- Tom Lee of Fundstrat has nearly doubled his forecast for bitcoin, calling for the cryptocurrency to hit $11,500 by mid-2018.

- Lee says that a recent dip in bitcoin’s price wiped out weak, low-conviction holdings, clearing the path for further gains.

Well that sure escalated quickly.

Tom Lee, the managing partner and head of research at Fundstrat Global Advisors, has almost doubled his forecast for bitcoin. He now expects the scorching-hot cryptocurrency to hit $11,500 by mid-2018, up from his previous estimate of $6,000 released in August.

The adjustment comes just a few weeks after Lee turned neutral on bitcoin, when it was hovering around the $7,400 level. At the time, he felt that there were simply too many “weak hands” holding the cryptocurrency with low conviction, leaving it susceptible to a sharp drop at the first sign of turbulence. In his mind, the appropriate level to start loading up on more bitcoin was around $5,500.

And sure enough, bitcoin fell last week to $5,600, which Lee says wiped out those fickle holdings and allowed him to resume his bullish view.

"This move to $5,600 cleaned up weak hands and we no longer feel caution is warranted," Lee wrote in a note to clients on Wednesday.

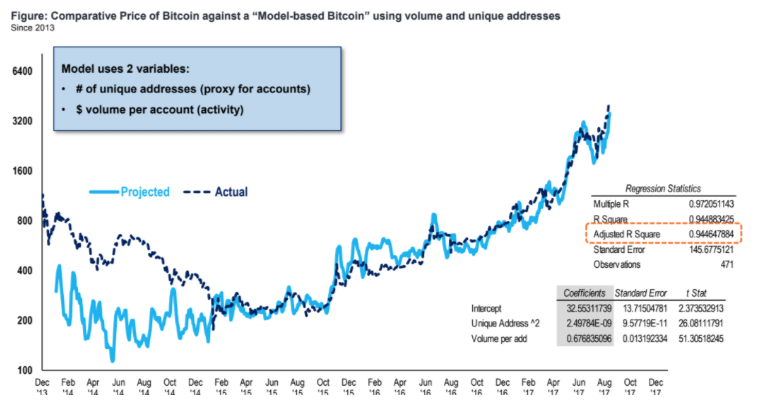

Further, two variables that explain 94% of bitcoin's historical moves - according to a statistical model developed by Lee - have rebounded, further fueling his optimism. Those variables are unique bitcoin network addresses and transaction volume per user, which, when regressed against the price of bitcoin, can provide signals suggesting possibilities for the future direction of the cryptocurrency.

Lee is also optimistic about the coming launch of bitcoin futures, which many think will increase the cryptocurrency's legitimacy, thereby expanding its potential user base. Bitcoin hit a new record on the news. Lee does warn, however, that the use of futures could further concentrate mining power.

Looking beyond bitcoin, Lee is one of the most bearish analysts on Wall Street when it comes to the stock market. He sees the benchmark S&P 500 ending 2017 at 2,475, which puts him in the bottom quartile of strategists surveyed by Bloomberg. The average price target is 2,524.