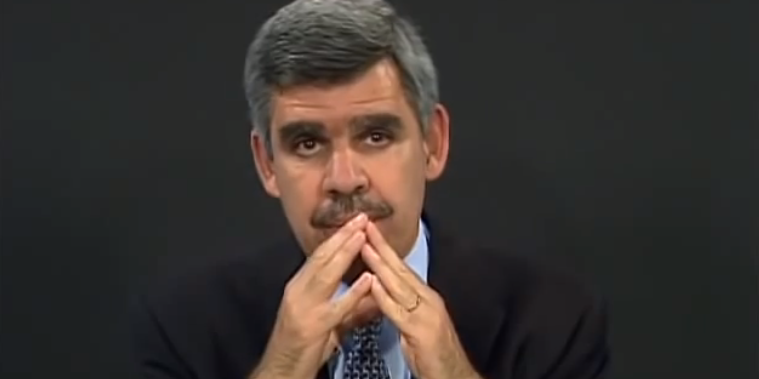

YouTube / TEDx Talks

- Mohamed El-Erian said the "wonderful world" of low market volatility may soon end.

- The well-known economist said the Fed needs to "ease off on its pedal-to-the-metal" stimulus.

- As for shortages, he said things will get worse before they get better.

Mohamed El-Erian said investors should brace for market volatility and worsening shortages as the holidays approach.

The economist and chief economic advisor for Allianz told Fox News' Chris Wallace that the "wonderful world" of low volatility may come to a halt.

"If I were an investor, I would recognize I'm riding a huge liquidity wave thanks to the Fed," he said Sunday. "But I would remember that waves tend to break at some point, so I would be very attentive."

El-Erian said the Fed should "ease off the pedal-to-the-metal monetary stimulus" as it continues to inject billions into the economy each month despite rising inflation.

"We've got to look very seriously at excess financial risk because what's going to happen if we're not careful is inflation, if it persists, would disrupt the financial markets that would then undermine the economy," he said.

El-Erian has long advised that the Fed should adjust its tapering timeline. He made the comment after September's big jobs-report miss and also said previously the central bank is responsible for turmoil in the bond markets.

When asked what investors should expect ahead of the holidays, El-Erian said things will get worse before they get better.

"We're going to have more shortages of goods. We're going to have higher prices. Inflation will remain in the 4-5% level, and it's just going to take time to sort these things out," he said.