Even with all the seemingly never-ending political hoopla, investors are feeling pretty optimistic.

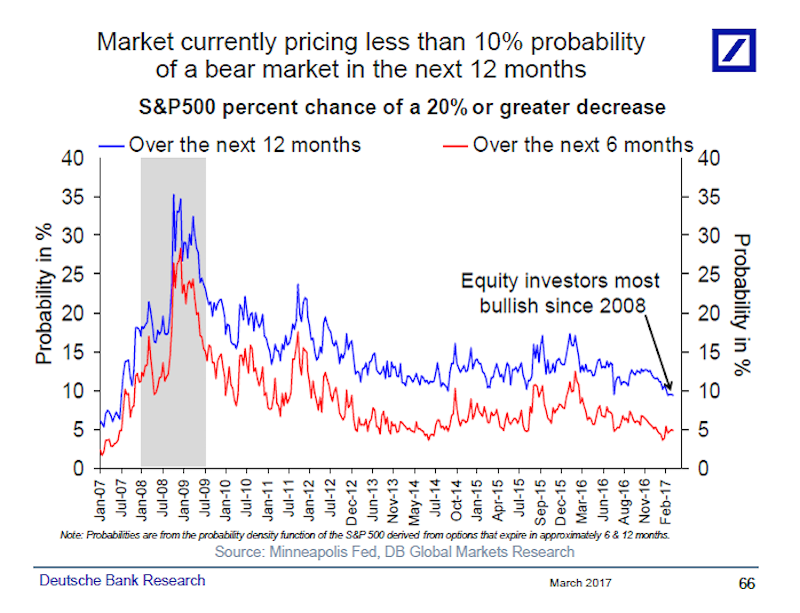

In a recent note to clients, Deutsche Bank’s Chief International Economist Torsten Sløk shared a chart showing that markets are currently pricing less than 10% probability of a bear market over the next 12 months – and an even smaller probability over the next six months.

For what it’s worth, the last time equity investors were this bullish was back in 2008.

“Despite enormous political uncertainty both in the US and Europe, stock markets continue to see very limited downside risks on the horizon with implied probabilities of a +20% correction in the S&P 500 at the lowest levels since 2008,” Sløk wrote.

Stocks rallied after the November election of US President Donald Trump as investors considered the possibility of deregulation, fiscal stimulus, and tax cuts. And they have continued climbing since, with the Dow blowing through 21,000 the day after a more measured tone in Trump’s speech to Congress on February 28.

As always, we must emphasize that the past does not predict the future. The fact that something has happened in the past does not mean that it will happen today, nor does it mean that it won't happen. In other words, this chart is not predicting an financial crash à la 2008.