- Manscaped is going public by merging with blank-check firm Bright Lights Acquisition.

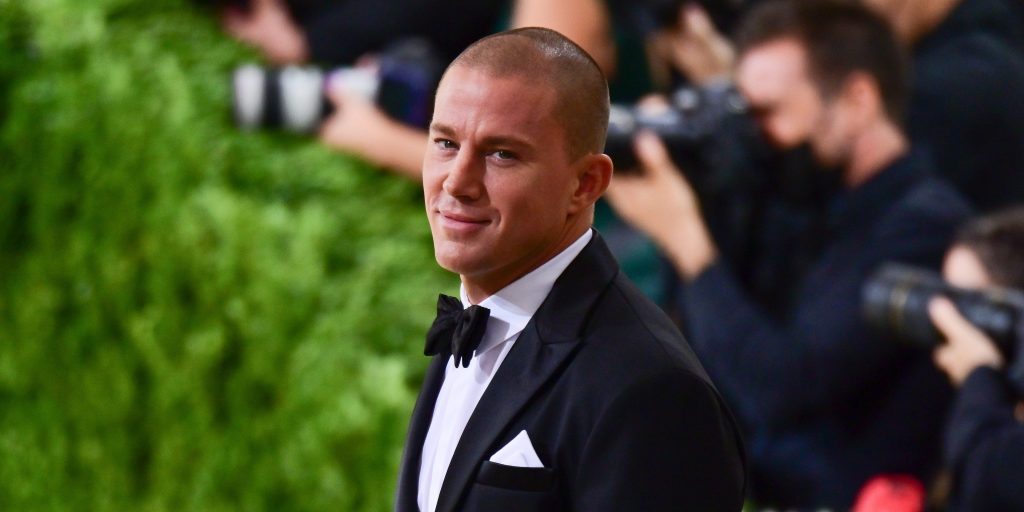

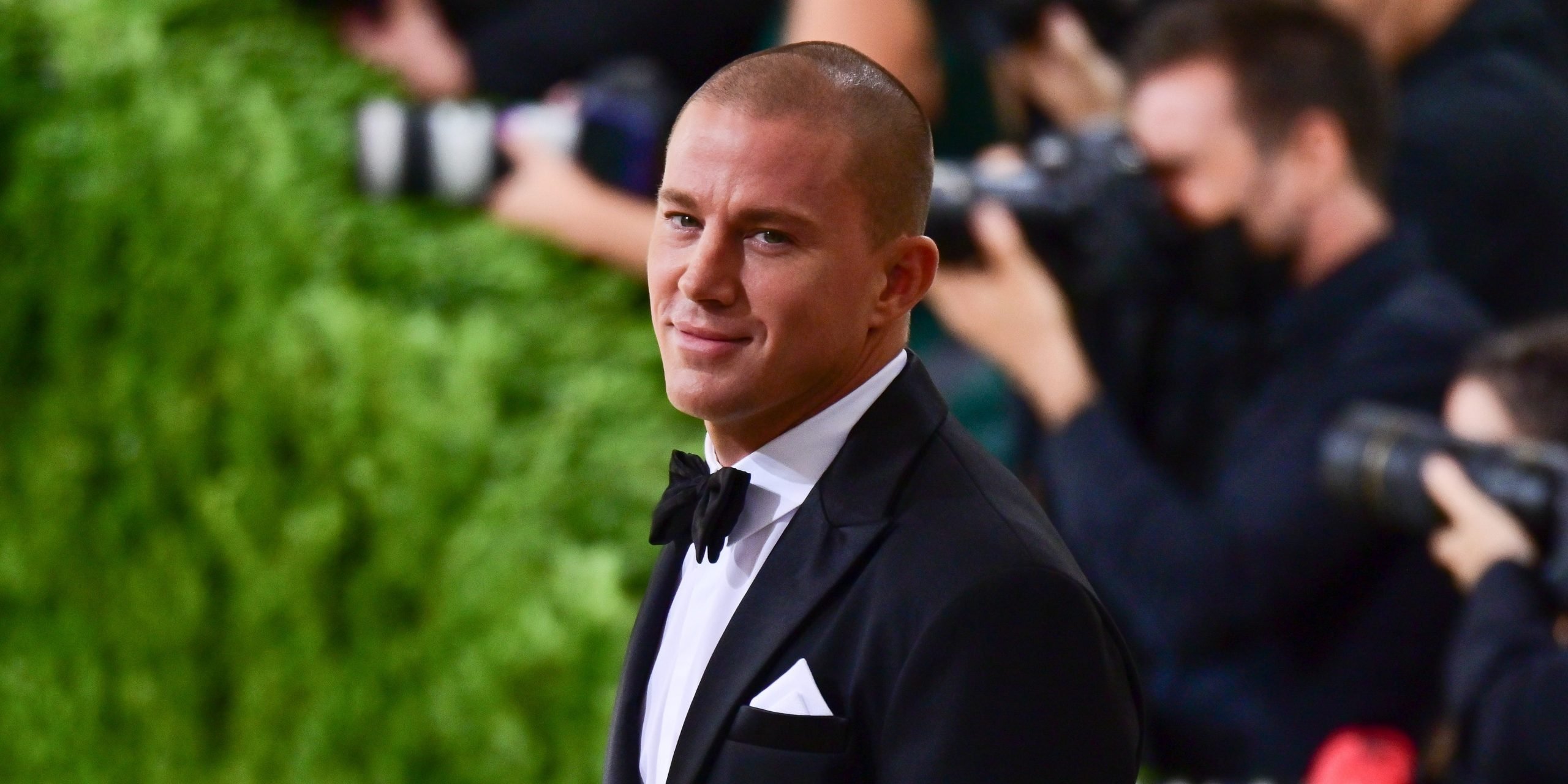

- Founded in 2016, the startup backed by Channing Tatum specializes in below the waist grooming for men.

- The California-based firm plans to list on the Nasdaq after the deal closes in the first quarter of next year.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Manscaped, a men's grooming startup backed by Channing Tatum, announced it is going public by merging with blank-check firm Bright Lights Acquisition Corp in a deal valuing the company at $1 billion.

The San Diego, California-based firm plans to list on the Nasdaq after the deal closes in the first quarter of next year. The combined company will be renamed Manscaped Holdings and will trade under the ticker MANS.

Upon completion, founder and CEO Paul Tran will continue to lead the firm. The transaction was unanimously approved by the boards of the two companies.

Manscaped is expected to receive up to $305 million in gross transaction proceeds, including $75 million from PIPE (private investment in public equity) at $9.20 per share. Some of the investors are Tatum, Endeavor Group Holdings, Guggenheim Investments, Signia Venture Partners, Saban Capital Group, and funds managed by UBS O'Connor.

The firm will also be debt-free at closing, according to the statement, and assuming no redemptions, will have $235 million on the balance sheet.

"The capital raised in this transaction will drive our ability to serve more men in more markets around the world, while also allowing us to grow the Manscaped routine into additional personal care and lifestyle product spaces," Tran said in a statement.

Founded in 2016, Manscaped specializes in below the waist grooming for men, a focus Tran said he wants to expand to address "all of men's self-care needs."

The company in the past 12 months has generated $285 million of revenue. It expects to grow to over $500 million in 2023 thanks to international growth and product expansion.

SPACs, which are shell companies seeking to merge with private companies with the intention of taking them public, have exploded in popularity in the last year.

In 2020, a total of 248 SPACs raised $83.3 billion according to SPAC Analytics. In 2021, data shows 555 SPACs have raised $150 billion, comprising 48% of initial public offerings.