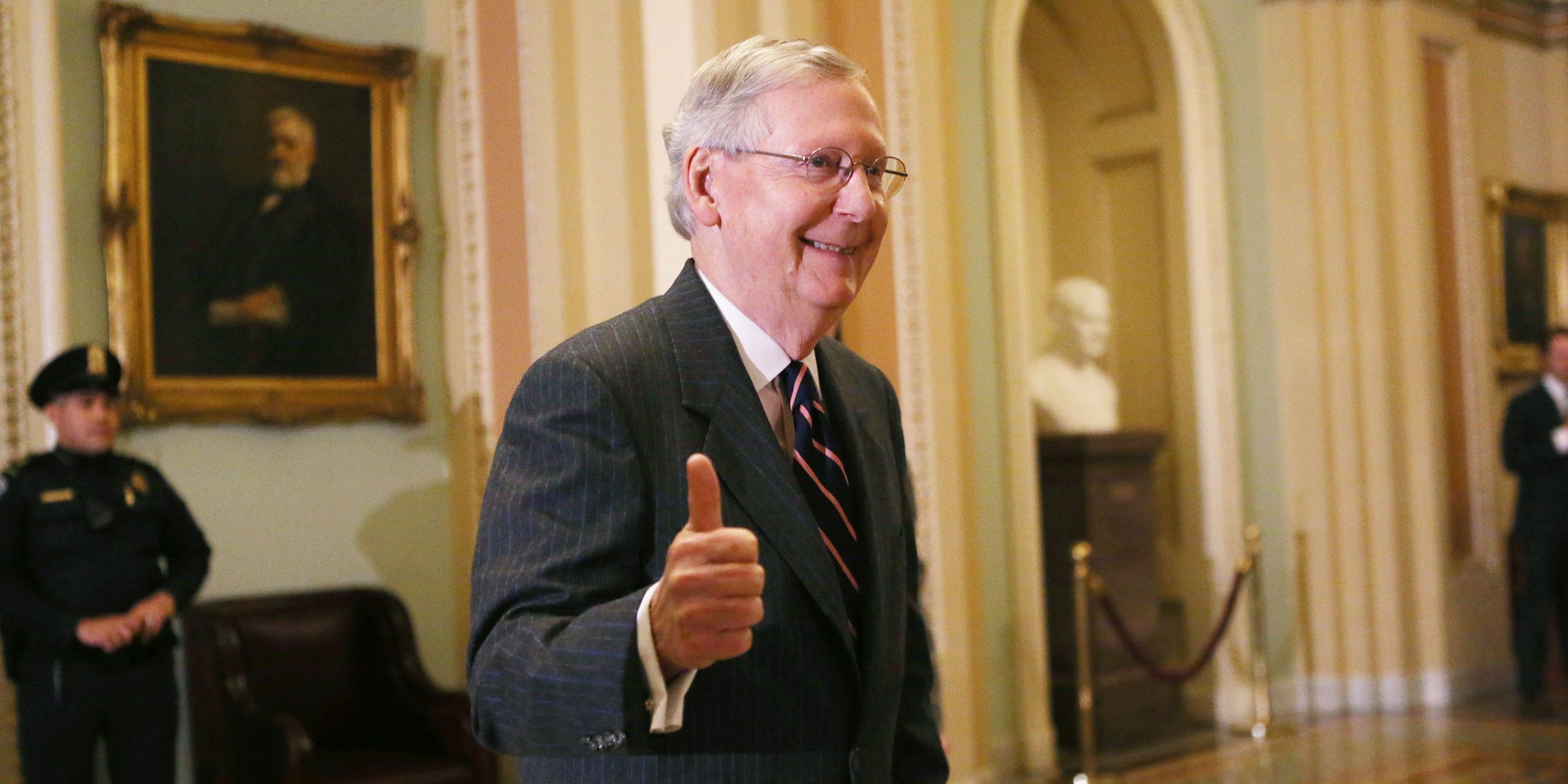

- US stocks extended earlier gains on Tuesday after Senate Majority Leader Mitch McConnell pledged to get a fiscal stimulus deal done before Congress leaves for the holidays.

- “We’re not leaving here without a COVID package,” McConnell said, adding: “No matter how long it takes, we’ll be here.”

- Also boosting investor sentiment is the rollout of Pfizer’s COVID-19 vaccine across the US this week.

- Watch major indexes update live here.

US stocks surged on Tuesday after it became clear to investors that another round of fiscal stimulus before the holidays is likely. The more than 1% move higher in stocks snapped a four-day losing streak in the S&P 500.

Giving investors confidence that a deal would get done was a pledge from Senate Majority Leader Mitch McConnell at the weekly Republican press conference.

“We’re not leaving here without a COVID package,” McConnell said, adding, “No matter how long it takes, we’ll be here.”

Here’s where US indexes stood at the 4 p.m. ET close on Tuesday:

- S&P 500: 3,694.62, up 1.3%

- Dow Jones industrial average: 30,199.31, up 1.1% (338 points)

- Nasdaq composite: 12,595.06, up 1.3%

Also boosting investor sentiment is the rollout of Pfizer's COVID-19 vaccine across the US this week. On Monday, healthcare workers began to receive the vaccine, helping them better combat the deadly virus on the front lines.

Moderna's COVID-19 vaccine is the next candidate expected to receive emergency use authorization from the FDA. The US plans to ship 6 million doses of Moderna's vaccine once the FDA authorizes it - more than double the initial shipment of Pfizer vaccines. Moderna fell as much as 7% in Tuesday trades.

Apple climbed 5% following a report that the company plans to boost its iPhone production 30% in the first half of 2021.

Goldman Sachs CEO David Solomon warned in an interview with CNBC that stock market euphoria driven by retail investors is too high, as evidenced by the surges in IPO names like DoorDash and Airbnb.

In merger news, Prevail Therapeutics surged as much as 84% after Eli Lilly said it would buy the firm for up to $1 billion to obtain its gene-therapy programs targeting Parkinson's disease and other ailments.

Oil prices edged higher. West Texas Intermediate crude rose as much as 1.6%, to $47.73 per barrel. Brent crude, oil's international benchmark, jumped 1.2%, to $50.89 per barrel, at intraday highs.

Gold rose as much as 1.5%, to $1,855.43 per ounce.