- The US added 199,000 payrolls in December, missing the average forecast of 450,000 new jobs.

- The unemployment rate slid to 3.9% from 4.2%, beating economist estimates.

- The report suggests the Omicron wave is having a significant effect on the US hiring recovery.

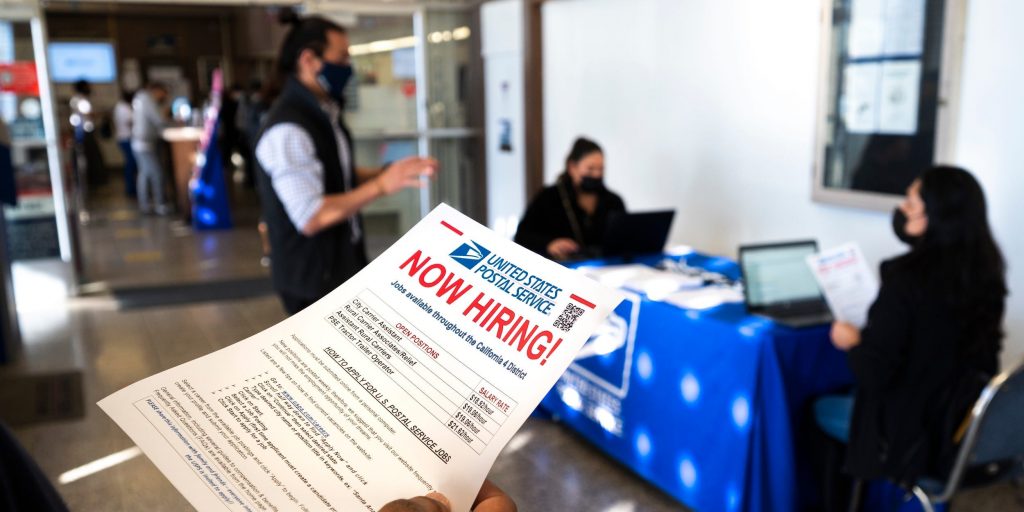

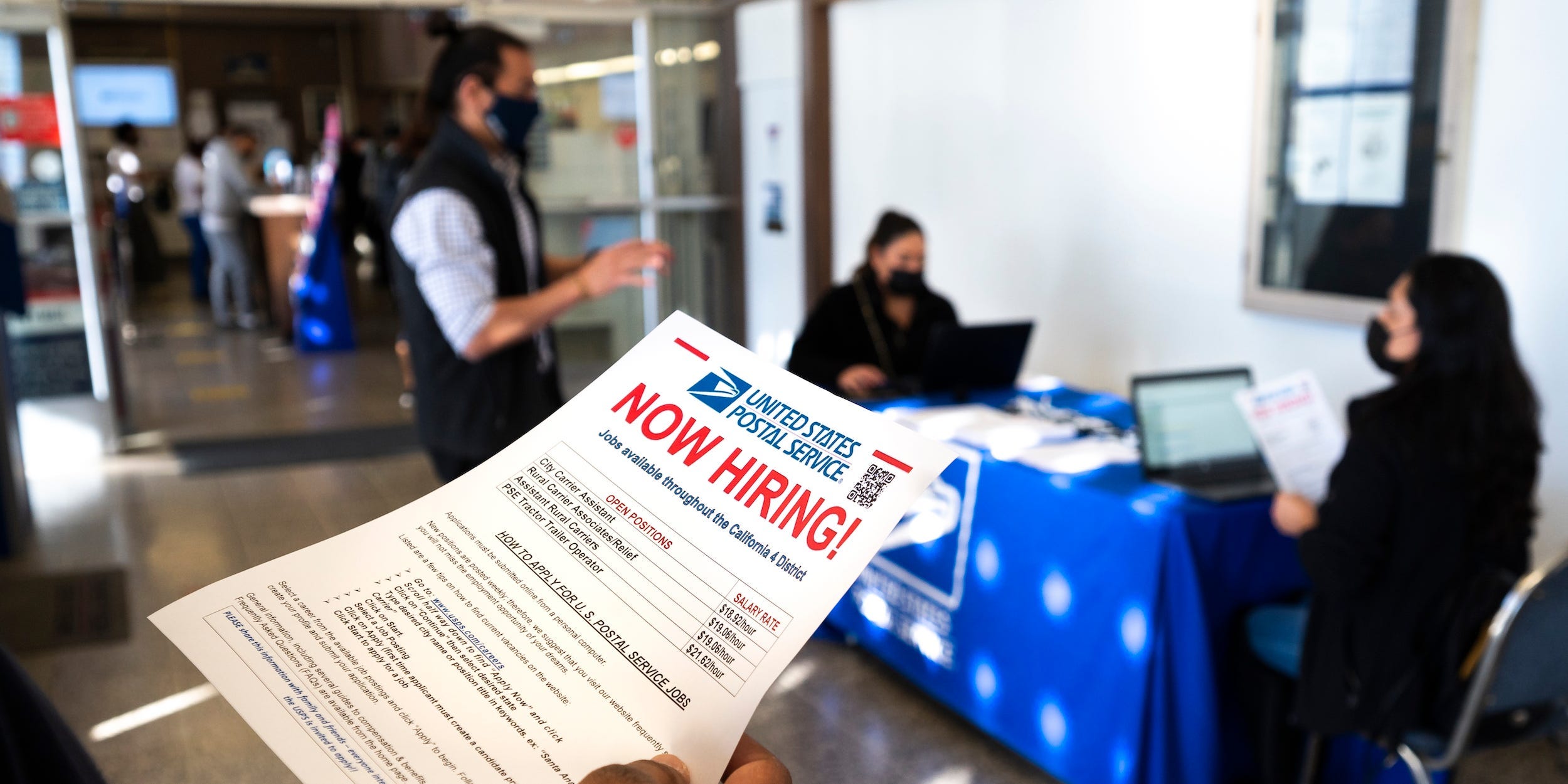

Hiring faltered again in December as the Omicron variant fueled yet another wave of coronavirus cases and economic restrictions.

The US added 199,000 nonfarm payrolls last month, the Bureau of Labor Statistics announced Friday. Economists surveyed by Bloomberg held a median forecast of 450,000 added jobs. The print reveals hiring slowed in the final weeks of 2021 as coronavirus case counts swung higher and fueled new concerns for the still-incomplete recovery.

November job growth was revised to 249,000 jobs from 210,000, according to the report. The latest count marks the worst month of job creation since December 2020, when the country shed 306,000 payrolls.

The unemployment rate slid to 3.9% from 4.2%, BLS said. That landed below the median forecast of 4.1%.

The report offers a gloomy look at how the labor market was performing as it entered the new year. The slump in job creation suggests the recovery isn't as resilient to Omicron as some hoped. The unemployment rate's steady decline still signals the labor market could return to pre-pandemic health by the end of 2022.

To be sure, the data only covers the recovery through mid-December. Daily virus case counts went parabolic later in the month as the more contagious variant proliferated amid holiday travel. Infections continued to surge higher in January and haven't yet shown signs of a consistent easing. While virus deaths are a fraction of the counts seen during last year's winter wave, the variant's contagion is still placing new pressure on businesses and Americans eyeing a return to the workplace.

