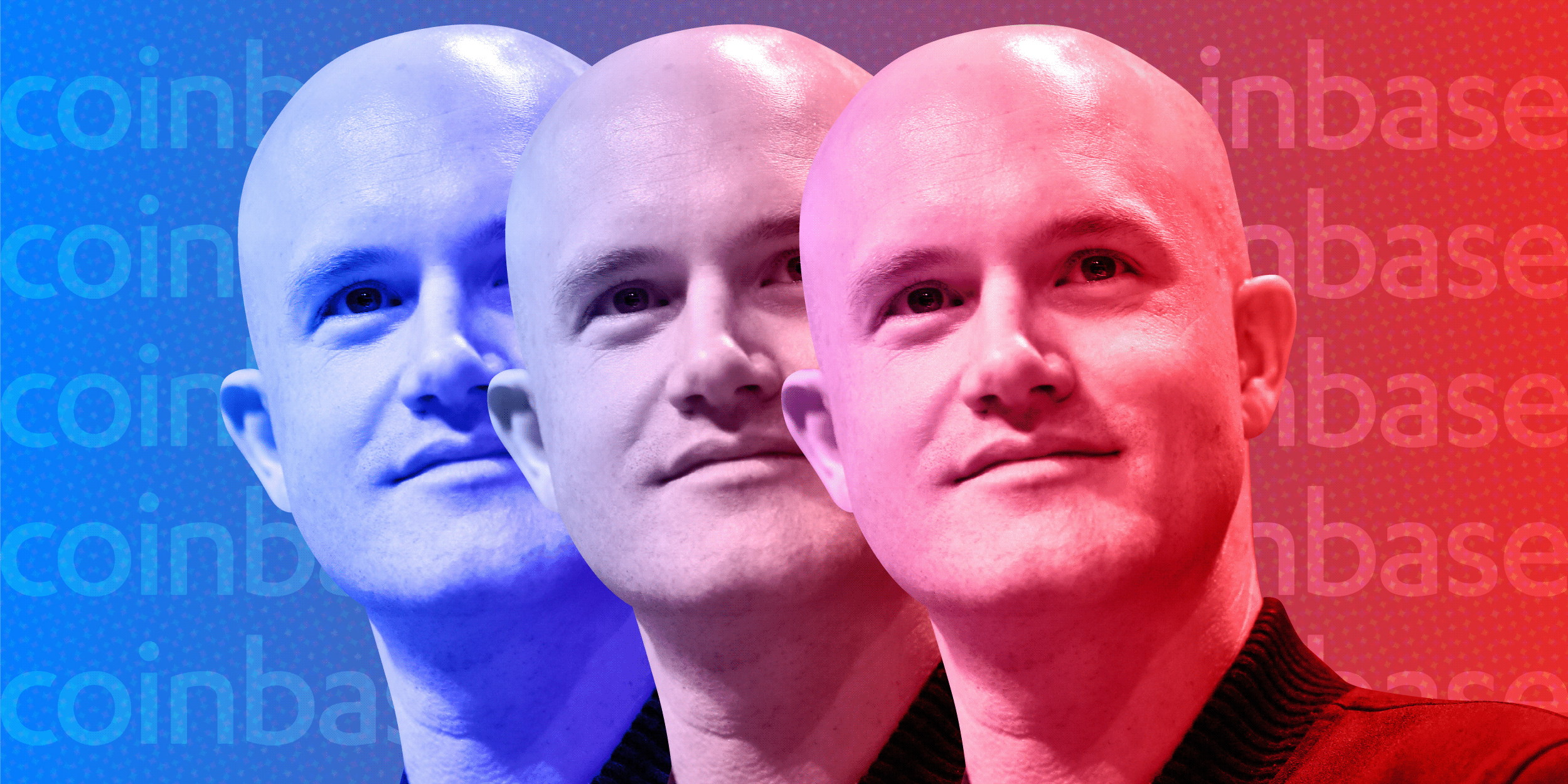

- Coinbase CEO Brian Armstrong said crypto tax rules proposed as part of the infrastructure bill "make no sense."

- "This provision could have a profound negative impact on crypto in the US and unintentionally push more innovation offshore," he said.

- The bill proposes that all cryptocurrency "brokers" and investors report their transactions to the IRS.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Coinbase CEO Brian Armstrong said the "hastily" proposed cryptocurrency tax provision "make no sense" and will push innovation away from the US if implemented.

"This makes no sense," Armstrong said in a series of tweets Wednesday. "This provision could have a profound negative impact on crypto in the US and unintentionally push more innovation offshore."

The CEO of the cryptocurrency exchange was referring to the last-minute addition to the $1 trillion infrastructure deal now advancing in the Senate.

Within the massive document – which runs over 2,500 pages in length – is a provision to increase government surveillance capabilities in the digital asset space.

More specifically, the bill proposes that all cryptocurrency "brokers" and investors report their transactions to the Internal Revenue Service, a requirement that would raise over $28 billion to fund infrastructure projects over the next decade.

Armstrong argued that the way in which the bill defines "brokers" broadly includes anyone who "effectuates transfers of digital assets."

"This means almost anyone in the crypto ecosystem (miners, validators, smart contracts, open source developers etc) could be treated as a 'broker' with massive reporting obligations."

The CEO gave smart contracts as an example, explaining how these are not companies but rather merely software running on the blockchain that anyone can use.

This specific provision is being contended by Sens. Ron Wyden of Oregon, Patrick Toomey of Pennsylvania, and Cynthia Lummis of Wyoming.

The senators are arguing that reporting obligations should apply only to individuals conducting transactions on exchanges where digital assets are bought, sold, and traded.

Armstrong said he agrees with cryptocurrency regulation but only if politicians don't "impose draconian burdens on an industry that will play a major role in the innovative future."