- Cathie Wood's flagship Ark Innovation ETF bought Robinhood as the trading app fell in its first day of public trading.

- Wood scooped up nearly nearly 1.3 million shares of Robinhood worth over $45 million.

- Fund filings show the ETF now holds roughly 3.6 million shares of Robinhood worth $126 million.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

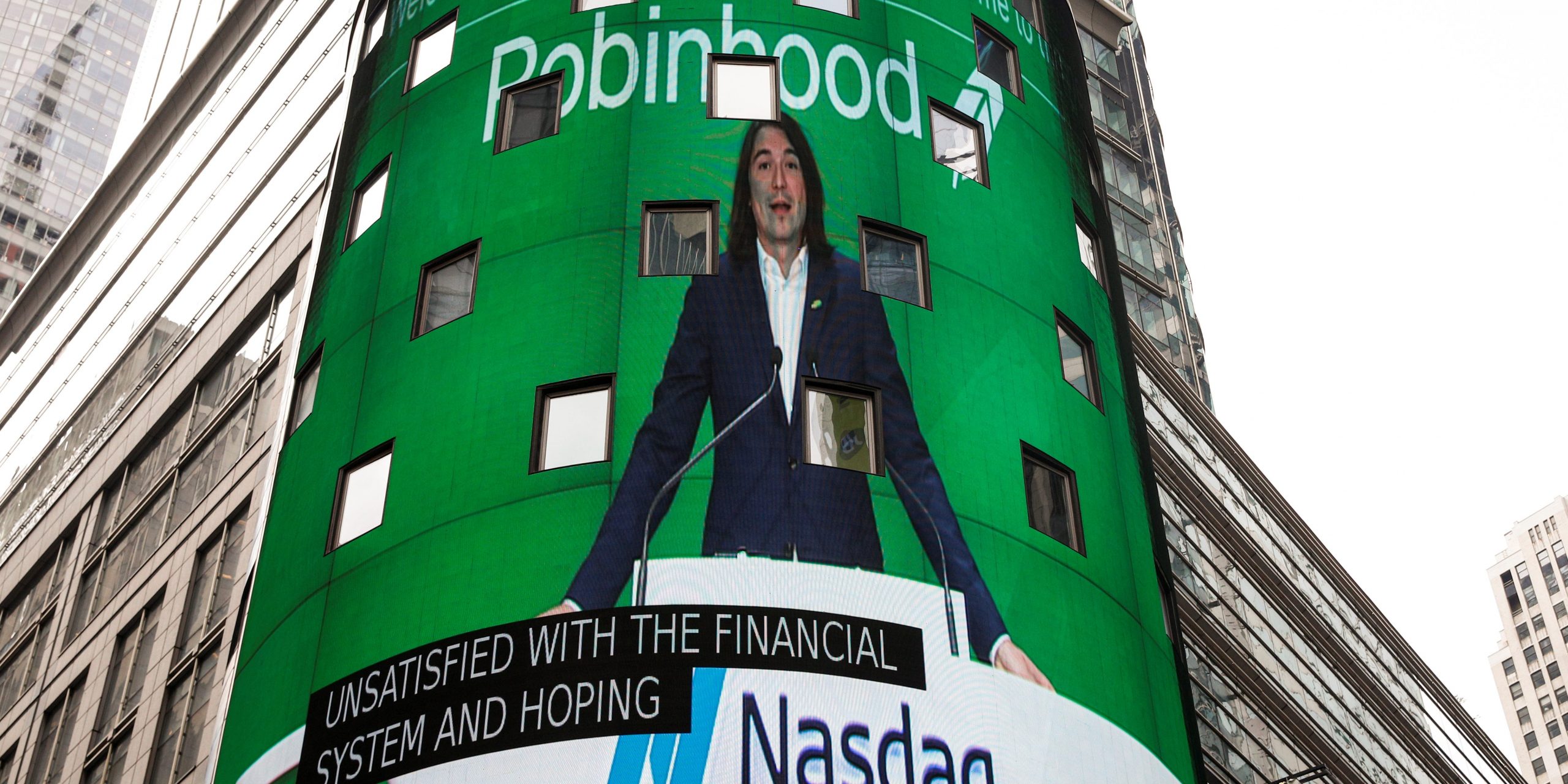

Cathie Wood's Ark Invest scooped up shares of Robinhood as the brokerage app fell on its first day of trading Thursday.

Wood's flagship Ark Innovation exchange traded fund purchased nearly 1.3 million shares of Robinhood worth over $45 million based on Thursday's closing price of $34.82. Fund filings show the Ark Innovation ETF now holds roughly 3.6 million shares of Robinhood worth $126 million, indicating Ark also bought the company before it made its public debut.

The mobile brokerage app priced its IPO Wednesday night at $38 per share, representing the bottom end of its targeted range of $38 to $42 per share. It ended its first day of trading down 8.37%.

Shares of Robinhood extended losses in premarket trading Friday, falling by more than 3% to around $33.70.

Wood's latest activity comes as she rapidly sheds Ark's positions in Chinese technology stocks amid an ongoing regulatory crackdown in Beijing.