- Rivian made its debut on the Nasdaq on Wednesday, closing 30% up from its offering price.

- Tesla CEO Elon Musk said in a tweet that high production and breakeven cash flow would be the "true test" for Rivian.

- Musk was responding to a tweet that said Tesla had already been selling its Roadster model for two years with plans to roll out Model S when it went public.

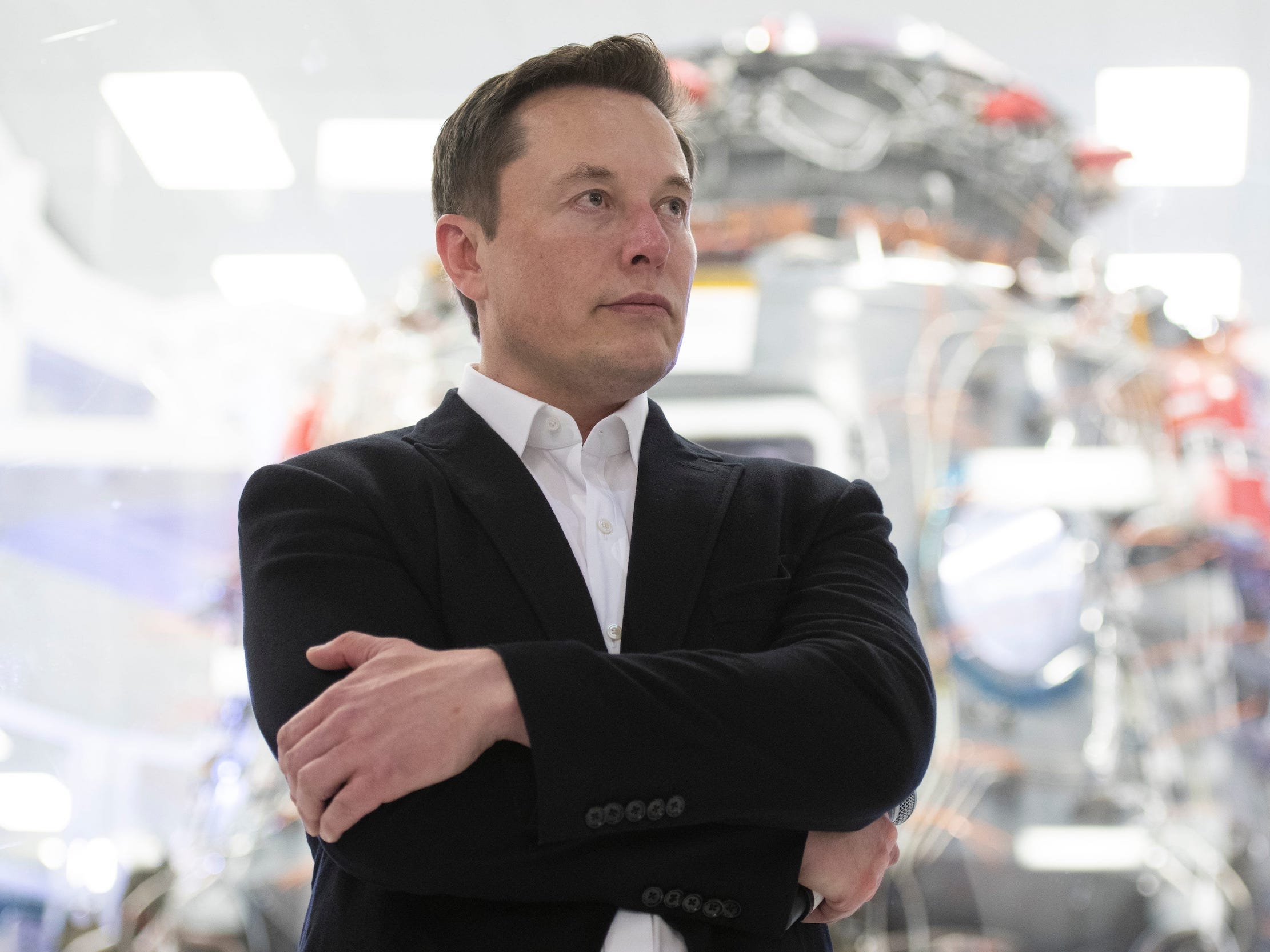

Elon Musk has weighed in on Tesla competitor Rivian a day after the latter's blockbuster IPO debut.

In a tweet, the Tesla CEO said high production and breakeven cash flow would be the "true test" for Rivian, but that Tesla is the only American carmaker to have achieved that goal in the last 100 years.

-Elon Musk (@elonmusk) November 11, 2021

Musk was responding to a tweet that pointed out that Tesla – which is cash flow positive – had already been selling its Roadster model for two years with plans to roll out Model S when it went public in 2010.

Rivian, in comparison, just started selling its vehicles and has reported a net loss of almost $1 billion in the first half of this year.

Rivian made its debut on the Nasdaq Wednesday, closing 30% up from its offering price. The startup's shares extended gains on Thursday, finishing the day 22% higher. The company's market cap is now over $100 billion, making it more valuable than legacy automakers Ford and General Motors.

It's not the first time Musk has commented on his company's competitor. Last month, he tweeted, "prototypes are trivial compared to scaling production & supply chain" in response to another tweet about Rivian's electric truck production rate.

Rivian did not immediately respond to Insider's request for comment on Musk's tweet.