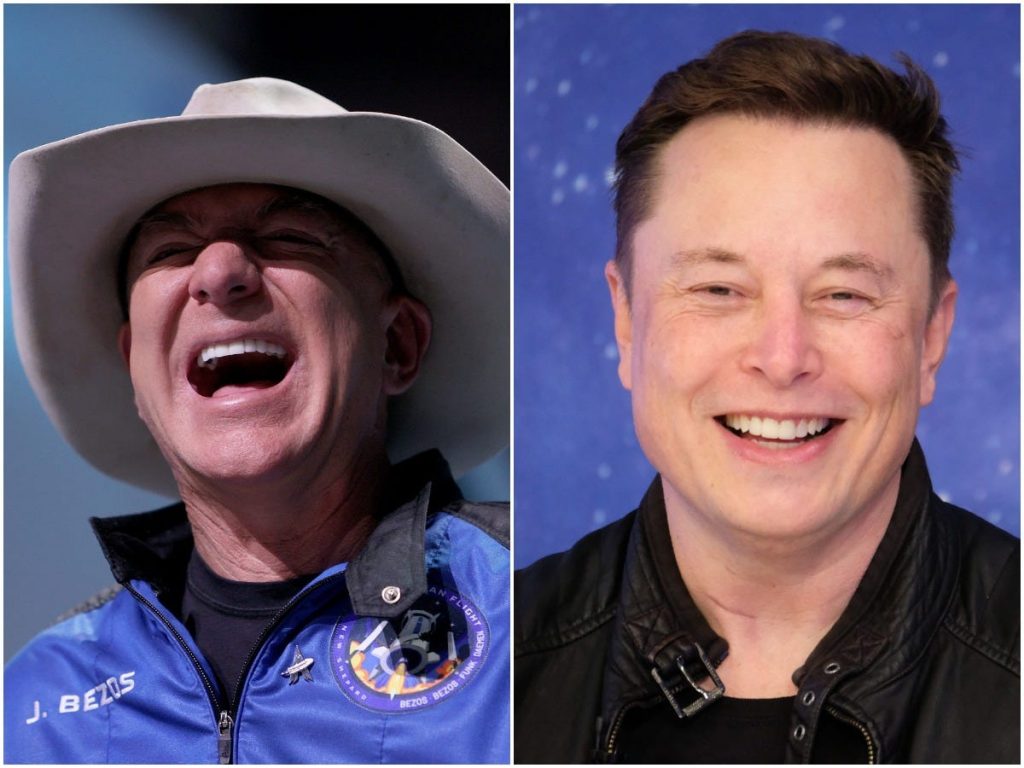

Joe Raedle/Getty Images/Axel Springer

- Democrats want to raise taxes on billionaires to offset infrastructure spending, a new twist on their tax plans.

- An analysis from economist Gabriel Zucman finds that the proposal could bring in $500 billion.

- Elon Musk alone would owe up to $50 billion, while Jeff Bezos could pay up to $44 billion.

Democrats are inching toward a big new tax on billionaires.

The latest proposal is a "billionaires' income tax" that would capture the untaxed massive stock gains that the richest of the rich have made in the last several years.

According to a new analysis, targeting billionaires alone would generate $500 billion – with $275 billion coming from the 10 richest billionaires alone.

Economist Gabriel Zucman, a longtime researcher on inequality and taxes on the wealthy, used SEC data and the Bloomberg Billionaires Index to estimate different billionaires' stock holdings and extrapolate what they'd pay under Senate Finance Chair Ron Wyden's new billionaire tax released on Wednesday.

