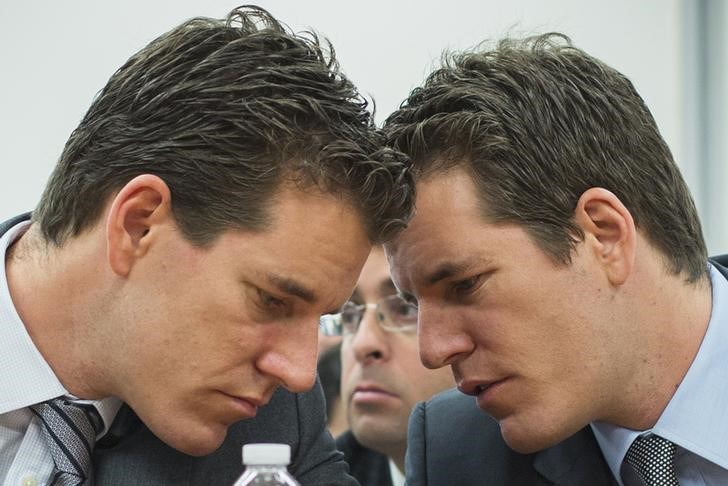

Bitcoin is crashing after the Securities and Exchange Commission rejected Tyler and Cameron Winklevoss’ proposal for an exchange-traded fund. The cryptocurrency plunged more than 16% in the moments after the decision was released and is now down 14%, or $192, at $1,000 per bitcoin.

“As discussed further below, the Commission is disapproving this proposed rule change because it does not find the proposal to be consistent with Section 6(b)(5) of the Exchange Act, which requires, among other things, that the rules of a national securities exchange be designed to prevent fraudulent and manipulative acts and practices and to protect investors and the public interest,” the SEC said in its release.

“Based on the record before it, the commission believes that the significant markets for bitcoin are unregulated,” it continued. “Therefore, as the exchange has not entered into, and would currently be unable to enter into, the type of surveillance-sharing agreement that has been in place with respect to all previously approved commodity-trust ETPs – agreements that help address concerns about the potential for fraudulent or manipulative acts and practices in this market – the commission does not find the proposed rule change to be consistent with the Exchange Act.”

2017 has been a volatile year for the cryptocurrency. It gained more than 20% in the first week of the year before crashing 35% on rumblings that China would begin cracking down on trading.

But the cryptocurrency has shrugged off news that China’s biggest exchanges started charging a flat fee of 0.2% per transaction, in addition to blocking customer withdrawals. It rallied more than 30% over the past month in the face of that news, as traders speculated the SEC would approve at least one of the three bitcoin ETFs.

Bitcoin rallied 120% in 2016 and was the top-performing currency in each of the past two years. Even with Friday's sell-off, bitcoin is still higher by about 10% this year.