Bitcoin is is trading down 4.7% at $2,623 a coin. Tuesday’s selling comes after a strong day of gains on Monday as traders continue to jockey for position ahead of the August 1 decision on whether or not bitcoin will be split in two.

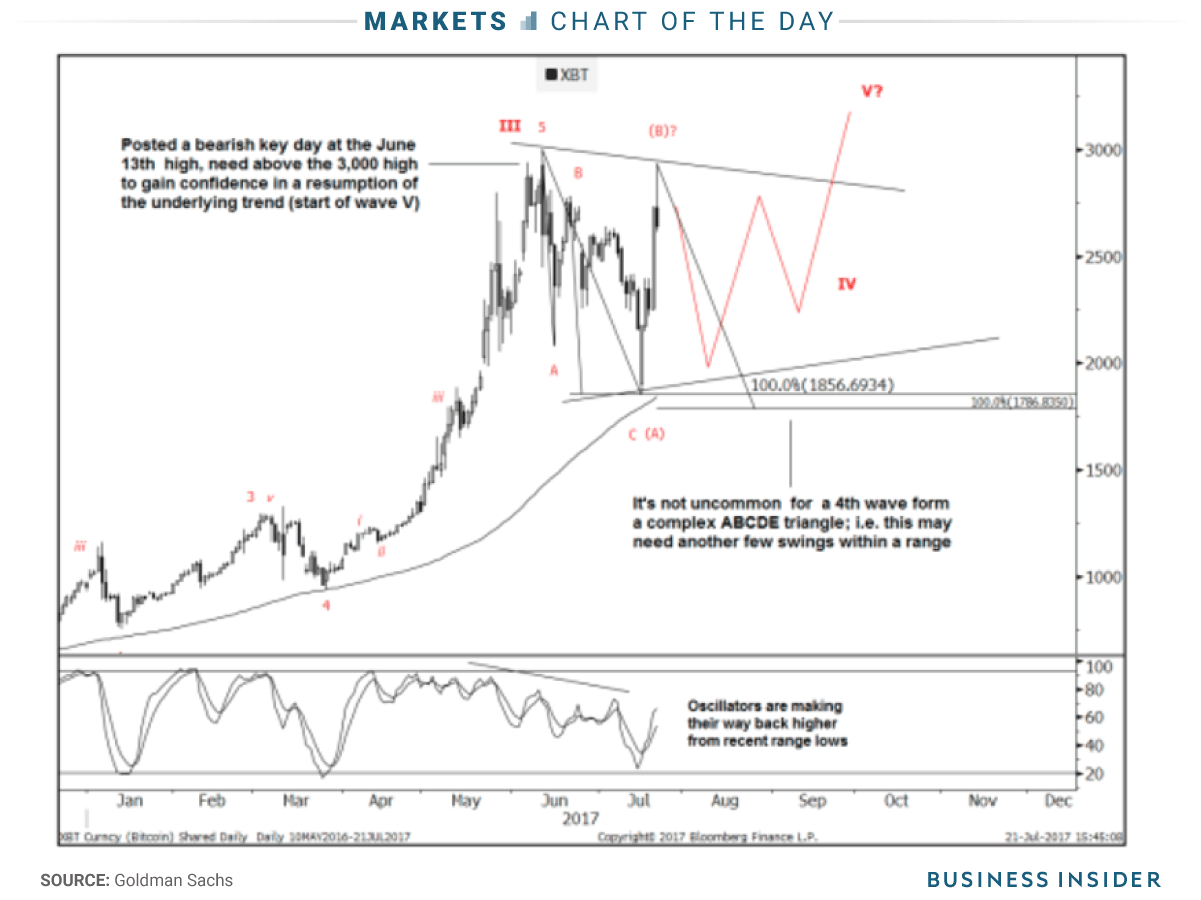

According to Sheba Jafari, the head of technical strategy at Goldman Sachs, bitcoin “may need another few swings” before the trend continues.

The cryprocurrency’s inability to breakout above its June 13 high of $3,000 suggests it is forming a triangle pattern that could see as many as five swings, and a low of $1,786, Jafari writes.

But fear not, says Jafari, because a run at record highs is in the cards as bitcoin remains in the fourth wave of a five wave series. “Anything above 3,000 (Jun. 13th high) will suggest potential to have already started wave V, which again has a minimum target at 2,988 and scope to reach 3,691 (the latter being a preferred target as this assumes a new high.),” Jafari wrote in a note to clients sent out on Monday.

So far Jafari has been spot on in her analysis. In early July, Jafari suggested bitcoin wouldn’t fall too far below $1,857. It fell to somewhere between $1,758 or $1,852 (depending on which data you use). A few weeks earlier, Jafari predicted a big drop was coming after bitcoin hit $3,000.

Bitcoin is up 166% so far in 2017.