Income inequality and political polarization have both recently increased in the US, leading to questions about a possible correlation or causal link.

And in a new working paper, economists David Autor, David Dorn, Gordon Hanson, and Kaveh Majlesi found empirical evidence linking the negative trade shock from China with an increase in electoral successes of non-centrist politicians and an increase in political polarization.

They found that areas in the US hit the hardest by trade shocks were more likely to shift away from centrist politicians. Crucially, it wasn’t so much that the politicians who were already in office shifted their views away from the center, but rather that the electorate voted in new representatives who espoused more left- or right-leaning ideas.

The team looked at the years from the first midterm election during the George W. Bush administration in 2002 to the first midterm elections during the Barack Obama administration in 2010. They chose those endpoints because congressional districts are redrawn after every decennial census and they wanted the longest recent period for which the boundaries were unchanged. Also, neither 2002 nor 2010 was a presidential election year.

It’s also noteworthy that China joined the World Trade Organization in 2001. Its share of world manufacturing exports surged to 15.1% by 2010, up from 4.8% in 2000. Plus, the later years of the time frame include the rise of the Tea Party movement.

Here's what the economists found, from their abstract (emphasis ours):

"Exploiting the exogenous component of rising trade with China and classifying legislator ideologies by their congressional voting record, we find strong evidence that congressional districts exposed to larger increases in import competition disproportionately removed moderate representatives from office in the 2000s. Trade-exposed districts initially in Republican hands become substantially more likely to elect a conservative Republican, while trade-exposed districts initially in Democratic hands become more likely to elect either a liberal Democrat or a conservative Republican.

"Polarization is also evident when breaking down districts by race: trade-exposed locations with a majority white population are disproportionately likely to replace moderate legislators with conservative Republicans, whereas locations with a majority non-white population tend to replace moderates with liberal Democrats."

To measure regional trade shocks, the authors of the paper broke the US up into regional labor markets, defined as commuting zones, and measured the change in import penetration from China for different manufacturing industries, weighted by employment in each commuting zone.

Those commuting zones don't match up exactly with congressional districts, so the authors divided the US into county-by-congressional district cells and mapped those to their corresponding commuting zones to get a sense of how elections went in districts with varying degrees of trade exposure.

This study applies specifically to trade shocks, and not economic shocks in general. The authors also looked at what happened after the 2006 housing bust and found that the polarization effects were "considerably weaker" than for trade shocks.

"Results on housing prices are broadly in line with our trade findings: local labor markets subject to larger post-2006 housing prices drops move away from moderate toward conservative legislators," they wrote. "However, these effects only hold for initially Republican districts."

Moreover, the findings do not support the stereotypical line of thinking, which is that trade shocks makes "red states redder or blue states bluer" in the sense that a party gains greater regional dominance. Rather, the authors note that more trade exposure "leads to fewer lopsided electoral victories, higher voter turnout, and larger individual campaign contributions, all of which indicate tighter races."

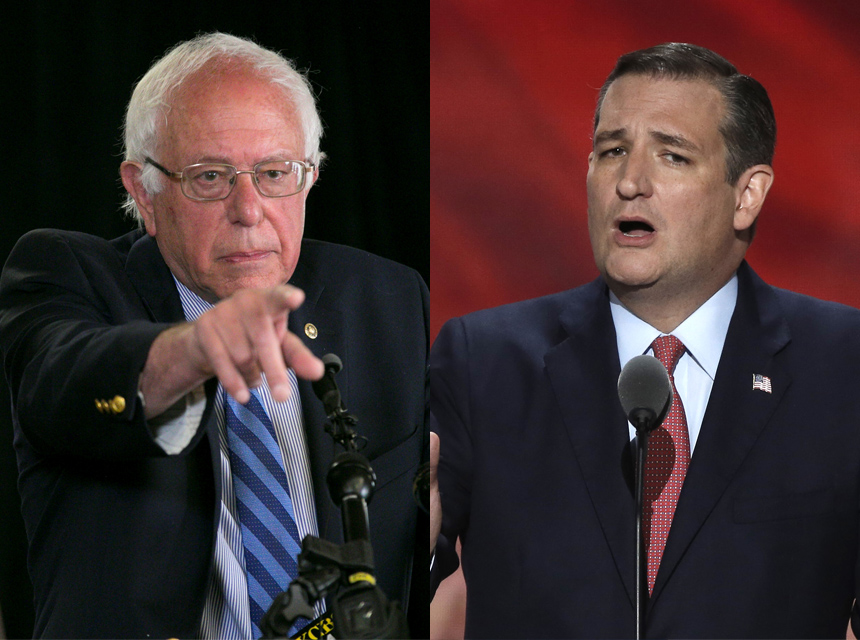

Although the authors of the paper looked at 2002 to 2010, trade was a huge issue in the 2016 US presidential election. We saw a similar pattern with the emergence of nontraditional candidates like Donald Trump and - to a much lesser degree, but still espousing a shift away from the center - Democratic candidate Bernie Sanders. Both pointed a finger at trade with China.

Even Hillary Clinton, more centrist than either Trump or Sanders, eventually abandoned support of the Trans-Pacific Partnership deal - after previously calling it the "gold standard" of trade agreements - ostensibly in an attempt to address voters' concerns.

However, while voters in the US and other developed markets increasingly regard free trade with skepticism, mainstream economists still virtually agree that free trade is good for an economy in the long run - even though within an economy there will be some people who benefit less, particularly in the short term - while trade-restrictive measures hurt consumers.

And this raises questions about not only how politicians will continue to respond during elections to voters' grievances amid a shifting socioeconomic landscape, but more importantly how they will respond when it comes to actually making policy.

We should note that the trade shock is, of course, not the sole variable affecting voters' decisions. The relationship of economics, race, social trends, institutions, and politics in the United States is far too complex to be limited to a single study - not to mention the fact that sometimes these factors are interconnected. Even just within economics, trade is not the whole story; automation also affects Americans' jobs. In short, trade is just one part of the big picture.

The authors also cite other papers in their work, noting that a consensus on the origins of political polarization has not been reached. Among some of the political, economic, and social phenomena linked with polarization they bring up are immigration, banking crises/stock market crashes, and tax and regulatory policies.

Check out the full paper on the relationship between trade exposure and political polarization »