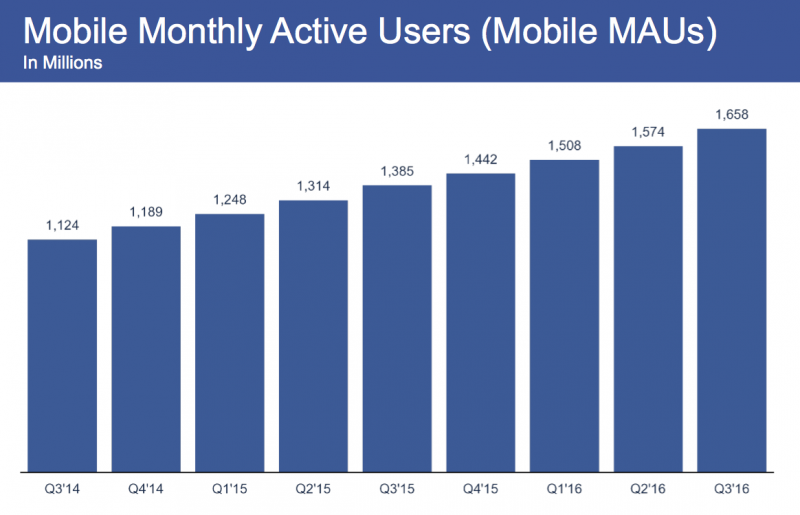

Facebook gained 80 million monthly users in the third quarter and for the first time now has more than 1 billion daily users on mobile. Its mobile ad business brought in $5.7 billion, which was 84% of its total ad revenue versus 78% in the year-ago period.

Perhaps more importantly, the ratio of daily users to monthly users - the best way to measure Facebook users' level of engagement with the service - held steady at 66% despite worries that increased competition from the likes of Snapchat is stealing away people's attention.

Despite Facebook's strong performance across the board, the company's guidance for 2017 sent its shares sinking more than 8% in after hours trading.

Worries for 2017

One less sunny moment during Facebook's earnings call was when CFO David Wehner reiterated that revenue growth rates will decline in the coming quarters.

One of the main contributions to Facebook's revenue growth is ad load, or the number of ads that can be placed in the News Feed. Wehner cautioned again on Wednesday that the company projects ad load growth to "come down meaningfully" in mid 2017, which means it's running out of space to serve ads.

Wehner also said that 2017 will be an "aggressive investment year" for the company as it seeks to grow capital expenditures "substantially" and ramp up hiring.

Facebook shares immediately fell more than 8%.

Here are some charts from Facebook that show the company's performance: