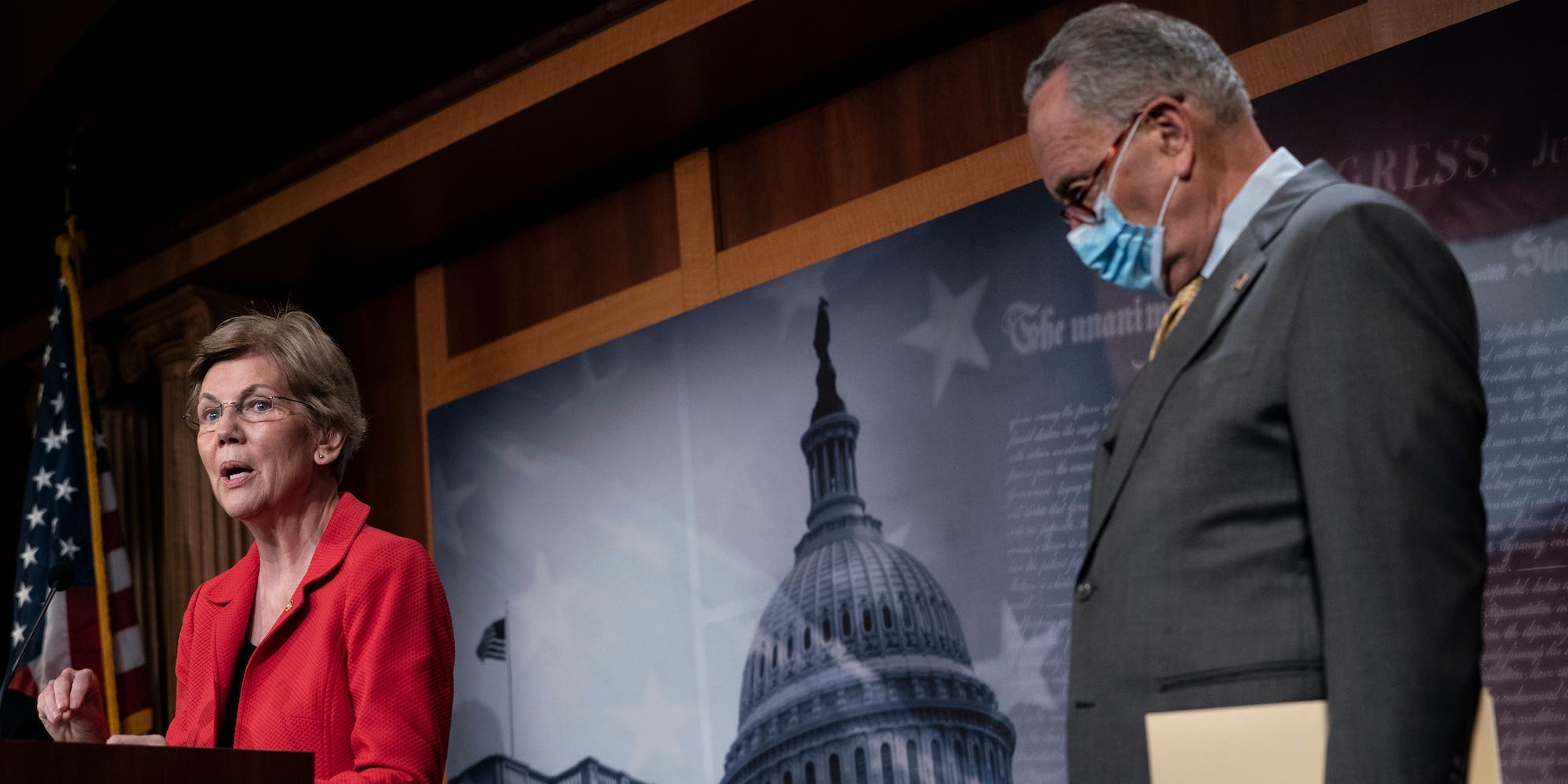

Drew Angerer/Getty Images

- Democratic Senators touted new student loan relief to push Biden to cancel $50,000 worth of debt.

- Sens. Warren and Menendez added an amendment in the stimulus to ease loan forgiveness.

- The amendment, now law, ensures student debt that's forgiven isn't taxable.

- See more stories on Insider's business page.

After additional student loan relief measures were announced on Monday, Democratic senators touted the change and further pushed for President Joe Biden to cancel $50,000 of student loan debt.

Education Secretary Miguel Cardona canceled student debt for 41,000 borrowers with disabilities and removed the requirement to submit income documentation for over 230,000 borrowers.

"So we have very good news for so many people who have student debt, the load of student debt on their shoulders…We've made another good step forward on our progress," Senate Majority Leader Chuck Schumer said in a press conference on Monday.

Schumer, speaking alongside Sens. Elizabeth Warren and Bob Menendez, explained that the two senators authored an amendment to Biden's $1.9 trillion economic stimulus bill that made it so borrowers who had their loans forgiven wouldn't have to pay taxes on them.

"Once student debt is forgiven, no matter how much, no taxes," Schumer explained.

Menendez said it's a "big deal" because as they push for Biden to forgive student loans, those who have their debt forgiven would not have to worry about getting a tax bill from the Internal Revenue Service afterward.

The tax rate before the bill was introduced was $2,200 for every $10,000.

Warren hailed the move as progress but called on Biden to cancel the $50,000 debt for millions of borrowers.

"This is about moving forward, this is our moment of momentum. We have gotten one more piece in place and now we're just ready for President Biden to sign the piece of paper to say 'cancel $50,000 worth of student loan debt,'" Warren said, adding that the cancellation would help reduce racial wealth gaps in the country.

Biden has previously rejected calls to wipe out $50,000 but said he supports forgiving $10,000.

Have a news tip? Contact this reporter at [email protected]