- Coinbase announced Tuesday that it will launch an index fund product.

- The fund will allow accredited investors to invest in a basket of cryptocurrencies listed on GDAX, Coinbase’s exchange.

Coinbase, the cryptocurrency trading platform, announced Tuesday the launch of an index fund which will allow investors to put money into a basket of four of the largest cryptocurrencies.

The so-called Coinbase Index Fund will give investors access to the digital currencies listed on GDAX, the exchange operated by Coinbase. It will be weighted by market capitalization and will adjust when new coins are added to the exchange.

The breakdown of the fund is as follows: 62% bitcoin, 27% ethereum, 7% bitcoin cash, and 4% litecoin. Investors can start signing up for the product, but it won’t be live for a couple of months, according to a spokesperson for Coinbase.

The index fund wouldn’t be the first one to hit the market. Bitwise Asset Management, for instance, operates a crypto index fund, holding ten cryptocurrencies weighted by market capitalization.

Coinbase product manager Reuben Bramanathan told Business Insider in a phone interview that the product reflects the growing demand on the part of institutional investors and high-net-worth individuals looking to dive into the market for digital coins, which stands at about $500 billion in value.

"We are seeing new investors coming to the market because they see an asset that is not correlated and outperforms, but they don't know which ones to buy," Bramanathan said.

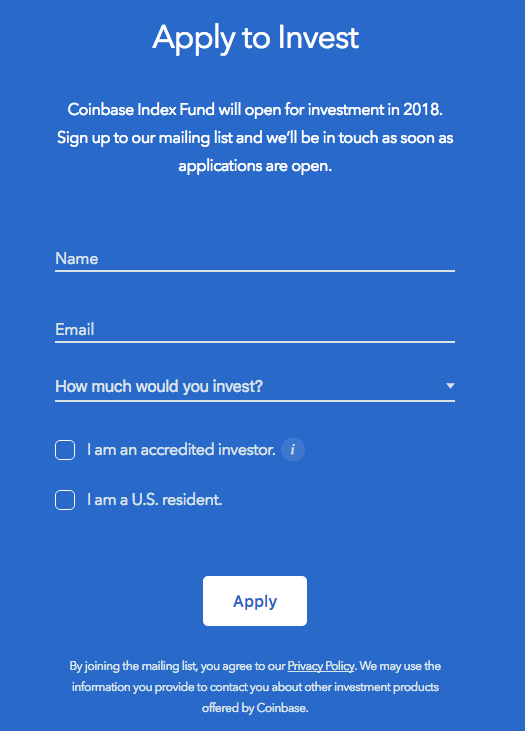

At this point, the product is open to only accredited investors because the company wants to wait on more clarity from the Securities and Exchange Commission on bitcoin-linked financial products, which the SEC pumped the brakes on.

In a letter signed by Dalia Blass, the SEC's director of the division of investment management, the agency said: "There are a number of significant investor protection issues that need to be examined before sponsors begin offering these funds to investors."

Bramanathan expects there is strong retail demand for an index fund product.

The move is a slight departure from Coinbase's main business of facilitating trading in the cryptocurrency market.

But the company's general manager Dan Romero told Business Insider's Becky Peterson that he is trying to build Coinbase into the Google of cryptocurrency. As Peterson pointed out recently, if there is one thing we know about Google, it is that they are always gate-crashing new markets.