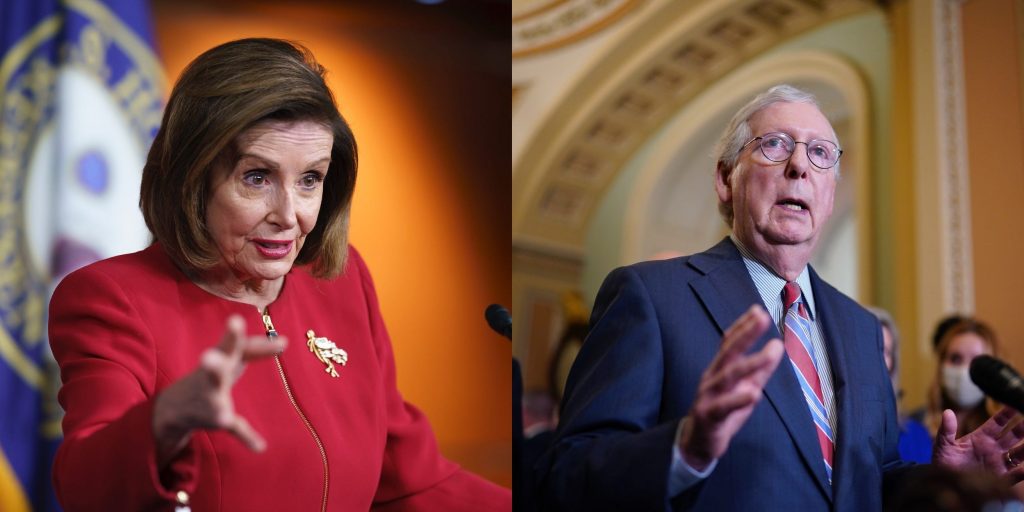

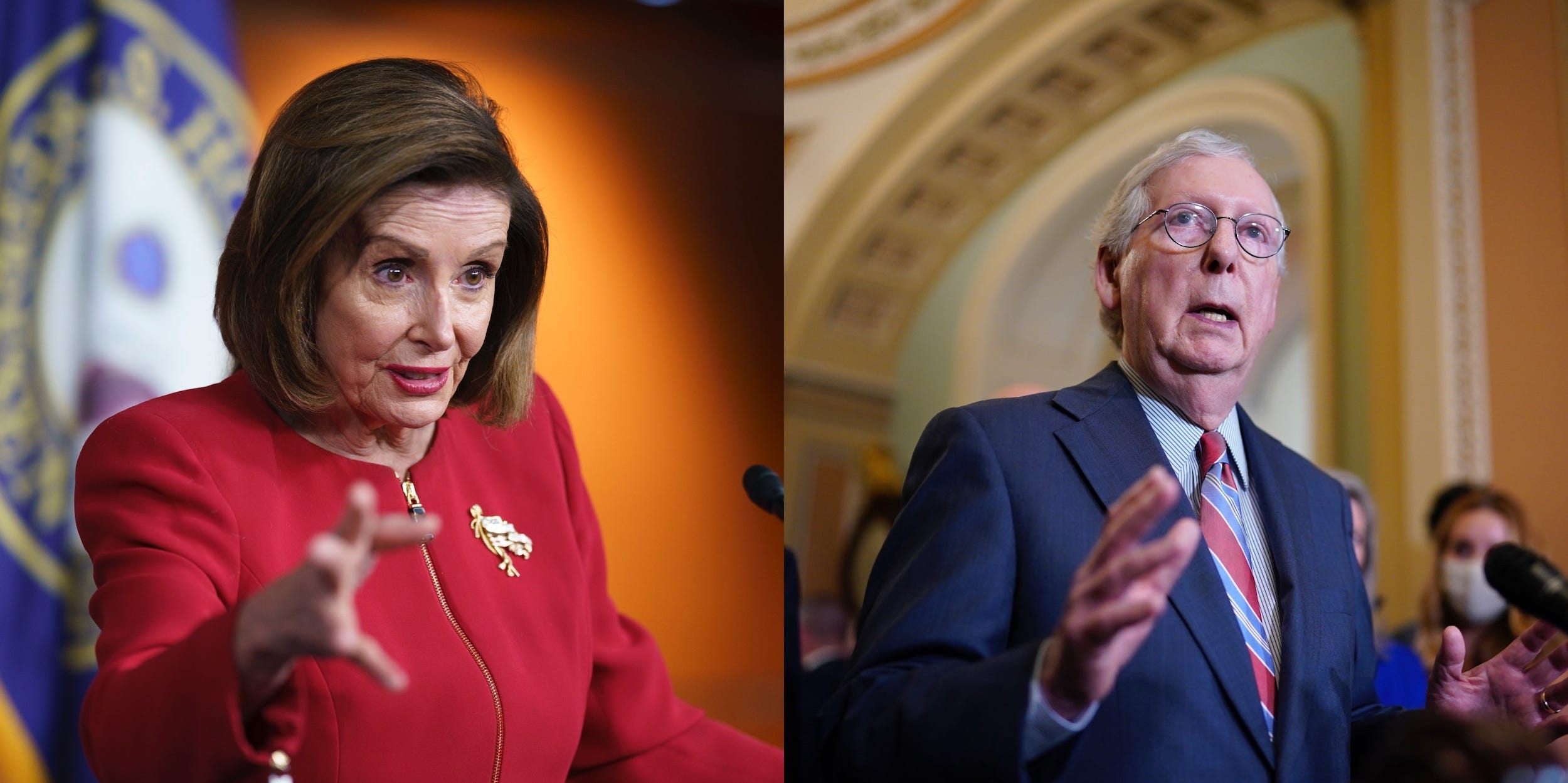

J. Scott Applewhite/AP Photo ; J. Scott Applewhite/AP Photo

- Failing to lift the debt ceiling would spark a recession similar to the financial crisis, Moody's said Tuesday.

- Nearly six million jobs would be erased and tanking stocks would cost Americans $15 trillion.

- The fallout would be "catastrophic," especially since the US is still recovering from COVID, Moody's added.

- See more stories on Insider's business page.

Failure to raise the limit on how much the US government can borrow could spark one of the biggest stock-market crashes in history and erase trillions of dollars in household wealth, Moody's Analytics said in a Tuesday report.

Congress has mere weeks to avoid that, and progress so far has been slow.

Democrats are pushing forward with their own bill to suspend the debt limit, allowing the government to keep borrowing cash and paying off its bills. But GOP lawmakers have made it clear they won't support such legislation. And Democrats' slim majority in the Senate means any dissent within their ranks could kill the effort.

Treasury Secretary Janet Yellen has warned that the government will hit the ceiling in mid-October. If the limit isn't lifted by then, the country faces "cataclysmic" economic fallout, economists led by Mark Zandi said. The team's simulations show a default on US debt powering a downturn similar to that seen during the Great Recession. Gross domestic product would slide by nearly 4%. The country would lose almost 6 million jobs. The unemployment rate would surge to 9% from 5.2%.

And stock prices would crash by one-third during the worst of the selloff. The market nosedive would swiftly wipe out $15 trillion in household wealth.

"If lawmakers are unable to increase or suspend the debt limit ... the resulting chaos in global financial markets will be difficult to bear," the Moody's economists said, adding the US and global economies "still have a long way to go to recover" from the COVID recession.

A recession of Congress' own making