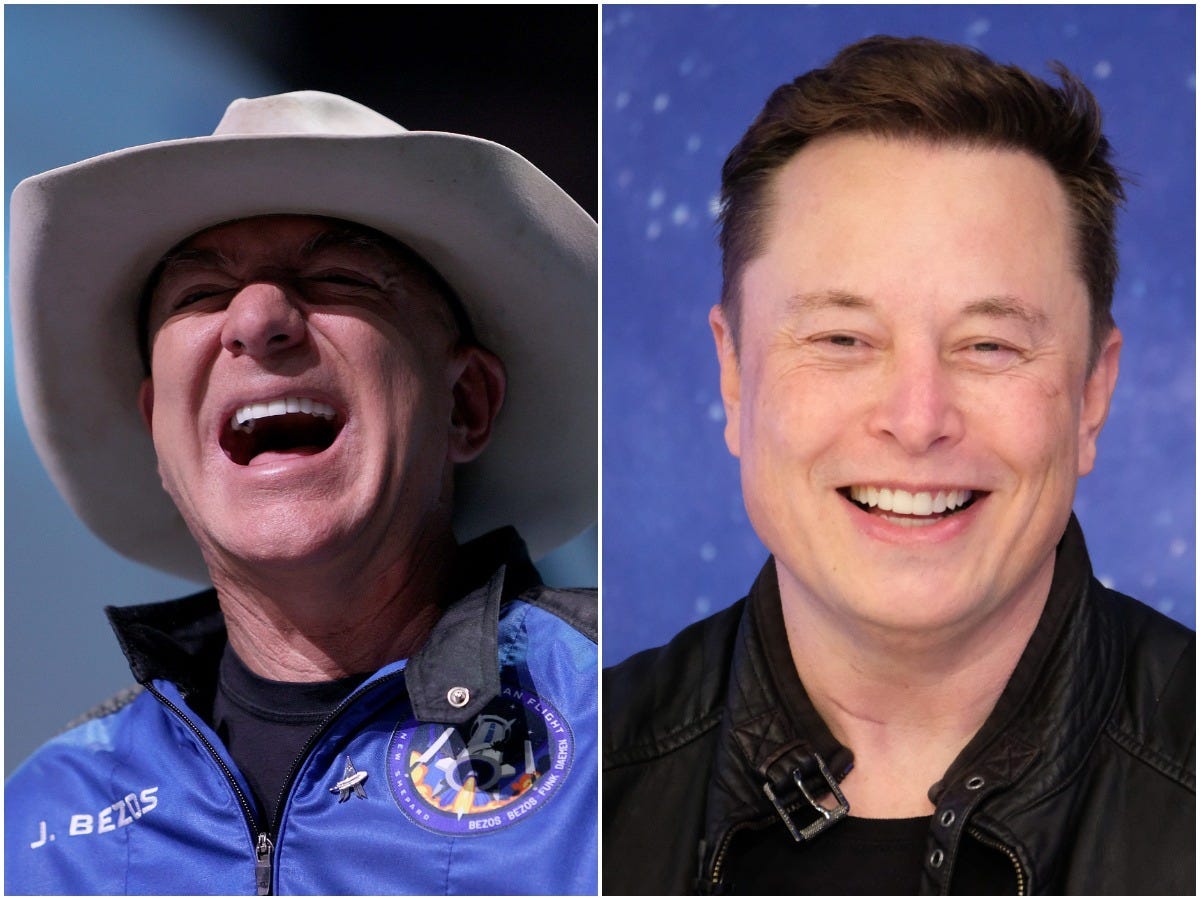

Zucman's analysis finds that Tesla CEO Elon Musk, the world's richest person, would see the largest bill of America's 700 or so billionaires, owing up to $50 billion. Meanwhile, Jeff Bezos -the richest in the world after Musk – would owe up to $44 billion. Here's what everyone's total bills could look like:

Wyden's proposal would expand the range of taxable assets for billionaires. Currently, assets like corporate stocks are taxed when they're sold at a profit; that's called a capital gain, and it's taxed at a lower rate than workers' income.

The left-leaning Center on Budget and Policy Priorities found in an analysis that capital gains taxes are essentially "effectively voluntary," because the holder of that asset can just hold onto it - letting unrealized gains accrue - or strategically sell it off coupled with capital losses. The new proposal would change that, making unrealized gains taxable income for America's billionaires, meaning they would have to pay taxes on wealth increases from assets going up, even if they don't sell their stocks.

Throughout the pandemic, billionaires have added $2.1 trillion to their collective fortunes, according to an analysis from the left-leaning Institute for Policy Studies (IPS) and Americans for Tax Fairness. That's a 70% increase, with a good chunk likely currently untaxable.

If Democrats have their way, it could help reverse years of accelerating inequality between the richest Americans and everyone else, experts say.

"Most of their wealth or economic income is in the form of their stuff they own going up in value because of the things they've done, primarily stock," Indiana University law professor David Gamage previously told Insider. "And, until they sell that stock - which they're never going to do, for the most part, because there's ways around that - it wouldn't be included in the tax space."

Right now, billionaires pay just 8.2% in income taxes annually, according to a White House estimate that takes into account unrealized gains.

But it's already running into opposition from Sen. Joe Manchin of West Virginia, a key swing vote in the 50-50 Senate. He criticized it on Wednesday as a punitive measure that would harm successful people.

"I don't like it," he told reporters. "I don't like the connotation that we're targeting different people, as people that basically, they contributed to society and create a lot of jobs and a lot of money and give a lot to philanthropic pursuits."

Other Democrats are concerned about setting up a potentially complex and hard-to-enforce new layer of the tax code for billionaires. "It's riskier," Sen. Tim Kaine of Virginia told Insider. "I think conceptually, it makes perfect sense. We just need to make sure we get the details right."

The billionaire tax proposal is serving as a back-up after Sen. Kyrsten Sinema of Arizona nixed individual and corporate tax hikes from the social spending plan. Whether it clears a narrowly divided House and Senate is still in the air. If it fails, it would create fresh headaches for Democrats trying to enact President Joe Biden's agenda.