The number of jobless Americans dropped by 483,000 to roughly 6.3 million, according to the report. On the payrolls front, the economy has about 3.6 million jobs to add before returning to its pre-pandemic total.

Labor force participation held flat at 61.9 in December, still 1.5% lower than the level seen before the pandemic. The measure, which tracks Americans working and in the process of finding work, has been among the slowest to recover.

Federal Reserve Chair Jerome Powell raised concerns around the sluggish rebound in December. Economists "certainly thought" the ending of enhanced unemployment benefits and increase in vaccinations would lift participation, he said. There's been "some improvement," but "we don't have a strong labor force participation recovery yet," he added in the December 15 press conference.

The average hourly wage rose by 19 cents, or 0.6%, in December to $31.31. That beat the median estimate of a 0.4% gain. Wages increased at a faster pace than usual throughout 2021 as the labor shortage gripped the recovery. Businesses quickly boosted pay to attract workers, with low-paying sectors exhibiting some of the biggest raises.

Data published earlier in the week suggests that overwhelming demand for workers lingered well into the fourth quarter. US job openings totaled 10.6 million in November, according to Job Openings and Labor Turnover Survey, or JOLTS, data published Tuesday. While that's down from the prior month's 11 million, it's still historically high and signals weak job uptake throughout the economy.

A record 4.5 million workers quit their jobs in November, hinting the so-called Great Resignation also charged forward. The accommodation, food services, health care, and transportation sectors saw the most quits, suggesting the pandemic's spread played a major role in prompting people to walk out.

This story is breaking, check back soon for updates.