- Cash App is placing restrictions on purchases of AMC and Nokia shares.

- The company says it was forced into the restrictions by its clearing broker, Axos.

- The move comes as Robinhood and other trading platforms are experiencing similar issues.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Square’s Cash App placed restrictions on purchases in AMC and Nokia on Tuesday after the company was notified by its clearing broker of increased capital requirements.

Cash App, like other trading platforms, works with a carrying broker-dealer and a clearing broker-dealer to process trades on their customers’ behalf. Clearing brokers are required by law to provide capital deposits to support trading.

After the run on stocks like GameStop, AMC, and Nokia in recent weeks, clearing brokers have been forced to support new capital requirements from the central clearinghouse (DTC). As a result, the brokers are asking trading platforms to halt purchases in popular names.

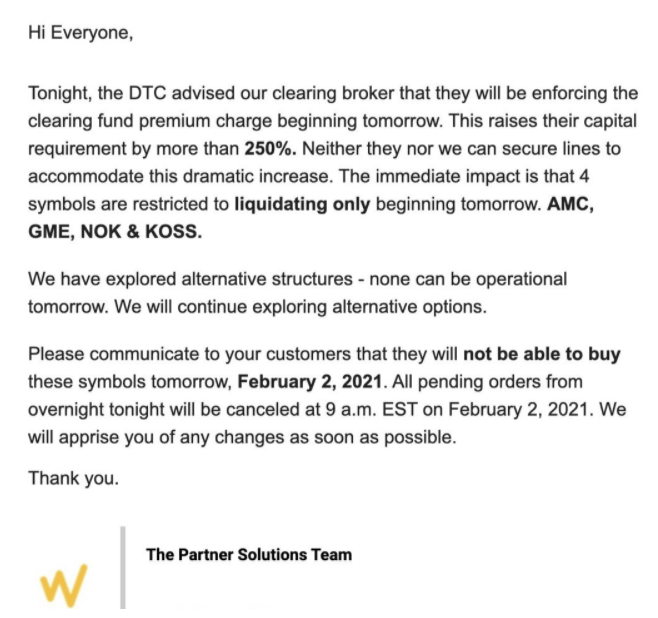

“To provide our customers with full transparency, we’ve posted the exact email we received from DriveWealth regarding the buy trade halt,” CashApp said in a statement. “Cash App has not yet been provided with a clear path to fix this situation ourselves. We are monitoring the situation closely and are working to make these stocks available for purchase again as soon as possible.”

CashApp

Although the email from Axos, Cash App's clearing broker, mentions GameStop and Koss, for now, Cash App has only restricted purchases in AMC and Nokia, and customers will still be allowed to sell shares on the open market.

Brokerages like Cash App, Robinhood, and others have been under pressure after putting restrictions on purchases in certain hot stocks. And despite the brokerages maintaining they have been forced into the move by clearinghouses, customers are still suing.

Robinhood and other platforms have been hit with dozens of legal suits over the past week as a result.

As shares of GameStop, AMC, Nokia, and other hot Reddit-related names continue to fall, the losses are piling up for retail investors.

Even Barstool Sports Dave Portnoy admitted to losing $700,000 in the stocks. Portnoy blamed "Vlad and company," referring to the team at Robinhood, for his losses in a tweet Tuesday morning, echoing a similar sentiment seen in the lawsuits against brokerages.