- A large portion of ICOs are funded by people who got rich buying Bitcoin. They need to diversify their exposure to the volatile cryptocurrency. But they don’t want to pay tax. On that basis, ICOs look like a good deal.

LONDON – Where is all this ICO money coming from?

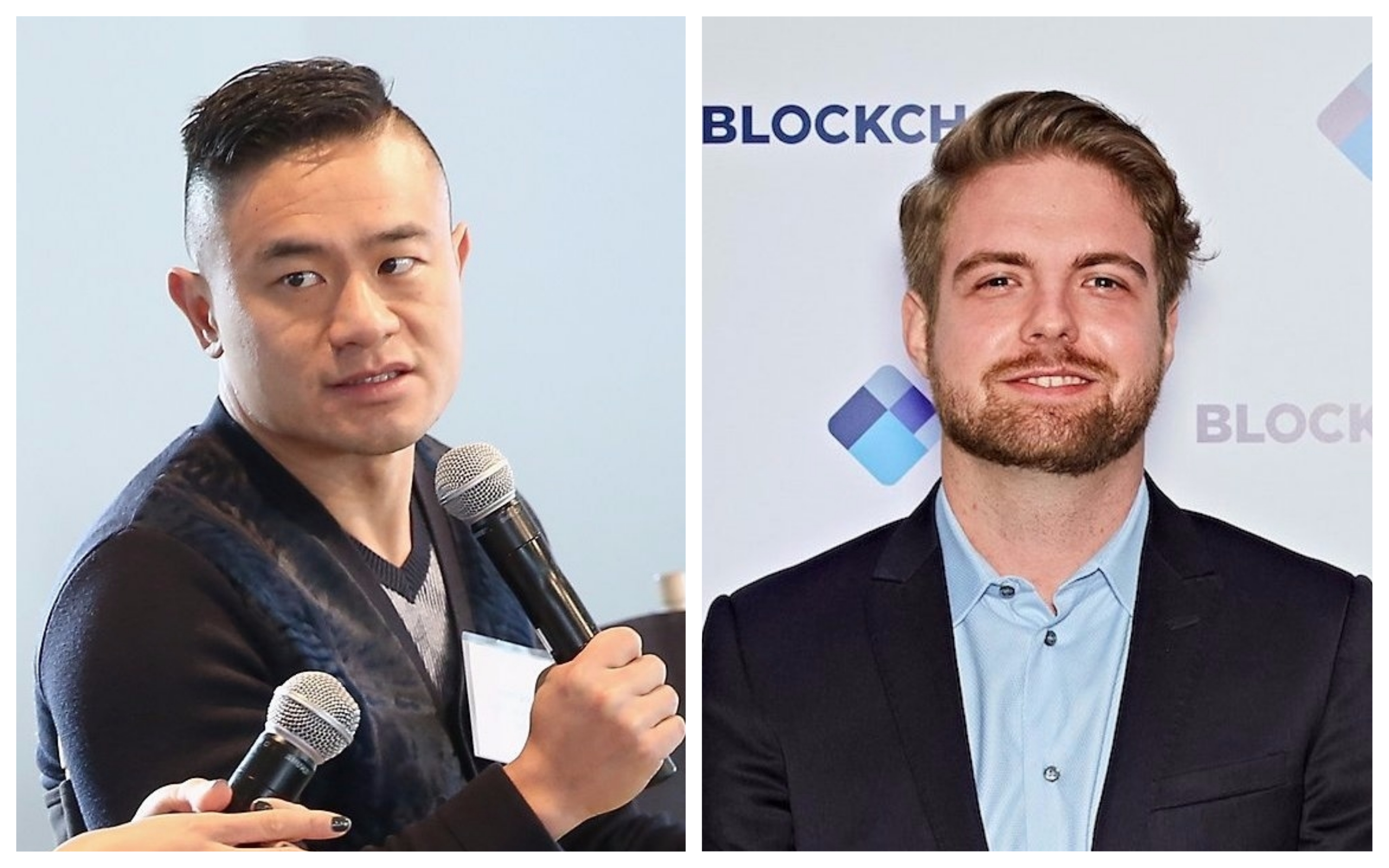

That was the question I wanted to ask when Business Insider was invited to lunch last week with Lightspeed Venture Partners investor Jeremy Liew and Blockchain founder/CEO Peter Smith at The Hoxton, a trendy hotel much favoured by tech startups in Shoreditch, London.

