- The Chinese yuan poses a threat to US dollar dominance, according to Nouriel Roubini.

- He predicted in a Financial Times column the emergence of a bipolar currency regime.

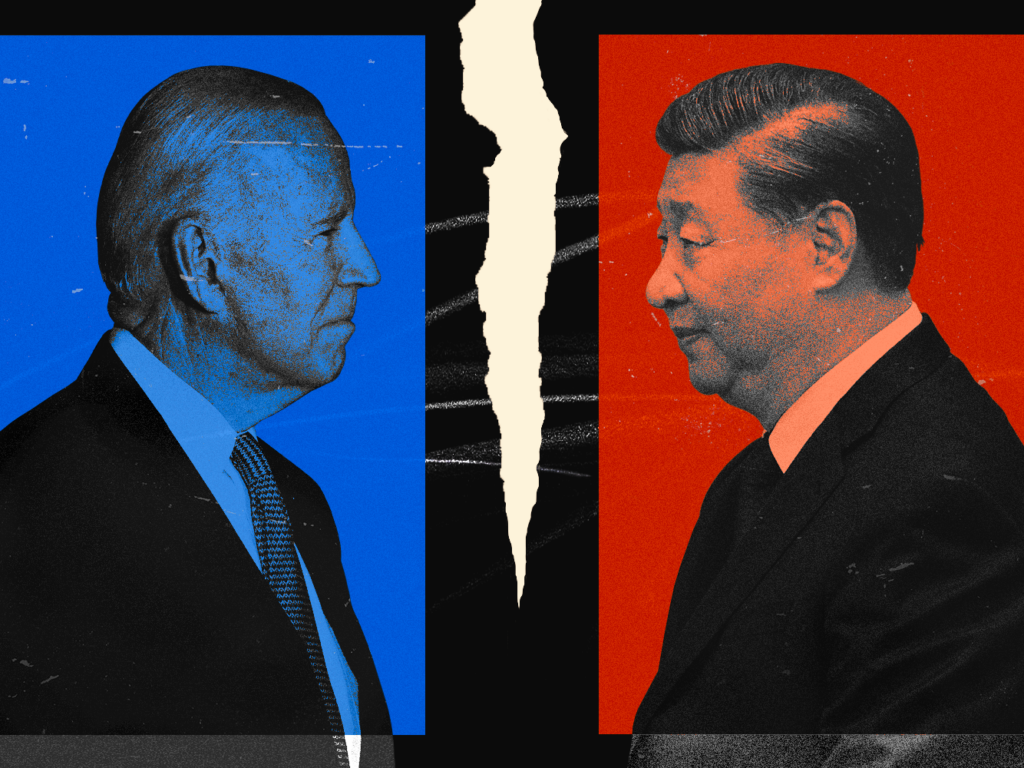

- "The intensifying geopolitical contest between Washington and Beijing will inevitably be felt in a bipolar global reserve currency regime as well."

The US dollar is facing a threat from the Chinese yuan and the end of its dominance in the global financial system, according to Nouriel Roubini, chief economist at Atlas Capital Team.

In a Financial Times column on Sunday, Roubini said that as the world becomes ever more split between US and Chinese influence, "it is likely that a bipolar, rather than a multipolar, currency regime will eventually replace the unipolar one."

The so-called Dr. Doom economist, who is noted for his dire predictions, said that while skeptics typically caution that China's stiff currency controls should prevent the yuan from overtaking the dollar, the US has its own version that "reduce the appeal of dollar assets among foes and relative friends."

"These include financial sanctions against its rivals, restrictions to inward investment in many national security-sensitive sectors and firms, and even secondary sanctions against friends who violate the primary ones," Roubini wrote.

Last year, the US and its Western allies froze Russia's foreign exchange reserves and kicked it out of the SWIFT financial system. In addition, the Biden administration has sought to cut off China's access to key technologies and investment that could aid its military.

Other attempts to erode the dollar's dominance have also emerged recently, including Russia and China opening talks last year to develop a new reserve currency with other BRICS countries as well as an effort by Russia and Iran to create a cryptocurrency backed by gold.

Meanwhile, China and Saudi Arabia have already transacted for oil in yuan this past December, Roubini said, and "it is not farfetched to think that Beijing could offer the Saudis and other Gulf Co-operation Council petrostates the ability to trade oil in RMB and to hold a greater share of their reserves in the Chinese currency."

The rise of a so-called petroyuan will gain momentum as China leverages its status as the world's biggest oil importer, analysts have said separately.

In addition, Roubini predicted that the growing interest in central bank digital currencies, or CBDCs, will help accelerate dollar's erosion as a global reserve currency over the next decade.

"The intensifying geopolitical contest between Washington and Beijing will inevitably be felt in a bipolar global reserve currency regime as well," Roubini said.

On the other side of the argument, top economist Paul Krugman said investors shouldn't lose sleep over potential threats to the dollar's dominance. The Nobel Prize-winning economist said Friday in a New York Times op-ed that he's not expecting to see the greenback unseated as the major currency for international trade anytime soon.