- Bethany McCamish is a freelance writer and designer who lives in Vancouver, Washington, with her fiancé, an electrical engineer.

- It took time for the couple to get on the same page financially. Once they discovered FIRE (financial Independence, retire early), they started to have open conversations about their spending habits and goals.

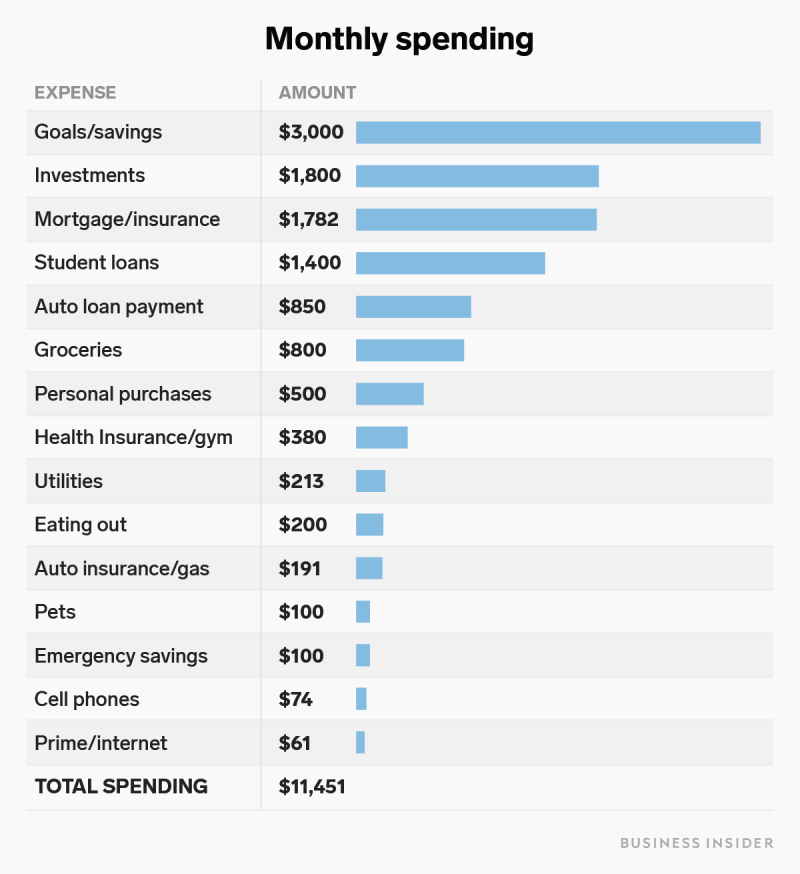

- Together, they bring home an average of $11,500 a month and their budget gives every dollar a job. They put a minimum of $1,400 a month toward student loan debt and about $4,900 into savings and investments.

- McCamish said they didn’t feel “wealthy” until they gained control of their money and put it to work in investments.

- Read more personal finance coverage.

My partner and I are total opposites in many ways. For the first four years of our relationship, this included the way we looked at money. I was the spender and he was the saver.

We were in college when we met. I was blissfully unaware of my finances, living paycheck to paycheck. To give you an idea of my ignorance, I didn’t even know how much I had taken out in student loans. I always made payments on time, paid off my credit cards every month, and called that good.

He was frugal. He never spent money on small items or lunches out. He saved all his money for the things that would make him happy. He bought a motorcycle and a car in cash during the first few years we were together. Still, the idea of investing and optimizing cash flow wasn’t something he even considered.

Our tipping point into financial awareness

My partner finished school a year after I had been working as a teacher. During that time I was the main breadwinner and his grants from school helped cover the rest. We rented an affordable apartment and lived modestly. After he graduated, he found a career in the engineering field and quickly became a high-earner.

With this increase in earnings, we happily adjusted our spending to fit. Lifestyle creep was real. We rented a home and started spending money. We went on an international trip and spent over $10,000. My partner was appalled at the amount of money we spent on that trip, and I simply shrugged it off as a worthwhile expense. Travel was something I always planned to do for the rest of my life, but I never even considered that we could do it for way cheaper.

My partner wasn't innocent in the spending money department during this time. He bought large purchases like an in-home gym and a new computer. Neither of us was saving anything or investing beyond the minimum company match for our retirement plans. We were both entirely ignoring my student loans, which totaled $78,000. It was our only form of debt because I was banking on Public Service Loan Forgiveness, a benefit that's available for federal loan borrowers who work in public service.

The fact is, we weren't talking about money. We talked about the big expenses, but that was it. Then, my partner listened to the ChooseFI podcast and was hook, line, and sinker pulled into the Financial Independence Retire Early (FIRE) movement.

He came home and exclaimed, "We need to cancel Netflix, cut the cable, and never go out again." I wasn't buying it. First, I didn't like being told what to do with my money. I also didn't like the idea of cutting everything.

What he was really saying was that we needed to look at where our money was going every month. From there we could decide what to cut and how to build wealth. We could remove stress from our lives, but not before adding a little first.

The many versions of our budget

Looking at how we spent money for the first time wasn't fun. Our heated conversations were a result of someone not feeling heard or feeling shamed for money choices. We looked at our finances together and had the attitude of "Why did you buy that?" instead of considering what each partner values spending money on.

