Drew Angerer/Getty Images

- Democrats included a tax exemption on student loan forgiveness through 2025 in the stimulus bill.

- Loan forgiveness is currently taxable, and this exemption would remove the burden of a tax bill.

- Biden says he doesn't have the authority to cancel student debt, but Democrats say this paves the way.

- Visit the Business section of Insider for more stories.

Student loan debt cancellation isn't included in President Joe Biden's stimulus plan, but Democrats still managed to put in a provision that will help the nearly 45 million student loan borrowers in the country, and potentially pave the way for debt cancellation.

On his first day in office, Biden extended the pause on student loan payments through the end of September, but he hasn't moved on a wider cancellation of student debt. He hasn't come out and said he doesn't want to – he insists that he does not have the authority to cancel $50,000 in student debt per person, while saying he may cancel $10,000.

Sen. Elizabeth Warren of Massachusetts – who ran on canceling $50,000 per person – introduced the stimulus provision with this in mind.

Currently, any student loan debt that the government cancels is considered taxable with some exceptions, like the Public Service Loan Forgiveness program. But Warren, along with Sen. Bob Menendez of New Jersey, included an exemption on all student loan forgiveness from taxation through the end of 2025 to ensure borrowers won't have to worry about a big tax bill.

Warren said she believes her tax exemption will pave the way for Biden to take the next step and cancel student debt.

She said in a statement: "This change clears the way for President Biden to use his authority to cancel $50,000 in student debt to provide a massive stimulus to our economy, help narrow the racial wealth gap, and lift this impossible burden off of tens of millions of families."

"Millions of Americans were already drowning under a mountain of student loan debt before getting hit with the economic impact of COVID-19," Menendez said in a statement. "And when they're lucky enough to get some relief, the government shouldn't then tie a heavy tax anchor to their financial life line. We now have a tremendous opportunity to relieve this paralyzing weight and that opportunity should not be jeopardized by an arbitrary tax bill on unrecognized income."

According to the press release, the average student loan borrower who earns $50,000 in income would save around $2,200 in taxes for every $10,000 of student loans forgiven, and Warren said the exemption she and Menendez introduced on March 1 would ensure borrowers are not "burdened with thousands of dollars in unexpected taxes."

-Elizabeth Warren (@SenWarren) March 6, 2021

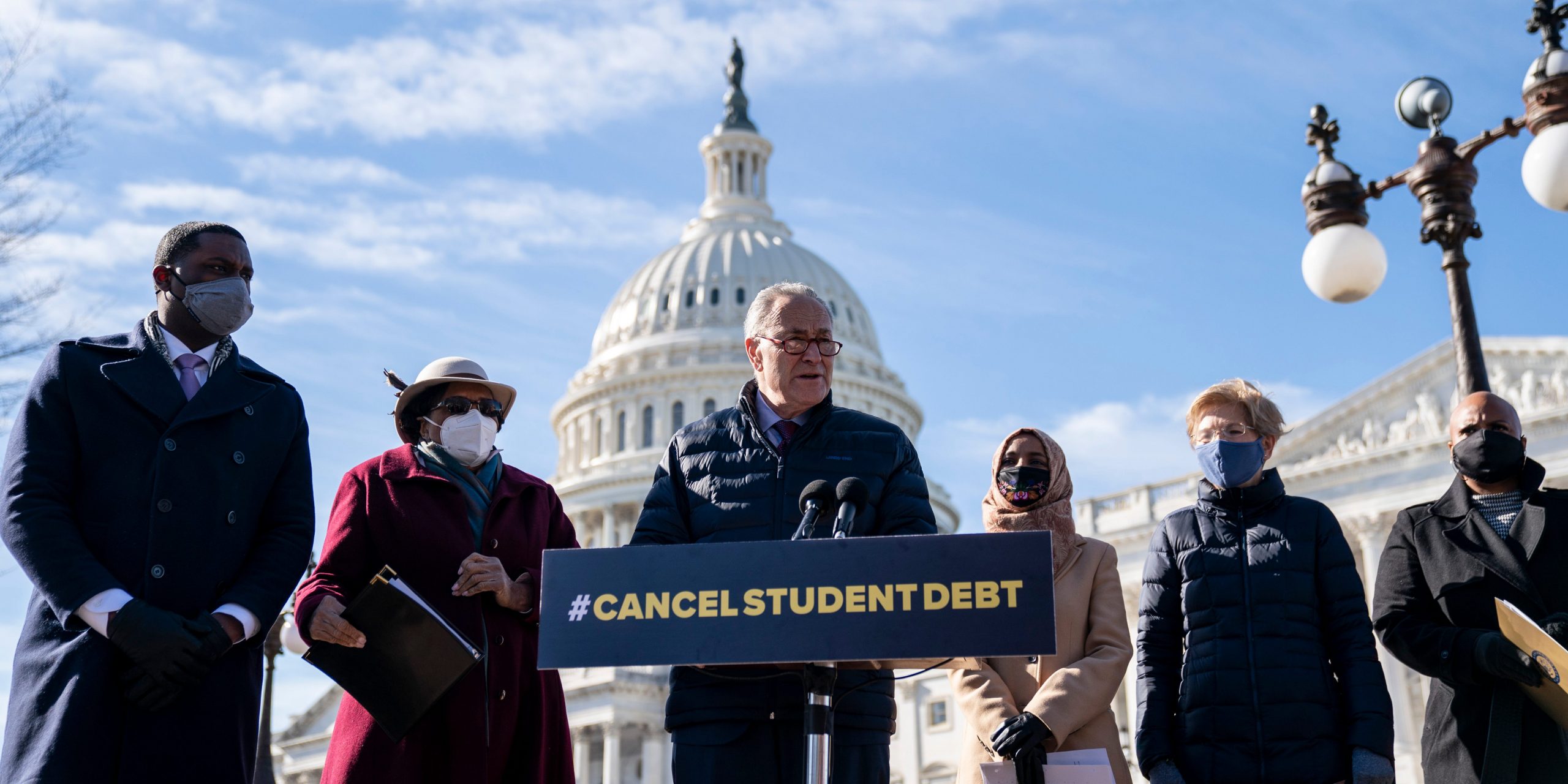

Progressive lawmakers have been calling on Biden to cancel up to $50,000 in student loan debt since he took office. On February 4, Warren was joined by Senate Majority Leader Chuck Schumer and four other House members in a press conference to request Biden use his executive powers to cancel student loan debt.

"There's very little that the president could do with the flick of a pen that would boost our economy more than canceling $50,000 in student debt," Schumer said during the press conference.

-Chuck Schumer (@SenSchumer) March 9, 2021

Schumer and Warren believe that Biden can use his powers under the Higher Education Act to cancel debt, but Biden disagrees, saying in a CNN town hall on February 16: "I will not make that happen."

"My point is: I understand the impact of debt, and it can be debilitating," Biden said at the town hall. "I am prepared to write off the $10,000 debt but not $50 [thousand], because I don't think I have the authority to do it."

White House Press Secretary Jen Psaki said during a press briefing on February 17, though, that Biden will ask the Justice Department to review his ability to use executive action on student debt cancellation, so the issue is not completely off the table.