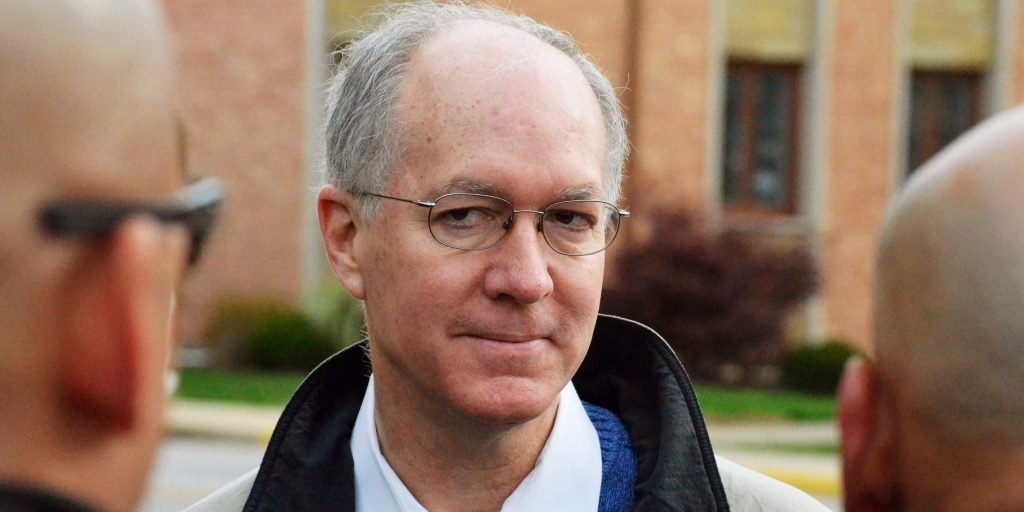

Nick Carey/Reuters

- US courts should be able to reverse crypto transactions, US Rep. Bill Foster said in an Axios interview.

- Until the crypto industry can manage ransomware attacks, anonymity will be hard to sustain, he said Tuesday.

- Regulations should hand a 'backdoor key' to courts for access to crypto networks, the congressman said.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

A court or other trusted third party should be able to reverse cryptocurrency transactions if they are fraudulent or the result of criminal activity, US Rep. Bill Foster said as he called for new regulation in an Axios interview.

The Illinois Democrat, who co-chairs the Congressional Blockchain Caucus, said that until the crypto industry can come up with solutions to deal with crypto-ransomware attacks, anonymity for those involved in transactions would be "very hard to sustain."

"You would have to be able to go to a court to unmask participants under some circumstances. It does not have to be visible to the whole world, and that may not even be desirable," Foster said in the interview on Tuesday.

The congressman proposed bringing in a regulatory framework that would provide a "very heavily guarded key of a cryptographic backdoor" to the likes of federal courts, so they could reverse transactions on a blockchain.

The proposals may provoke outcry from crypto fans, keen to keep digital assets free from government control and manipulation, he acknowledged. But Foster said he could think of no better solution.

"Now, I've just said about three things there that will drive the crypto purists berserk, like the trusted third party and so on," he said. "But in fact, there's not a technological alternative that I'm aware of."

"For most people, if they're going to have a big part of their net worth tied up in crypto assets, they're going to want to have that security blanket of a trusted third party that can solve the problem," he added.

Colonial Pipeline paid a bitcoin ransom worth about $4.4. million to hackers in May, after its pipeline network was paralyzed in a cyberattack, though US authorities were able to recover the majority of the payment. The major cybersecurity incident forced the closure of one of the most important conduits for fuel supply in the US, causing gasoline shortages in some states.

As a result of that incident, future crypto regulations are likely to explicitly target access to information about individual ownership of accounts, Carlos Betancourt, cofounder and principal at crypto hedge fund BKCoin Capital, told Insider. That will enable law enforcement agencies to track the money flows - just like they do today between banks, he said.

While Foster stressed the US doesn't want to go down China's route of heavy surveillance over the crypto space, he does see a need for something to be done to combat criminal usage.

"We're going to have to establish a wall between the legal and the illegal," he said.