- A report from Bank of America Merrill Lynch concluded that hiring and promoting women to leadership positions drives returns and boosts the overall economy.

- If gender parity were theoretically reached, $28 trillion would be added to the global econom, according to a study by McKinsey.

- This article is part of Business Insider’s ongoing series on Better Capitalism.

Bank of America Merrill Lynch has a new report out for International Women’s Day that projects the potentially tremendous impact increased women’s equality could have on global markets.

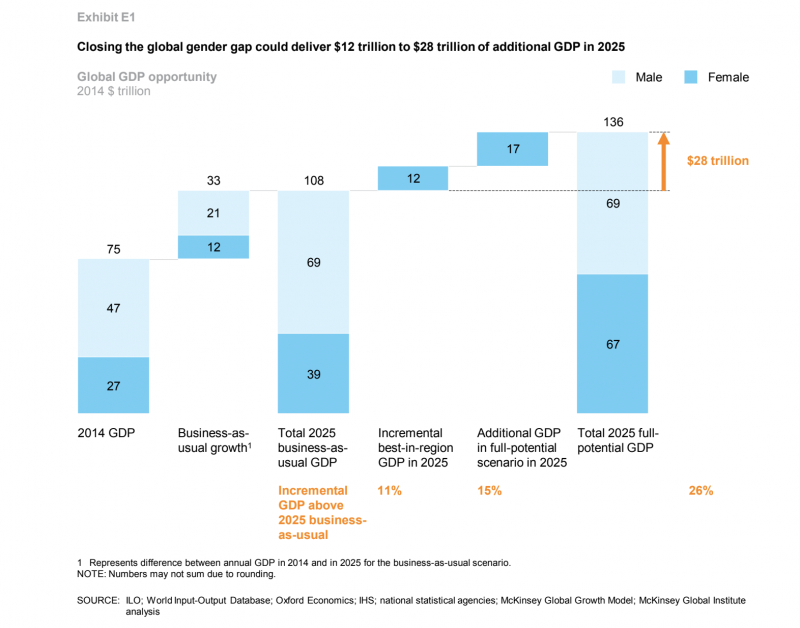

It’s a synthesis of recent research, and a finding that kicks it off is that if women were to theoretically have economic parity with men by 2025, it would boost global GDP by up to $28 trillion – the size of America and China’s GDPs combined.

That number is drawn from a 2015 McKinsey Global Institute report that considered 95 countries. While the researchers presented it as a utopian scenario where massive change (far exceeding current rates) happened in a short time, it’s meant to highlight the ramifications of the existing gender gap. The BAML paper then showed that steps taken to decrease the size of this gap, namely hiring more women and having more women in leadership positions, has positive effects on a smaller scale as well.

McKinsey’s analysts found that, in another ideal scenario but one that’s more readily attainable, “if every country matched the progress toward gender parity of its fastest-improving neighbor, global GDP could increase by up to $12 trillion in 2025.”

The following chart from McKinsey compares current growth rates with projections for both matching regional bests and full parity:

"We acknowledge that gender parity in economic outcomes (such as participation in the workforce or presence in leadership positions) is not necessarily a normative ideal, as it involves human beings making personal choices about the lives they lead; we also recognize that men can be disadvantaged relative to women in some instances," the McKinsey authors wrote. "However, we believe that the world, including the private sector, would benefit by focusing on the large economic opportunity of improving parity between men and women."

The BAML paper also referenced data from the World Economic Forum, World Bank, and the United Nations that found "the labour force participation rate is 50-56% for women vs. 77-82% for men," expressing the long way to go. That said, any progress at all has benefits.

From 2005 to 2017, the BAML authors wrote, S&P 500 companies with diverse boards had a higher return on equity than those that didn't, as did those with the highest percentages of women in leadership positions.

BAML and UBS researchers have both determined that this correlation is likely due to a few factors. Companies that bring a diversity of experiences to their boards and C-suite are typically better prepared to meet the needs of their customers, and are better for attracting young talent. Additionally, companies that recognize the lasting value of investing in the women who work for them are often better run in general.

The BAML authors wrote that "incentives to close the gender gap are evident: our work suggests that companies focused on gender diversity at a board, C-suite and firm level have consistently achieved higher ROE and lower earnings risk in subsequent years."