- Facebook says it expects to be fined up to $5 billion by US regulators.

- The social network announced its Q1 2019 financial results on Wednesday, and beat analysts’ expectations on revenues.

- It also announced that it was setting aside $3 billion for what is expected to be a record-breaking, multi-billion dollar settlement with the FTC over privacy issues.

Facebook has set aside $3 billion in anticipation of an expected record-breaking, multi-billion dollar fine from US regulators.

On Wednesday, the California-based social networking giant announced its Q1 2019 financial results. It beat Wall Street’s expectations for revenue for the quarter, posting results of $15.08 – and announced that it was preparing for a settlement with the Federal Trade Commission in the $3-5 billion range over privacy issues.

This would be the largest ever fine by the FTC, and relates to its ongoing investigation of Facebook launched following the Cambridge Analytica scandal, over alleged violations of a 2011 consent decree on user privacy.

The tech firm has been beset by scandals for the past two years, from Cambridge Analytica’s misappropriation of tens of millions of users’ data to the platform’s role in spreading hate speech that fueled genocide in Myanmar.

Such a fine would be the largest monetary penalty the company has faced to date for its missteps, but it still pales in comparison to its billions in annual profits. The market effectively shrugged off concerns about its impact, with Facebook's stock leaping in after-hours trading by around 8%, to $197 per share.

Facebook says that had it not set the funds aside, its earnings per share would have been $1.89 - significantly higher than analysts' expectation of $1.62.

"In the first quarter of 2019, we recorded an accrual of $3 billion in connection with the ongoing inquiry of the FTC," a Facebook spokesperson said in a statement. "This matter remains unresolved, and we estimate that the associated range of loss is between $3 billion and $5 billion."

Here are the key numbers (and what analysts were expecting, via Bloomberg):

- Revenue: $15.08 billion ($14.97 billion expected), up 26% year-on-year

- Earnings per share (GAAP): $0.85 (expected was $1.62, which didn't take into account the cash set aside for the expected settlement)

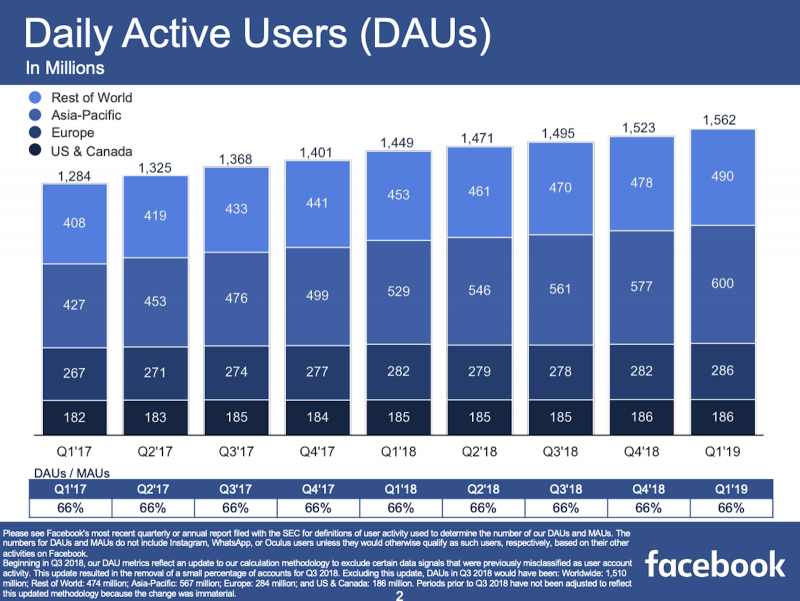

- Daily Active Users: 1.56 billion (in line with expectations)

- Monthly Active Users: 2.38 billion (2.37 billion expected)

- Watch Facebook trade live »

Meanwhile, the total number of daily users of Facebook's entire "family of apps" has grown to 2.1 billion, up from 2 billion, while monthly active users has held steady at 2.7 billion. The company has previously said that at some point it will stop disclosing its daily and monthly active users for the core Facebook app, replacing it instead only with this "family of apps" figure.

Such a move would help disguise any drop-off in users in the core Facebook app, that has borne the brunt of the company's scandals and is increasingly overshadowed by buzzy sister app Instagram. But data released by Facebook on Wednesday shows that (for now, at least) the social network continues to hold broadly steady, and has continued to slowly grow its European userbase again after roughly flatlining for the past year.

A key area of focus for investors is the continued growth of Instagram, even as the core Facebook app's business slows, and as the company adapts its advertising model to the (relatively) new Stories format across the company's various apps.

On a call with Facebook executives on Wednesday, analysts focused largely on the the company's new purported emphasis on "privacy" and how it could affect the business, as well as the potential of ecommerce for the company, and the growth of Stories. The first and only question about the potential FTC settlement came towards the tail-end of the call.

Facebook's years of scandals haven't halted its rapid growth, and prior to releasing its earnings on Wednesday the company's stock was hovering around $183 a share - below its all-time highs of $218 in July 2018, but well above the $123 mark it was languishing at as recently as December.

Business Insider is covering Facebook's earnings live. Refresh this page or click here for updates.

Do you work at Facebook? Got a tip? Contact this reporter via encrypted messaging app Signal at +1 (650) 636-6268 using a non-work phone, email at [email protected], Telegram or WeChat at robaeprice, or Twitter DM at @robaeprice. (PR pitches by email only, please.) You can also contact Business Insider securely via SecureDrop.