- Retail investors appetite for meme stocks is beginning to wane, according to Vanda Research.

- The firm outlines the three types of stocks that could benefit as investors look for the next hot trade.

- "If purchases of meme stocks continue to decline, retail investors will rotate into other speculative stocks," Vanda said.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Retail investors' appetite for so-called meme stocks is beginning to wane, and three types of stocks could be the next target for this cohort of investors, according to a Wednesday note from Vanda Research.

Weekly purchases of a basket of meme stocks have fallen more than 50% this month, from a peak of $963 million on June 8 to $417 million this week, according to the note. Despite the decline in retail purchases, prices of meme stocks have held their own, as "few institutional investors can or dare to short these stocks," Vanda said.

AMC Entertainment is still trading just below record highs at $56.43 as of Tuesday's close, while GameStop's stock price remains above $200 a full five months after it peaked at nearly $400 amid an epic short-squeeze.

While Vanda expects flows into meme stocks to decline going forward, "we don't think it will die completely," the note said.

Still, retail investors are likely to move on from meme stocks and focus on finding the next hot trade, which could very well be in the hydrogen, crypto, or cannabis sectors, according to Vanda.

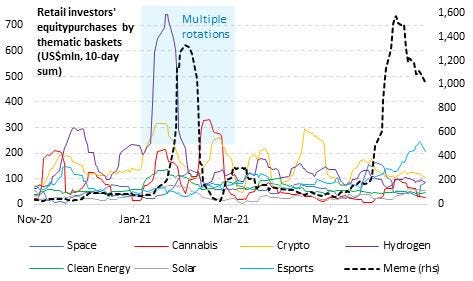

Hydrogen stocks saw big inflows before the meme-stock category blew up in early 2021, while cannabis and crypto stocks "exploded as soon as trading restrictions on highly shorted stocks were put in place," the note said.

While none of these speculative assets saw broad retail participation in the second quarter, retail FOMO should eventually kick in as their prices continue to rise.

"If purchases of meme stocks continue to decline, retail investors will rotate into other speculative stocks, as they did in January and February," Vanda concluded.