More than $1.8 billion has been raised in “initial coin offerings” this year, much of it by companies you have never heard of. There’s an ICO to build the largest aquarium in the world, for instance. And one for prostitution.

It’s not clear where this $1.8 billion originated, however. The traditional funders of venture capital are so-called “limited partners,” like banks and pension funds. They aren’t the ones throwing money at imaginary currencies with imaginary values.

A $2 billion firehose of risk-loving money.

ICOs are largely unregulated offerings of digital coins, a bit like Bitcoin, that dozens of small tech companies are selling to raise funding. They operate like IPOs, but instead of offering equity they offer cryptocurrency tokens of their own design. The coins can then be exchanged at a later date, either traded to other buyers or for assets produced by the company itself.

ICOs are as exciting, and risky, and crazy, as they sound.

So who is providing this firehose of risk-loving money?

In Liew and Smith's opinion, a lot of it is coming from Bitcoin millionaires who want to diversify their exposure.

Many people who bought Bitcoin years ago are now staggeringly wealthy. In 2012, Bitcoin traded for $10 a coin. If you bought $3,000 of Bitcoin that year and held it, you'd now be a millionaire.

It's hard to say how many secret Bitcoin millionaires there are in the world, but it's a lot. There are 17 million Bitcoin wallets on Blockchain's system alone. Not all of them are millionaires, obviously. But enough of them are.

When you're a Bitcoin millionaire and the Chinese government can wipe away 25% of your assets in an afternoon, you need to act.

Their problem is that Bitcoin remains enormously volatile. A year ago it traded below $1,000. It peaked at $4,950 this month but has since fallen back again to $3,222 at the time of writing, largely due to the news that China would ban ICOs and severely tighten regulations around Bitcoin.

When you're a Bitcoin millionaire and a single press release from the Chinese government can wipe away 25% of your assets in an afternoon, you need to take action. (Of course, the prices of most digital coins rise and fall in rough tandem with Bitcoin so there is a question about how "diversified" you'd be with the bulk of your wealth in the crypto markets. But still.)

ICOs are where that action is going. I started by asking Liew - Snapchat's first investor - what he thought of the ICO arena, which to outsiders just looks crazy.

It looks crazy to us too. - Jeremy Liew

"It looks crazy to us too," Liew joked over guacamole and chips.

But there are diamonds inside that craziness, he believes, and the key is to ignore the noise in favour of the really solid ideas that offer buyers assets that have a real underlying value.

One example is Filecoin, he says, which lets users buy computer storage space on a decentralised server network. On one level, Filecoin is simply a credit that lets you buy a place to store your stuff.

But Filecoin can be traded like Bitcoin, so unspent Filecoin might - or might not - appreciate in value like an investment. And it can be cashed out for Bitcoin or regular fiat "real world" currency if you don't want it anymore. It's a digital credit that entitles you to a purchasable asset, but its value fluctuates like a currency. In other words, it could, therefore, pay off as an investment.

"It's kind of like anybody in the world being able to get a seed investment in a Google or a Facebook or an Amazon or something like that," according to Fred Wilson, a partner at Union Square Ventures (he's an investor).

A good way to diversify out of Bitcoin without alerting the government is to trade into an ICO.

There's an added wrinkle: Tax.

So far, governments have not been very good at taxing Bitcoin. They disagree on whether it's property or currency, for instance. And because you can hold Bitcoin almost anonymously, it's hard for governments to find it and tax it. Bitcoin generally becomes taxable at the moment you convert it into cash. But it's no fun being a Bitcoin millionaire if, as soon as you buy a Ferrari, the government says, "Hey, nice Ferrari! Where did you get the money for it?"

Most ICO currencies are tradeable with Bitcoin. So a good way to diversify out of Bitcoin without alerting the IRS and HMRC is to trade into an ICO. if you've got $1 million in Bitcoin lying around, then throwing $100,000 into an ICO isn't too painful, especially if you believe that ICO is going through the roof.

There will be a shakeout. - Peter Smith

That's the promise. Prices fall, too, of course.

"There will be a shakeout" Blockchain's Smith says. The dumb, non-transparent, risky companies will get washed away just like they did in the dot-com bubble of 2000. Eventually, the ICO market will settle in as a funding device for prosaic but valuable small-cap businesses that large banks usually ignore.

But until then, it's the Wild West out there.