Publishers are receiving far less money than might have been expected from placing their content on the third-party distribution platforms owned by companies including Facebook, Google, and Snapchat, according to a new report.

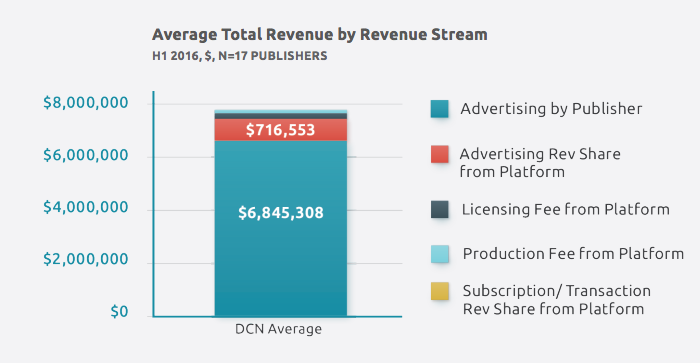

The report, from premium publisher trade body Digital Content Next (DCN), claims that the (mean) average premium publisher generated $7.7 million in revenue from distributing their content on third-party platforms in the first half of 2016 – equivalent to around 14% of their overall revenues in the period.

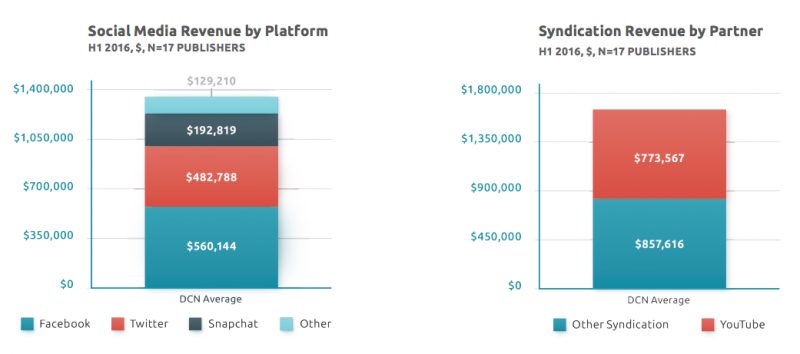

On average, premium publishing companies generated $773,567 in the first half of 2016 by distributing their content on YouTube. Content published to Facebook earned an average of $560,144 in the period, Twitter generated an average of $482,788, and Snapchat generated $192,819 for each publisher in the sample.

DCN commissioned Powers Media & Entertainment Consulting to collect data and survey 19 of its members – including The Financial Times, ESPN, Bloomberg, NBC, and The New York Times – about the way they use and generate revenue from third-party distribution platforms. It then conducted in-depth interviews with eight of those members. The report did not offer financial details for each publisher, but instead provided the average amount a typical premium publisher receives.

Business Insider has obtained a copy of the report, which was distributed privately to the trade body’s members last week. (Business Insider is also a member of DCN and participated in the study, but this article’s author did not obtain the report’s findings via a Business Insider employee.)

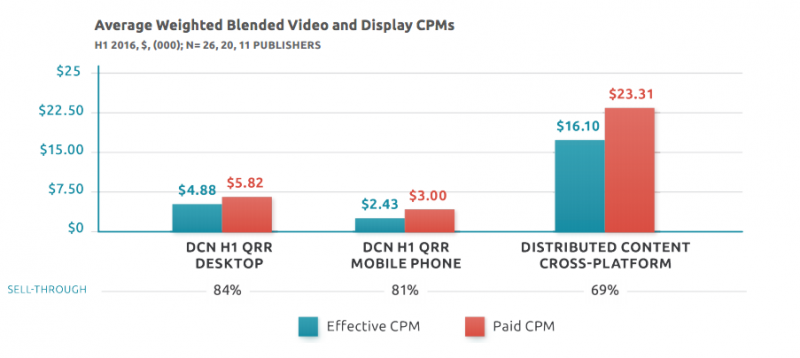

Overall, the report's implication is that while many publishers are attempting to get their heads around their distributed content strategies, distributed content platforms are providing too little by way of monetization for the high-quality content that gives those platforms credibility among users and advertisers.

Publishers face a difficult dichotomy when it comes to working with third-party distribution platforms.

On the one hand, platforms like Facebook and Google drive huge traffic to publishers' websites, which they can monetize themselves through ads, subscriptions, or ecommerce.

But those platforms are also seen as competitors for their readers' eyeballs. And - through programs like Google AMP, Facebook's Instant Articles, and Snapchat Discover - publishers are being encouraged to publish their content directly to those platforms, following where their readers are, but ceding full control over the monetization of that audience and the data they can gather about them.

As Jason Kint, DCN chief executive has previously pointed out, Google and Facebook accounted for all the growth in the US digital ad industry in the first half of the year (if you compare PwC and IAB ad spend figures with Google and Facebook's quarterly earnings) - while the rest of the industry appeared to shrink.

There appears to be an economic gap between the time spent on those platforms and the money publishers can make from distributing their content there.

.@iab it does seem relevant to note when you back out Facebook and Google, the digital ad industry actually shrunk in 1st half. #unhealthy pic.twitter.com/x0gRXWz6XT

— Jason Kint (@jason_kint) November 1, 2016

Kint declined to comment on the findings of DCN's report. Facebook and Twitter also declined to comment. Google did not immediately respond to requests for comment.

A spokesperson for Snap, which owns Snapchat, said the company couldn't comment directly on the findings, having not seen the methodology used for the report, but added that the figure cited was not representative of the revenue opportunities its Discover section offers advertisers.

The report's executive summary outlined the unique challenges of working with each of the distribution platforms, which may be preventing publishers from making more money from their distributed content:

"Facebook does not offer video ad products that scale for TV/cable companies, with the ability to integrate ad serving and third-party measurement.

Facebook Instant Articles has program restrictions, such as the number and types of ad units, that make it hard for publishers to monetize at rates comparable to their own sites, as well as measurement limitations which hinder comparisons of financial and content consumption performance between the platform and publishers' own sites.

Facebook Live has yet to scale or prove a revenue model beyond the publisher production guarantees.

While Google AMP is gaining ground with pure play and print publishers, it is not geared for TV/cable companies.

Twitter Amplify has not scaled.

Snapchat recently announced a new licensing model for Discover channels which may translate into a limited upside for monetization by publishers.

YouTube has proven a fickle partner as demonstrated by recent problems publishers have had with YouTube prioritizing its own skippable video ad inventory (i.e. units that allow the viewer to skip the ad after five seconds) over non-skippable partner inventory."

But while these platforms do have their challenges, it's worth noting that most of their publisher partnership programs are relatively new and constantly evolving. All of the platforms mentioned above have been increasing their efforts to build relationships with the publisher community in recent months.

To name just a few examples:

- Facebook recently hired TV journalist Campbell Brown to help it build better relationships with news organizations; Facebook is also testing mid-roll ads in Facebook Live; Snapchat is reportedly switching Discover to a licensing model that could unlock more revenue for publishers than the current advertising-share model; Twitter is expanding its Amplify program and opening up pre-roll video advertising bought via automated systems to more than 300 partners; YouTube is reportedly working on a streaming TV service called "Unplugged" that will need quality TV-like content; Google is expanding the Digital News Initiative it launched in 2015 to work with more publishers across more products and services.