- Two of the biggest cryptocurrency exchanges, Coinbase and Gemini, crashed on Wednesday morning, making it impossible for many users to buy or sell digital currency.

- Coinbase said it saw “all-time-high traffic” that contributed to system outages.

- Bitcoin fell to about $9,000 on Wednesday after surging earlier to over $11,000.

Bitcoin on Wednesday dropped to about $9,200, from an all-time high of about $11,400, after many users found themselves locked out of two of the biggest cryptocurrency exchanges in the US.

The digital exchanges Coinbase and Gemini crashed on Wednesday after bitcoin prices surged above $11,000 per coin early in the morning.

People also reported being locked out of accounts on GDAX, Coinbase’s professional trading platform, and Bitstamp, a bitcoin exchange based in Luxembourg.

Users of the digital exchanges saw slowed performance on the websites, and, in some cases, couldn't log into their accounts.

Bitcoin trading was fully restored on both exchanges by Thursday morning, though both sites reported ongoing maintance.

Coinbase, which says it has exchanged over $50 billion in cryptocurrency since its launch in 2012, posted about a "partial system outage" early Wednesday, though many users found themselves locked out of their accounts by the afternoon.

Dave Farmer, the director of business operations at Coinbase, said the company experienced "all-time-high traffic" early Wednesday, causing some users to experience slowness.

"Should be fully resolved in the next couple of hours," Farmer said in prepared remarks.

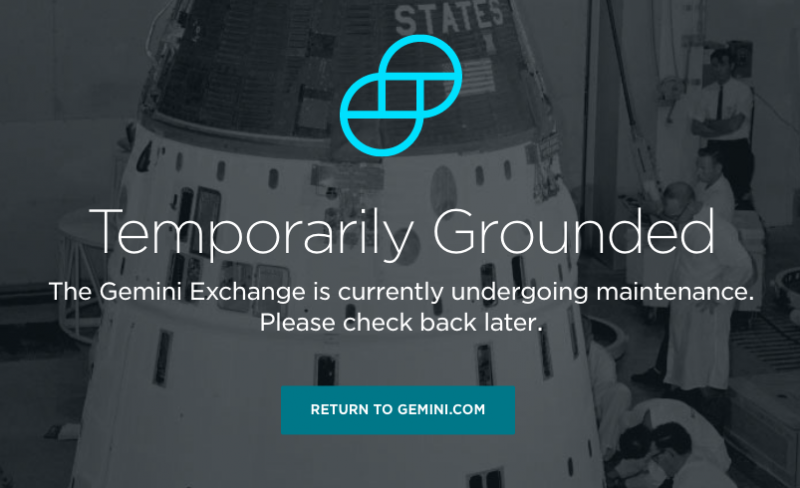

Gemini, the exchange started by the Winklevoss twins in 2015, showed many users a "504 gateway time-out" message, which means its servers were not responding to requests. The company posted on its status page: "Systems are currently experiencing degraded performance."

Gemini underwent maintenance most of Wednesday, though users regained access by the evening.