The Washington Post / Contributor/Getty Images

- Home sales have slowed, but buyers waiting for prices to cool were out of luck in June.

- Home prices surged at the fastest annual pace since 1979 as demand pressures endured, CoreLogic said.

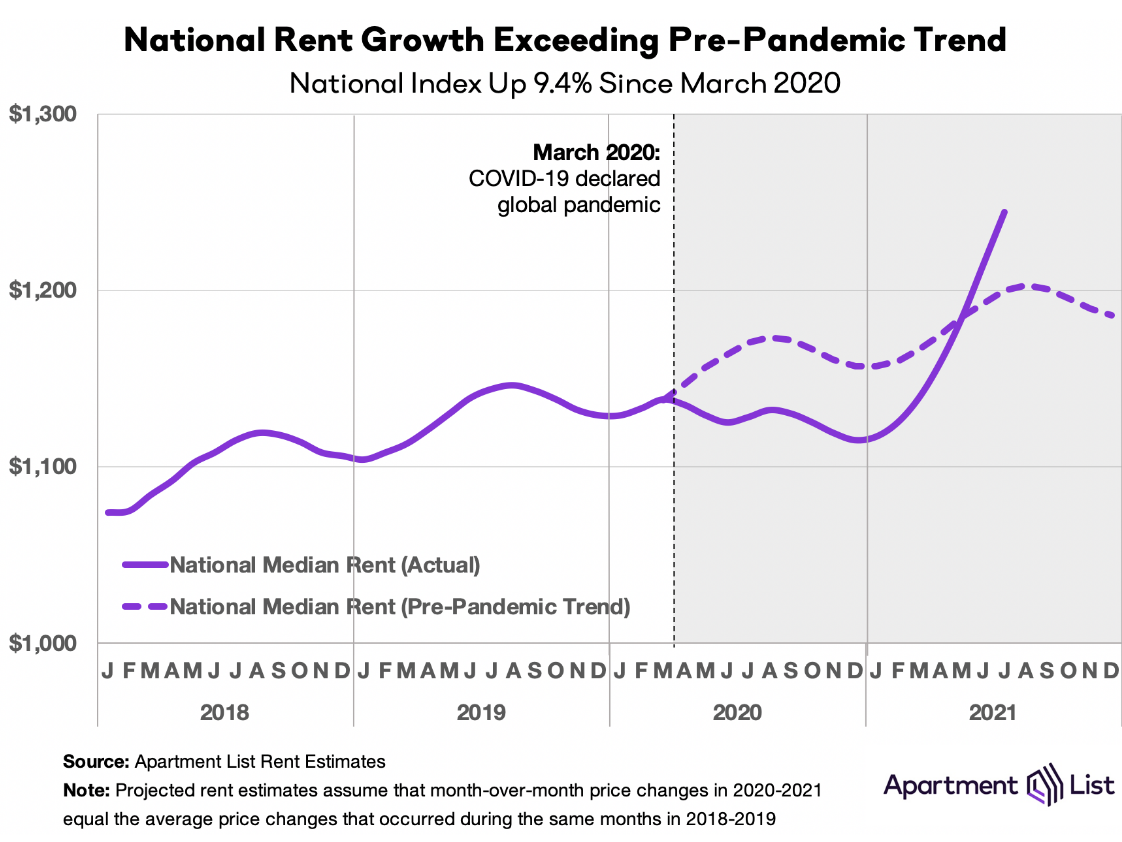

- Rentals aren't better. Prices leaped 2.5% in June, to well above the pre-pandemic trend, Apartment List said.

- See more stories on Insider's business page.

Housing prices got out of hand early in 2021, so Americans went on something of a strike.

They simply thought the deals weren't good enough, and home sales subsequently slowed from the frenetic pace seen earlier in the pandemic. The market is still far from normal, though, and by many measures, the affordability crisis is only getting worse.

The stark imbalance between the number of homes available and the number of people wanting to buy continued to lift prices at an astonishing rate into summer. Prices rose 17.2% year-over-year in June, housing data company CoreLogic said Tuesday. That's the largest one-year increase since 1979, though the measure is somewhat skewed by the much lower prices seen earlier in the pandemic.

On a month-over-month basis, prices rose 2.3% in June. That's how much prices typically rise in an entire year.

The market remains rife with prospective buyers and too few sellers. The rate of inflation risks pushing less wealthy Americans out of the market.

"With plenty of cash on the sidelines, along with very low mortgage rates, prices are heading up and affordability will become a more acute issue for the foreseeable future," Frank Martell, president and CEO of CoreLogic, said in a statement.

The homebuying spree is bleeding into the rental market

Rents rose 2.5% from May to June and sit 11.4% higher than they were at the end of 2020, Apartment List said in a July 26 report. By comparison, rent growth from January to July averaged just 3.3% in the three years before the pandemic.

The recent surge in rent prices places costs "well ahead" of the growth trend seen in 2019, Apartment List economists Chris Salviati, Igor Popov, and Rob Warnock said in the report. The price boom is taking place in "virtually every major market across the country," they added. And while rents remain below their pre-pandemic levels in 13 major markets, prices are rebounding quickly, according to the report.

"As economic recovery continues to gain momentum, we may be seeing the release of pent-up demand from renters who had been delaying moves due to the pandemic," the team said. "Whereas last year's peak moving season was halted by the pandemic, this year's seasonal spike is more than making up for lost time."

UBS says there's some reason to be optimistic

While prices have leaped higher, spending should soften as inventory bounces back in the months ahead, UBS economists led by Ajit Agrawal said in a Tuesday note. That's already shown up in homebuyer sentiments, which soured through 2021 amid the historic price surge. Pending home sales also slowed, suggesting high prices are finally slamming the brakes on market activity.

Separately, the population shift away from cities has started to fade, the team said. The start of the pandemic saw Americans move away from cities and flock to exurbs, areas more rural than suburbs that offer more space and cheaper housing.

Yet the trend slowed somewhat in May and June as reopening led businesses to call employees back to their offices. That return-to-work should reverse out-migration from many cities and, in turn, cool booming demand in suburban and rural neighborhoods, the economists said.

Still, that reversal isn't likely to play out until the end of the year, according to UBS. Buyers, then, are best off staying patient as economists forecast weaker demand, rebounding supply, and a fizzling-out of the exurban migration.