Bitcoin had a blistering first half of 2017. It rallied from about $1,000 a coin to a record high near $3,000 before finishing June near $2,500. It booked a first-half gain of about 168%.

The historic run for the cryptocurrency has prompted observers both in the tech world and on Wall Street to talk about the cryptocurrency being in a “bubble.”

Last week, Jeffrey Kleintop, the chief global investment strategist at Charles Schwab, suggested bitcoin was in a bubble unlike any we had ever seen before. Kleintop’s warning came just a few weeks after tech billionaire Mark Cuban tweeted: “I think it’s in a bubble. I just don’t know when or how much it corrects. When everyone is bragging about how easy they are making $=bubble.”

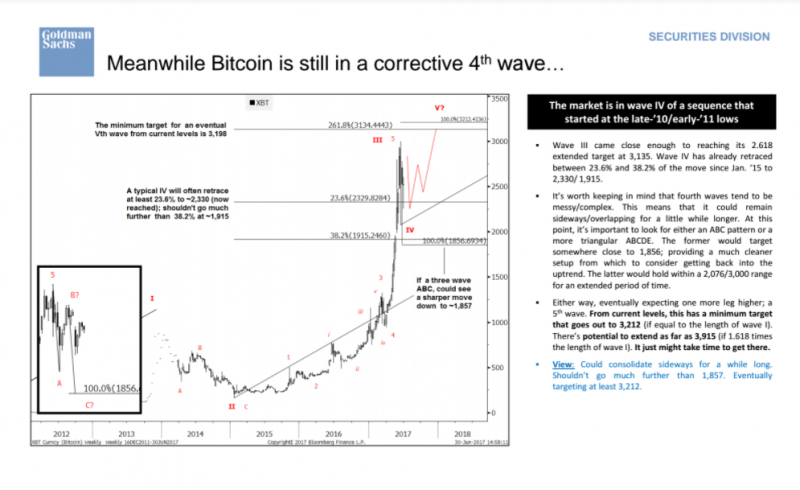

Goldman Sachs thinks bitcoin could see a big drop before running to another record high. In a note to clients sent out Sunday, Sheba Jafari, the head of technical strategy at Goldman Sachs, suggested that while bitcoin’s correction hadn’t run its course, the cryptocurrency was ultimately heading higher.

Jafari wrote bitcoin was “still in a corrective 4th wave” that “shouldn’t go much further than 1,857.” That would make for a drop of about 25% from its current level.

But bitcoin enthusiasts shouldn't worry too much, according to Jafari, because from there she sees the fifth wave of the move taking the cryptocurrency to a record high.

"From current levels, this has a minimum target that goes out to 3,212 (if equal to the length of wave I)," Jafari wrote. "There's potential to extend as far as 3,915 (if 1.618 times the length of wave I). It just might take time to get there."