We had to switch this mindset of blame. That doesn't mean we don't call out each other's issues, but we do so in a way that is asking a question instead of making an assumption. It helped once we set our money goals, because it turned the question into, "How does that impact getting to our goals?"

Our first budget was on paper and consisted of scribbles about what we each spent. Needless to say, we gave it up pretty fast. The second go-around we used Mint for our budget, which worked out pretty well. What was missing was a one-sheet spread that detailed both of our finances combined.

After my partner's income doubled due to a role change at work and my income shifted from consistent as a teacher to fluctuating as a freelancer, we knew it was time to combine on one spreadsheet. This helped us give every dollar coming in a job.

Now, my partner makes $8,500 a month and I average $3,000. Here's where it goes in a typical month:

Our biggest budget lines: housing, student loans, and investing

The mortgage, student loan payments, and our investments make up the big-ticket items in our budget. In our area, right by Portland, Oregon, the mortgage payment is equivalent to renting a two-bedroom apartment. So we feel very lucky to own a home that we've built equity in rather than paying rent.

Since I quit teaching to freelance, I became ineligible for Public Service Loan Forgiveness. Now, we made our new goal paying off my student loans. A minimum of $1,400 goes toward the balance every month as well as any extra income I make.

I'm in my 20s and my partner is in his 30s, so time is on our side. This makes investing a priority for us at the same time as student debt pay-off. We want to make sure he at least gets his 401(k) match. I have an automatic withdrawal from my "paycheck" straight to a traditional IRA as well.

For us, financial independence means having the freedom to choose what you want to do and when. That's why we invest so much and are working to get rid of student debt - for the freedom to make our own choices.

After a big raise, we kept our lifestyle the same

Since the income increase for my partner was recent, we left our budget the same. That's where the budget item for "goals/savings" comes in. That $3,000 is the income increase and "leftover" amount each month after we've paid for everything else.

For the first few months after he received the pay bump, we put this money away for our wedding fund. Once we save up enough for that, we started putting it away for a large student loan payment.

If we were to use our emergency fund, we would re-allocate the money we're putting toward student loans to re-build that fund. If we needed to travel for work, family, or fun, we would take a portion of this "leftover" money and save it for that expense. Since the holidays are coming up and we plan to make donations in the names of our loved ones again, this money will go towards giving.

Having the extra money is a life-changer for us. It's allowing us to prepare for our future in a way that we couldn't have dreamed of.

Our crazy $800 food bill

For two people, $800 a month isn't low. Our health is important to us, and we eat a vegan plant-based diet. We also love to cook and this means we make all kinds of vegan-friendly recipes. Trying new recipes means buying new and different ingredients. This brings the cost of our grocery bill up, but we think it's worth it.

Two other categories are included in the grocery bill: alcohol and household items. We buy beer, wine, and most recently saké, to enjoy at home. It's much cheaper than going out. This combined with one big Costco run to stock up on household items keeps our grocery budget at $800 at its max and $600 on months when we're cutting out new recipes or drinks.

Things we don't spend a lot of money on: shopping, entertainment, and decor

The one line in the budget called "personal purchases" pretty much includes all of our shopping we do for ourselves, including things like cosmetics, shampoo, haircuts, clothing, Amazon purchases, books, etc. It's all wrapped up in this category and that's because we cut those expenses down a while ago.

Getting a pedicure or a massage for us is a treat and would come from that section of the budget if we decided it was worth spending on.

We don't have cable and rarely go to the movies. The last time we went, we used the free movie tickets that were gifted to us over a year ago. We find free ways to entertain ourselves like hiking, borrowing my aunt's kayaks, or going for a bike ride. If we are going to spend money out, it's usually on food with friends.

We gave our money a purpose, and everything goes toward fulfilling that

We've decided our money's mission is to enable us to travel, eat well, and bring others with us when we do. This will be made possible by paying off my student loans, investing in retirement, and saving for upcoming expenses ahead of time.

To support this mission, we did all the usual financial advice, including shopping with a list, having a waiting period before buying something, saving money first, meal planning, and having a budget.

These things help, but it's not what really keeps our financial journey progressing. Meal planning isn't going to immediately make you financially savvy, just like depriving yourself of things you love doesn't mean you're a boss with money.

The most important thing we did was look at our money mindsets. We addressed our privilege and our wealth. We looked at why we spent money, we started communicating about everything, and we came up with our goals. By looking at the emotional side of money we could continue the conversation, which in turn lets us continue moving toward our goals.

Getting on the same financial page led to some serious accomplishments

Since discovering the concept of financial independence in 2017, we conquered some major financial milestones. We were able to:

- Save $110,000 towards our retirement and make the savings automatic

- Buy our first home, renovate it, and now have $40,000 of equity

- Learn how to travel hack so we could still travel while working on financial goals

- Build-up our emergency fund

- Increase both of our incomes

- I was able to quit teaching and become a freelancer

We could do these things by deciding what we wanted our money to do for us. We could also do these things because we are privileged. Even though I have serious student-loan debt, we don't have barriers to financial success that others may face. This was especially true when our income increased.

In my mind, we have always been "rich." But we weren't wealthy until we started to control our money and let it work for us.