The Tuesday report sheds more light on just how dangerous a government default would be. It also joins several warnings already made by the Biden administration and other economists.

The White House told state and local governments on Friday that failure to lift the debt ceiling would force stark cuts to federal support. Programs ranging from free school lunches to Medicaid would face a funding freeze. Disaster relief from FEMA would be dramatically scaled back. And the country would likely slide into recession as governments are forced to balance their budgets and slash jobs.

David Kelly, chief global strategist at JPMorgan, used more colorful terms to describe the fallout. Congress's last-minute negotiations over the debt ceiling are similar to kids playing with a "box of dynamite," he said in a September 13 note. Each generation of lawmakers has been "just a little more reckless and irresponsible than the last," and it may be time to retire the debt limit entirely before it forces a government default, he added.

To be sure, Democrats and Republicans are both confident the government will avoid a debt-ceiling downturn. After all, this debate has happened 57 times in the last 50 years, and solutions were reached each of those times. Lawmakers are just split on how to solve the problem today.

The easiest solution requires 10 Senate Republicans to join Democrats in voting to lift or suspend the limit. Yet Senate Minority Leader Mitch McConnell has been adamant that GOP members won't support such action.

Democrats, however, have slammed Republicans for failing to undertake the historically bipartisan action. The GOP is pursuing a "dine-and-dash of historic proportions," as they racked up trillions of dollars in debt with their 2017 tax cuts and last year's stimulus spending, Senate Majority Leader Chuck Schumer tweeted Tuesday.

Democrats will need all 50 Senate members to back the House's last-ditch fix if they're to sidestep Republicans and go it alone. With members already disagreeing over other legislation, the "political brinkmanship ... is thus painful to watch," Moody's said.

Dit artikel is oorspronkelijk verschenen op z24.nl