In a CNBC interview on January 6, Fed Vice Chair Stanley Fischer said that four rate hikes in 2016 would be “in the ballpark.” Yet here we are on September 21 with the Fed not yet having raised rates even once this year.

Furthermore, while the Fed says that every meeting is live, a November rate hike seems likely to be off the table as there is no Fed press conference to explain such a move if it were to happen.

That leaves the December meeting as the only meeting left in the calender year. And it seems unlikely that the Fed would hike rates by more than 25 basis points in one meeting when it has failed raise rates even once this year.

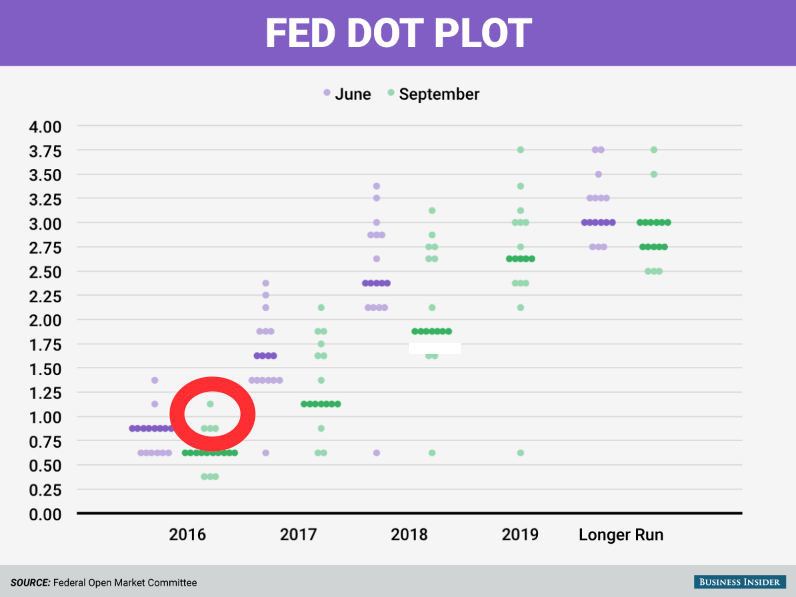

So maybe the Fed should explain its “dot plot,” which shows three members calling for two rate hikes and another member calling for three rate hikes before the end of the year.

We are all ears…