- In a wide-ranging report on blockchain and cryptocurrencies, Credit Suisse said blockchain would reach full maturity in 2025.

- Market watchers can expect 2018 to be a year in which “certain products go viral” and “new providers/models emerge.”

The hype around bitcoin, and its underpinning blockchain technology, is real. But we are still a ways off from blockchain reaching full maturity.

Blockchain, which is best explained as a decentralized ledger, is best known for being the technology behind red-hot bitcoin. But its potential use-cases do not just reside in the world for digital currencies or financial services, according to a wide-ranging report by Credit Suisse, the Switzerland-based bank.

According to the bank, a survey conducted by the World Economic Forum found 58% of executives anticipate 10% of global GDP to “be stored on the blockchain before 2025.”

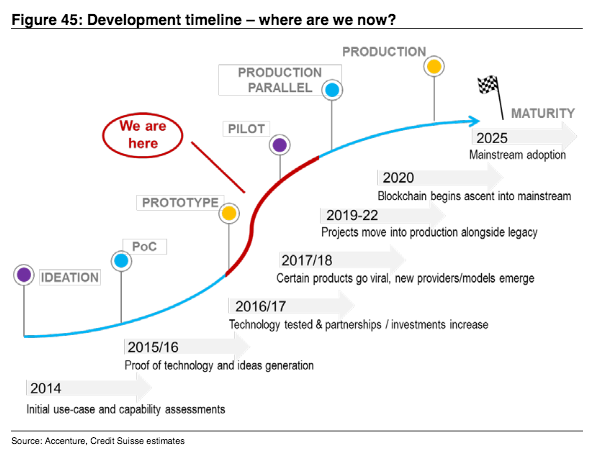

That's the year Credit Suisse expects the technology to reach full maturity. At the moment, the technology is in the middle of the prototype and pilot stage.

Market watchers can expect 2018 to be a year in which "certain products go viral" and "new providers/models emerge," according to the bank.

Here's a chart illustrating blockchain's development timeline:

2017 saw a lot of blockchain partnerships come to fruition. In financial services for instance, a number of banks launched collaborative ventures to test out the blockchain.

In December, UBS announced a pilot with a number of other banks, which will help prepare them for Markets in Financial Instruments Directive (MIFID) II, a sweeping regulatory overhaul in Europe that went live this year.

Instead of trusting a third party to review data and then provide feedback about the accuracy of each party's data, the banks will rely on the blockchain.

Financial services is not the only industry that'll benefit from blockchain, according to the bank.

"In fields where there is perhaps more room to experiment with real-world applications, such as consumer products and manufacturing, we have seen companies begin to deploy blockchain solutions in 2017," Credit Suisse said.

As for 2018, the bank said it will be a critical year.

"Blockchain solutions will come into production as the "low-hanging fruit" of the industry is addressed - i.e. where blockchain's use is immediately obvious, such as payments and trade finance," the bank said.