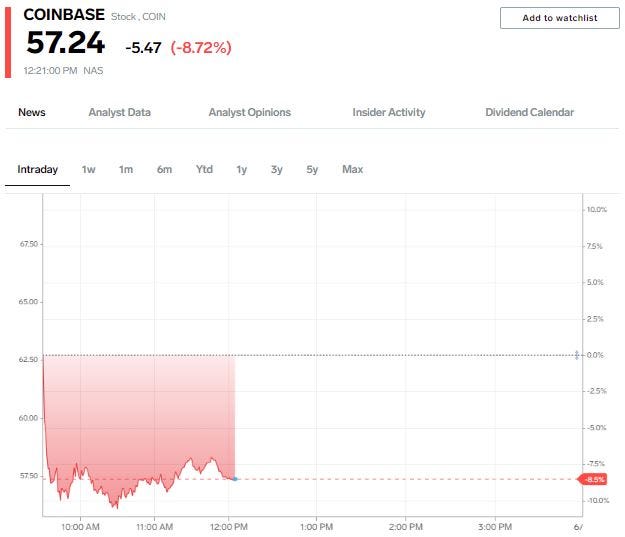

- Coinbase fell 11% on Monday after Goldman Sachs downgraded the crypto exchange to "Sell."

- The bank said the ongoing decline in crypto prices will hurt trading volumes and reduce Coinbase's revenue.

- Goldman Sachs set a $45 price target for Coinbase, implying a potential decline of 23% from current levels.

The ongoing bear market for Coinbase stock won't end anytime soon, according to a Monday downgrade note from Goldman Sachs.

The bank said the sharp decline in bitcoin and other cryptocurrencies should depress trading volumes, which is essential for a crypto exchange like Coinbase to thrive. Goldman Sachs analyst Will Nance downgraded Coinbase to "Sell" from "Neutral" and set a $45 price target, which implies potential downside of 23% from current levels.

Shares of Coinbase fell as much as 11% on Monday and are down 86% from their record high as cryptocurrencies have erased trillions of dollars in value since bitcoin peaked in November. Sentiment has been crushed in the crypto space after several high-profile stablecoin implosions led to billions of dollars of losses for investors, and increased regulation will likely depress Coinbase's revenue further, according to the note.

Based on current crypto asset levels and trading volumes, Nance estimated Coinbase's revenue will fall 61% year over year in 2022.

And while Coinbase announced an 18% reduction in its workforce earlier this month, those cost-saving steps will likely not be enough, and more job cuts are likely, according to the note.

"We believe Coinbase will need to make substantial reductions in its cost base in order to stem the resulting cash burn as retail trading activity dries up," Nance said, adding that the company's large stock based compensation program could lead to significant shareholder dilution and/or result in a talent drain as its stock becomes less appealing as a form of payment to employees.

Competition is also heating up for Coinbase, which could put significant pressure on the business in the coming months and result in fast fee rate compression.

"From a valuation standpoint, with Coinbase trading at an ~$11.5 billion market cap relative to its ~$3.8 billion net cash position, we believe valuation support is limited as higher revenues in the near term would require higher crypto prices and we forecast breakeven to negative adjusted EBITDA over the next several years," Nance said.

It's been a tough going for Coinbase since it went public last year. If Goldman Sachs is right and Coinbase reaches its $45 price target, it would represent a total drawdown of nearly 90% for the stock.